- Sweden

- /

- Capital Markets

- /

- OM:CS

A Look at CoinShares (OM:CS) Valuation Following New TON ETP Launch and Nordea Partnership

Reviewed by Simply Wall St

CoinShares International (OM:CS) has announced a flurry of product launches, including a new Toncoin ETP and a major partnership with Nordea for a Bitcoin investment vehicle. These developments offer European investors expanded and regulated blockchain exposure.

See our latest analysis for CoinShares International.

Those product launches and the Nordea partnership have arrived against the backdrop of a resurgent CoinShares share price, with momentum building rapidly. The stock’s 1-year total shareholder return is a staggering 247%, and even over the past 90 days, investors enjoyed a 62% share price return. This clearly reflects surging interest and positive sentiment after a period of strong execution and sector tailwinds.

If this wave of digital asset innovation has sparked your curiosity, now’s a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

Yet, with CoinShares’ shares rising so dramatically, the question remains: has the current price already factored in these latest breakthroughs and potential future growth, or is there still a genuine buying opportunity for investors?

Price-to-Earnings of 9.3x: Is it Justified?

CoinShares International’s stock trades at a price-to-earnings ratio of just 9.3x, substantially below both sector peers and the wider industry, despite its powerful recent run.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay today for each unit of current earnings. For companies in the capital markets space, it is a crucial metric since it can highlight potential market mispricing of future profit expectations.

In this case, the market appears to be pricing CoinShares well below its peer group, signaling a lack of exuberance. The peer group P/E sits at 22.1x and the broader Swedish Capital Markets industry is even higher at 24.4x. Intriguingly, our best estimate of a fair P/E for CoinShares is 18.7x, which is also far above the current multiple. If the market adjusts closer to the fair ratio, the stock could see significant re-rating.

Explore the SWS fair ratio for CoinShares International

Result: Price-to-Earnings of 9.3x (UNDERVALUED)

However, a significant discount to analysts' price targets and slow net income growth may signal potential headwinds or cautious sentiment in the near term.

Find out about the key risks to this CoinShares International narrative.

Another View: Discounted Cash Flow Model

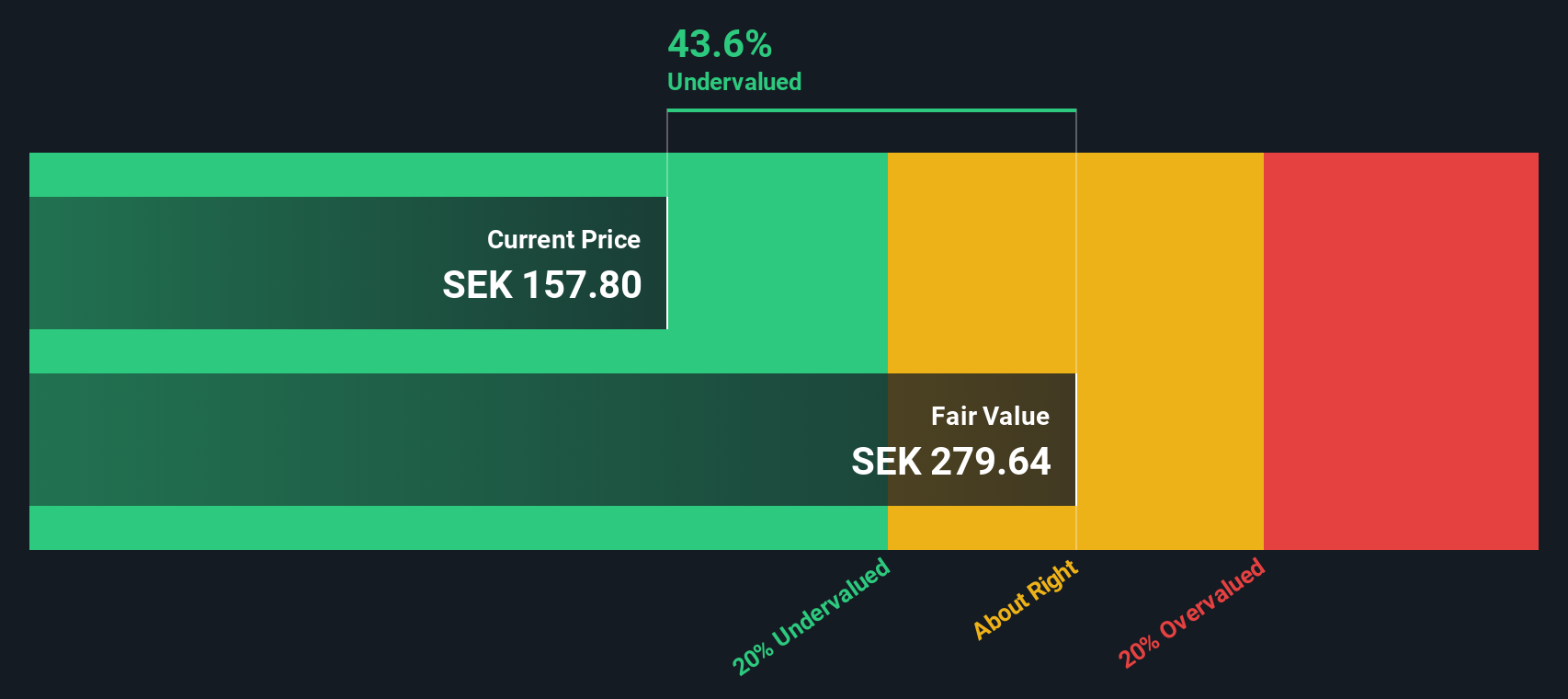

While the market is currently valuing CoinShares at a significant discount based on earnings multiples, our SWS DCF model comes to a similar conclusion. The DCF suggests the shares are undervalued, calculating a fair value of SEK285.99 compared to the current price of SEK168.4. This perspective points to a substantial upside, but are markets ever that simple?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoinShares International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoinShares International Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized CoinShares story in just a few minutes. Do it your way.

A great starting point for your CoinShares International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead by targeting tomorrow’s winners, not just today’s headlines. Here are three fresh ways to find your next opportunity before everyone else does:

- Tap into the world of high-potential innovation with these 26 AI penny stocks and seek out trailblazers driving breakthroughs in artificial intelligence.

- Supercharge your long-term income and stability by checking out these 22 dividend stocks with yields > 3%, designed for steady yield seekers who want more than just capital gains.

- Take an early position in a field with explosive upside by browsing these 3590 penny stocks with strong financials, which uncovers affordable companies poised for rapid growth and hidden value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CS

CoinShares International

Engages in the creating financial products with digital assets and blockchain technology business in Jersey.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives