- Sweden

- /

- Capital Markets

- /

- OM:EQT

Forecast: Analysts Think EQT AB (publ)'s (STO:EQT) Business Prospects Have Improved Drastically

Shareholders in EQT AB (publ) (STO:EQT) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. EQT has also found favour with investors, with the stock up a notable 20% to kr430 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

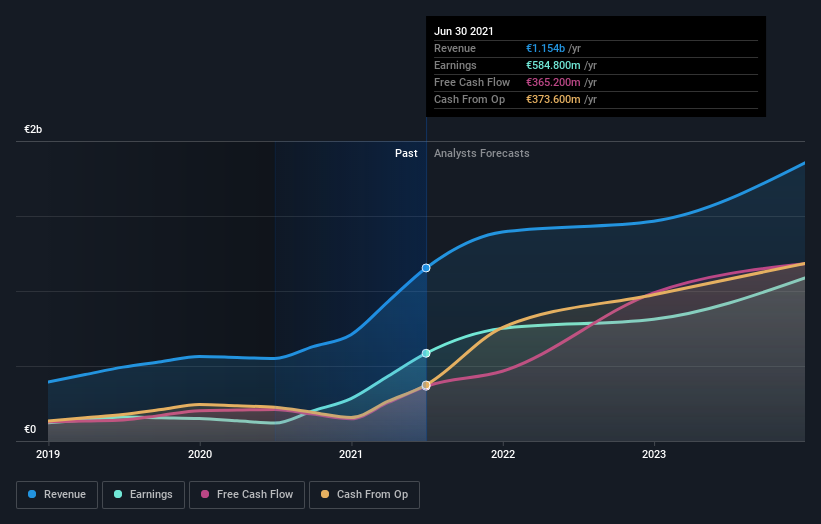

Following the upgrade, the most recent consensus for EQT from its nine analysts is for revenues of €1.4b in 2021 which, if met, would be a substantial 21% increase on its sales over the past 12 months. Statutory earnings per share are presumed to bounce 26% to €0.77. Prior to this update, the analysts had been forecasting revenues of €1.3b and earnings per share (EPS) of €0.69 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for EQT

It will come as no surprise to learn that the analysts have increased their price target for EQT 6.1% to €33.12 on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values EQT at €459 per share, while the most bearish prices it at €269. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the EQT's past performance and to peers in the same industry. It's pretty clear that there is an expectation that EQT's revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 46% growth on an annualised basis. This is compared to a historical growth rate of 110% over the past year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 18% annually. So it's pretty clear that, while EQT's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at EQT.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for EQT going out to 2023, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading EQT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026