- Sweden

- /

- Capital Markets

- /

- OM:EQT

Assessing EQT’s (OM:EQT) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

EQT (OM:EQT) has caught the attention of investors over the past month, with shares fluctuating on shifting sentiment. These moves come in the context of generally positive long-term returns for the Stockholm-based investment firm.

See our latest analysis for EQT.

EQT’s share price has seen a bit of a rally in the past week, climbing close to 5 percent and suggesting renewed optimism about the company’s prospects. Over the past year, shareholders have enjoyed a total return of 15.5 percent, reinforcing EQT’s longer-term growth story even as short-term momentum builds.

If you’re curious about other opportunities in dynamic markets, now might be the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With strong recent gains and solid historical returns, the key question now is whether EQT’s impressive track record still leaves room for upside, or if all future growth has already been factored into the current share price.

Most Popular Narrative: 10% Undervalued

With EQT’s fair value sitting notably above the last close, the latest narrative points to meaningful upside for shareholders who look beyond today’s price. The widely followed outlook suggests current market levels may not reflect the firm’s full long-term earnings power.

The firm's global diversification, especially its push into fast-growing Asian markets (e.g., India, Japan) and the U.S., positions it to benefit as more capital is funneled into private assets in these regions, supporting sustained AUM growth and higher future earnings.

Want to see what really fuels this bullish outlook? The entire valuation hinges on aggressive international expansion, new high-octane revenue streams, and a leap in profitability. Dive in to discover the surprising forecasts and bold assumptions that drive this value projection.

Result: Fair Value of $372.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower fundraising growth or unexpected setbacks in global expansion could quickly dampen EQT’s ambitious growth story and undermine bullish forecasts.

Find out about the key risks to this EQT narrative.

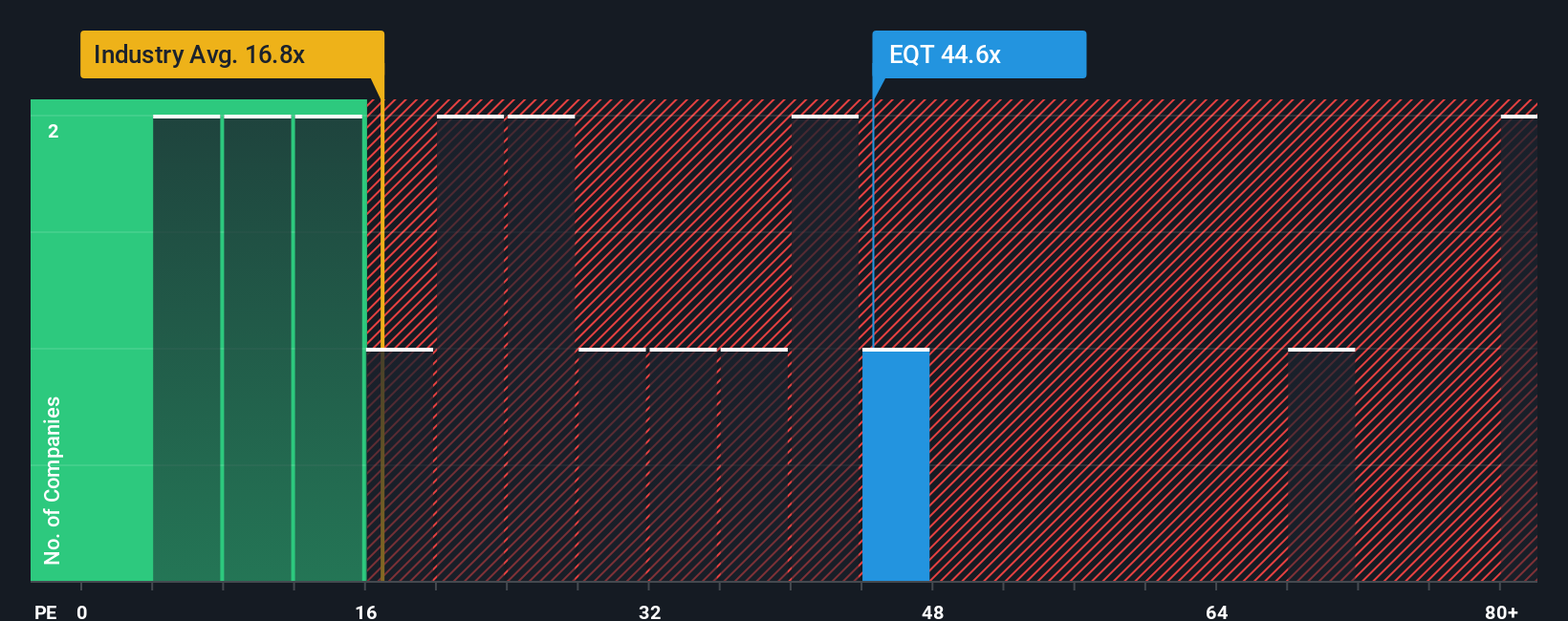

Another View: Market Ratios Pose a Valuation Reality Check

While one method points to EQT being undervalued, comparing its price-to-earnings ratio tells a more cautionary story. EQT trades at 42.5x, significantly above both its industry average and its fair ratio of 30.9x. This wide gap suggests a risk that market expectations could adjust downward. Are investors paying too much for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EQT Narrative

Keep in mind, you can dig into the numbers yourself and craft a personalized story around EQT’s future in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EQT.

Looking for More Smart Investment Opportunities?

Don’t let profitable trends pass you by. The market’s most exciting ideas could be yours to act on today. Get inspired and seize your next winning move with these powerful screeners:

- Capture sustained growth by checking out these 16 dividend stocks with yields > 3%, where high-yield companies are beating expectations and rewarding shareholders with impressive payouts.

- Spot the innovators changing healthcare forever through these 31 healthcare AI stocks, and position yourself at the forefront of life-changing medical advancements powered by artificial intelligence.

- Boost your portfolio’s upside potential by targeting these 879 undervalued stocks based on cash flows, featuring stocks that the market may be mispricing based on robust future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity & venture capital firm specializing in private capital and real asset segments.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives