- Sweden

- /

- Capital Markets

- /

- OM:CS

Should Investors Reconsider CoinShares After Its 80% Rally and New Digital Asset Product Launch?

Reviewed by Bailey Pemberton

Thinking about what to do with your CoinShares International shares? You’re not alone. With eye-catching returns and a valuation score that almost tops the scale, investors have plenty to consider right now. The stock closed at 154.6 with a 12.0% jump over the past week, while the past month’s gain of 16.6% hints at growing confidence in the company’s position within the ever-evolving digital asset landscape. Year to date, CoinShares is up an astonishing 79.6%, and the returns over the last year stand at 183.5%. If you zoom out even further, the three-year return soars to 369.3%, easily outpacing most of the wider market.

What’s driving this remarkable performance? Part of the story is the broader market’s renewed interest in digital assets, both as an alternative investment and as a hedge amid shifting macroeconomic conditions. There has also been an uptick in institutional involvement in blockchain-based products, which boosts expectations for companies like CoinShares International. But before getting caught up in the excitement, it’s crucial to ask whether these big moves are justified or if the stock’s price has simply gotten ahead of itself.

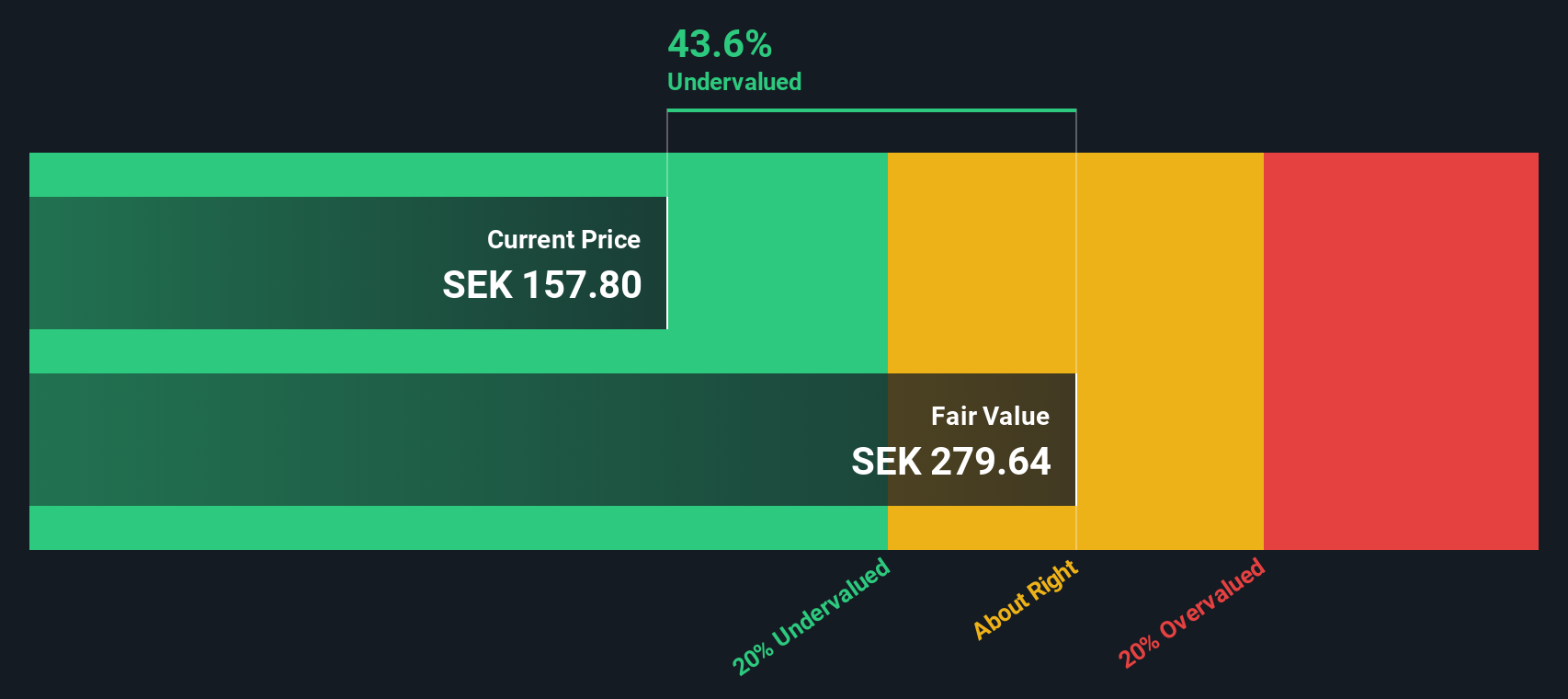

That is where valuation comes in. CoinShares currently scores a 5 out of 6 on our comprehensive valuation checks, suggesting it is undervalued in almost every way we measure. Still, there is more to valuation than just running the numbers. Let’s walk through the usual approaches and stay tuned, because at the end, I’ll share the most powerful lens for understanding what this stock might really be worth.

Approach 1: CoinShares International Excess Returns Analysis

The Excess Returns Model evaluates how effectively a company uses its invested capital to generate profits above its cost of equity. For CoinShares International, this approach reveals key strengths in its recent performance. Specifically, the average Return on Equity (ROE) stands at an impressive 38.34%, which is calculated from the median of the past five years. With a Book Value of SEK6.23 per share and a Stable EPS of SEK1.76 per share, CoinShares is consistently generating value for its shareholders. The company's Cost of Equity, at SEK0.33 per share, is notably lower than its actual earnings, resulting in an Excess Return of SEK1.43 per share. This indicates CoinShares is not just covering the cost of its equity but significantly surpassing it.

The Stable Book Value, derived from the five-year median at SEK4.59 per share, further supports the company’s strong position. When applying this model, the estimated intrinsic value lands at SEK276.61 per share, which is substantially higher than the current share price of SEK154.60. This translates to an intrinsic discount of approximately 44.1%, strongly suggesting the stock remains undervalued even after its recent impressive run.

Result: UNDERVALUED

Our Excess Returns analysis suggests CoinShares International is undervalued by 44.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CoinShares International Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested tool for valuing established, profitable companies like CoinShares International. It allows investors to see how much they are paying for each unit of company earnings, which is a critical perspective when those earnings are consistent and meaningful, as is the case here.

In general, a higher PE ratio can be justified for companies with stronger earnings growth prospects or lower perceived risk, while lower ratios may reflect uncertainty or slower expected earnings expansion. For context, CoinShares currently trades at a PE ratio of 8.6x, which is noticeably lower than the industry average of 19.6x and the peer group average of 24.4x. At first glance, this suggests the stock could be attractively valued relative to its sector.

However, Simply Wall St’s “Fair Ratio” offers even deeper insight. This proprietary metric estimates what the PE should be after factoring in not just company fundamentals like earnings growth and profit margins, but also industry dynamics, risk factors, and market capitalization. Unlike simple peer or industry comparisons, the Fair Ratio, at 19.7x for CoinShares, offers a more tailored benchmark, helping investors understand value in a nuanced and holistic manner.

Comparing the Fair Ratio (19.7x) with the company’s current PE (8.6x) reveals that CoinShares trades at a substantial discount to its justified valuation multiple, signaling meaningful upside potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoinShares International Narrative

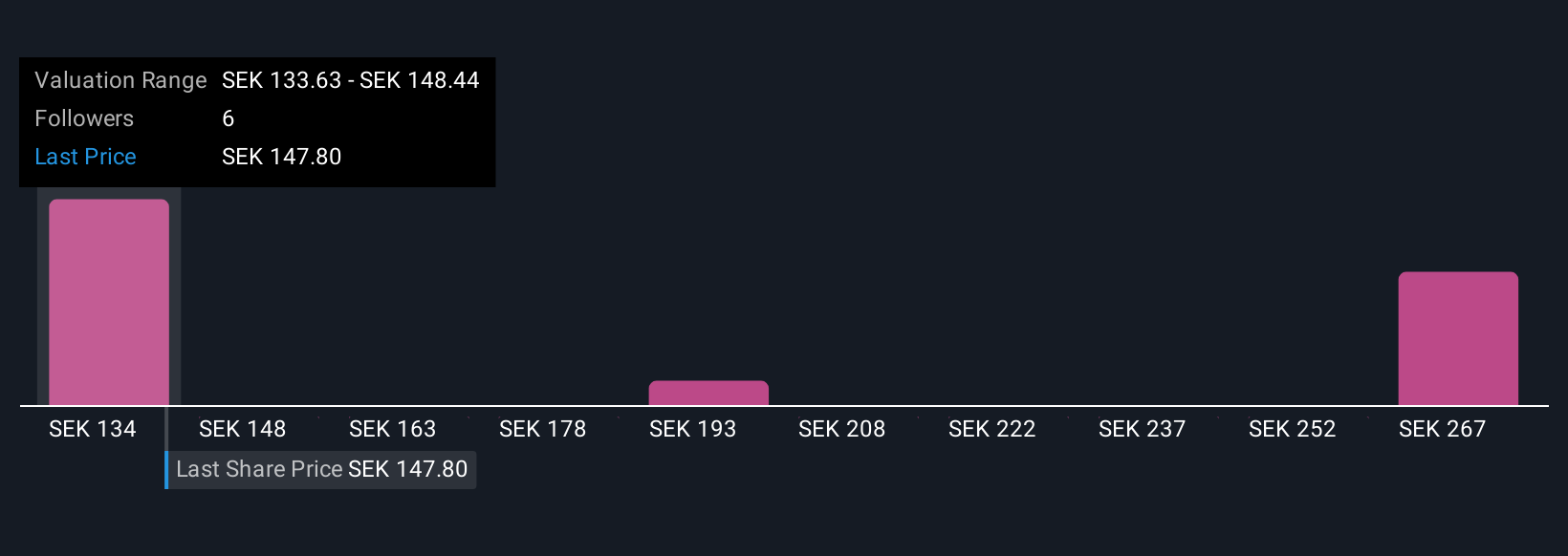

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your investment story—your unique perspective on a company, expressed through your assumptions about its future revenue, earnings, and profit margins, all of which roll up into your estimate of fair value. Narratives connect the dots between what a company does, how its future might unfold, and what you think it is truly worth.

On Simply Wall St’s platform, Narratives are an easy, accessible tool available to everyone in the Community page, empowering millions of investors to build and share their own views. By linking a company’s story directly to financial forecasts and fair value, Narratives help you quickly decide if now is the right time to buy or sell. Simply compare your Fair Value with the current share price and see if there is an opportunity. As new information like earnings updates or news arrives, your Narrative updates in real time, so you are always investing with the latest outlook in mind. For example, with CoinShares International, one investor’s most optimistic Narrative might see much higher future earnings, while another, more cautious Narrative, projects slower revenue growth. This helps each person make decisions anchored in their own convictions.

Do you think there's more to the story for CoinShares International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives