- Sweden

- /

- Capital Markets

- /

- OM:CS

CoinShares’ Launch of Staked Toncoin ETP Could Be a Game Changer for CoinShares International (OM:CS)

Reviewed by Sasha Jovanovic

- CoinShares International recently launched the CoinShares Physical Staked Toncoin, a regulated exchange-traded product providing direct exposure to Toncoin, a blockchain integrated with Telegram's global platform, following its announced merger with Vine Hill Capital Investment Corp.

- This product stands out by offering 0% management fees and staking yield, leveraging Telegram’s 900 million–plus user base for real-world blockchain utility.

- We’ll examine how CoinShares’ integration of institutional-grade digital products with accessible blockchain utility impacts its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is CoinShares International's Investment Narrative?

For shareholders of CoinShares International, the core story is about believing in the firm's ability to bridge institutional finance with powerful blockchain adoption at scale. The recent launch of CoinShares Physical Staked Toncoin, coming alongside the announced merger with Vine Hill Capital, stands out as a potential near-term catalyst: it directly connects CoinShares to Telegram's vast user base, offering a differentiated route to blockchain-powered assets with real-world utility. This could temporarily lift sentiment and visibility for CoinShares, especially as competitors look for utility and yield in regulated digital products. However, with high quality but volatile share price moves and substantial non-cash earnings, risk remains around how sustainable these launches will be in driving consistent revenue and profit growth amid a highly competitive and complex regulatory market. Short-term price moves have reflected optimism, but key risks, such as slower earnings growth and board refreshment, haven’t disappeared.

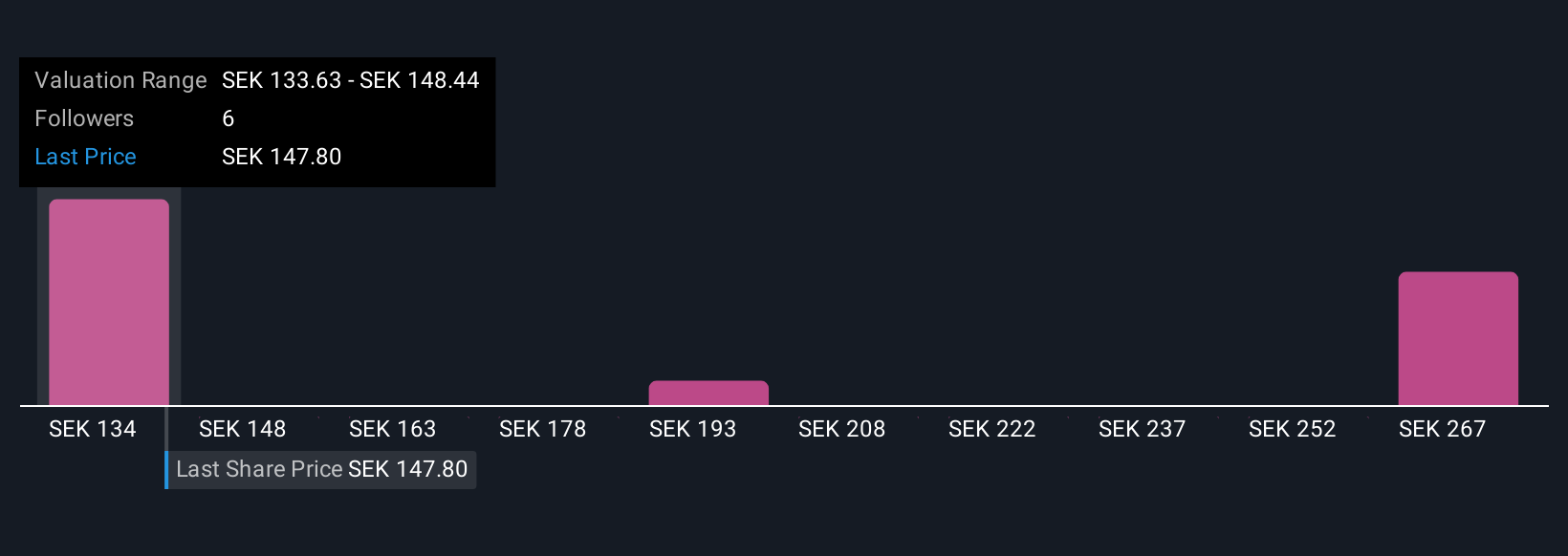

But there’s a risk from the pace of earnings growth that can’t be ignored. CoinShares International's shares have been on the rise but are still potentially undervalued by 41%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on CoinShares International - why the stock might be worth 21% less than the current price!

Build Your Own CoinShares International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CoinShares International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CoinShares International's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives