Stock Analysis

- Sweden

- /

- Capital Markets

- /

- OM:RATO B

Exploring Undiscovered Swedish Stocks In July 2024

Reviewed by Simply Wall St

As global markets experience fluctuations, Sweden's small-cap stocks present a unique landscape for investors in July 2024. With the broader European indices showing resilience amidst varying economic signals, these lesser-known Swedish entities might offer intriguing opportunities under current market conditions. In exploring undiscovered stocks, it's essential to consider companies that demonstrate robust fundamentals and potential resilience or growth alignment with ongoing economic trends and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Softronic | NA | 3.42% | 7.64% | ★★★★★★ |

| Bahnhof | NA | 9.47% | 15.07% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Rederiaktiebolaget Gotland | NA | -14.29% | 18.06% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Karnell Group | 44.29% | 22.04% | 39.45% | ★★★★★☆ |

| Solid Försäkringsaktiebolag | NA | 4.38% | 29.89% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a Swedish investment firm focusing on private equity and venture capital across various stages, with a market capitalization of SEK 10.88 billion.

Operations: Creades generates revenue primarily through direct investments, achieving a consistently high gross profit margin of 100% in recent years. The company has minimal operating expenses relative to its gross profit, which contributes to its robust net income margins, often exceeding 90%.

Creades, a lesser-known Swedish entity, showcases robust financial health with a striking 129.4% earnings growth over the past year, significantly outpacing the Diversified Financial industry's decline of 3.9%. This growth is supported by its debt-free status and a compelling price-to-earnings ratio of 9.9x, which stands well below the Swedish market average of 23.3x. Recent results further highlight its potential; Q2 revenue surged to SEK 833 million from last year's negative SEK 353 million, alongside net income rising to SEK 771 million from a net loss of SEK 299 million.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a Swedish investment firm focusing on private equity and venture capital across various stages, with a market capitalization of SEK 10.88 billion.

Operations: Creades generates revenue primarily through direct investments, achieving a consistently high gross profit margin of 100% in recent years. The company has minimal operating expenses relative to its gross profit, which contributes to its robust net income margins, often exceeding 90%.

Creades, a lesser-known Swedish entity, showcases robust financial health with a striking 129.4% earnings growth over the past year, significantly outpacing the Diversified Financial industry's decline of 3.9%. This growth is supported by its debt-free status and a compelling price-to-earnings ratio of 9.9x, which stands well below the Swedish market average of 23.3x. Recent results further highlight its potential; Q2 revenue surged to SEK 833 million from last year's negative SEK 353 million, alongside net income rising to SEK 771 million from a net loss of SEK 299 million.

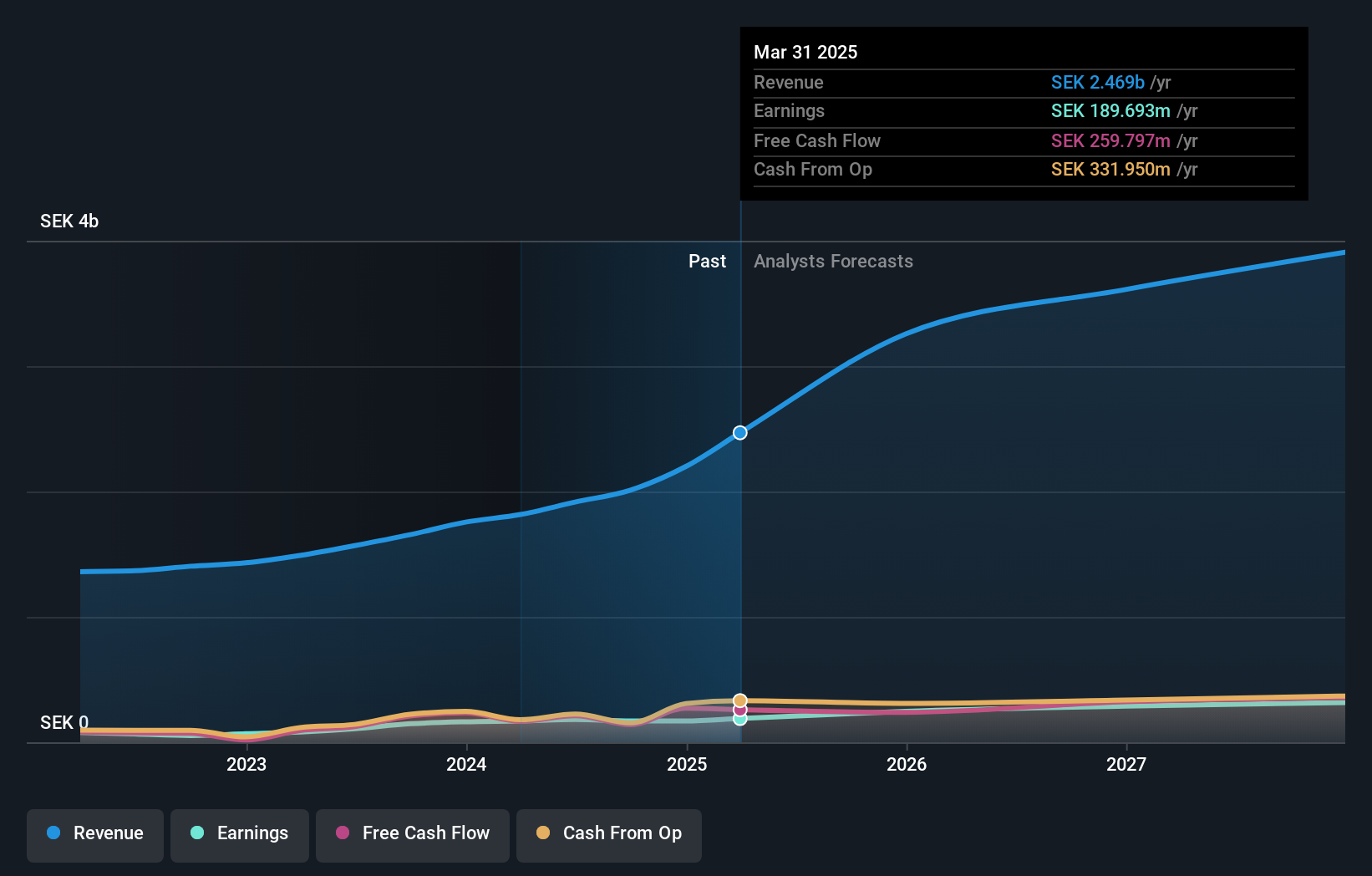

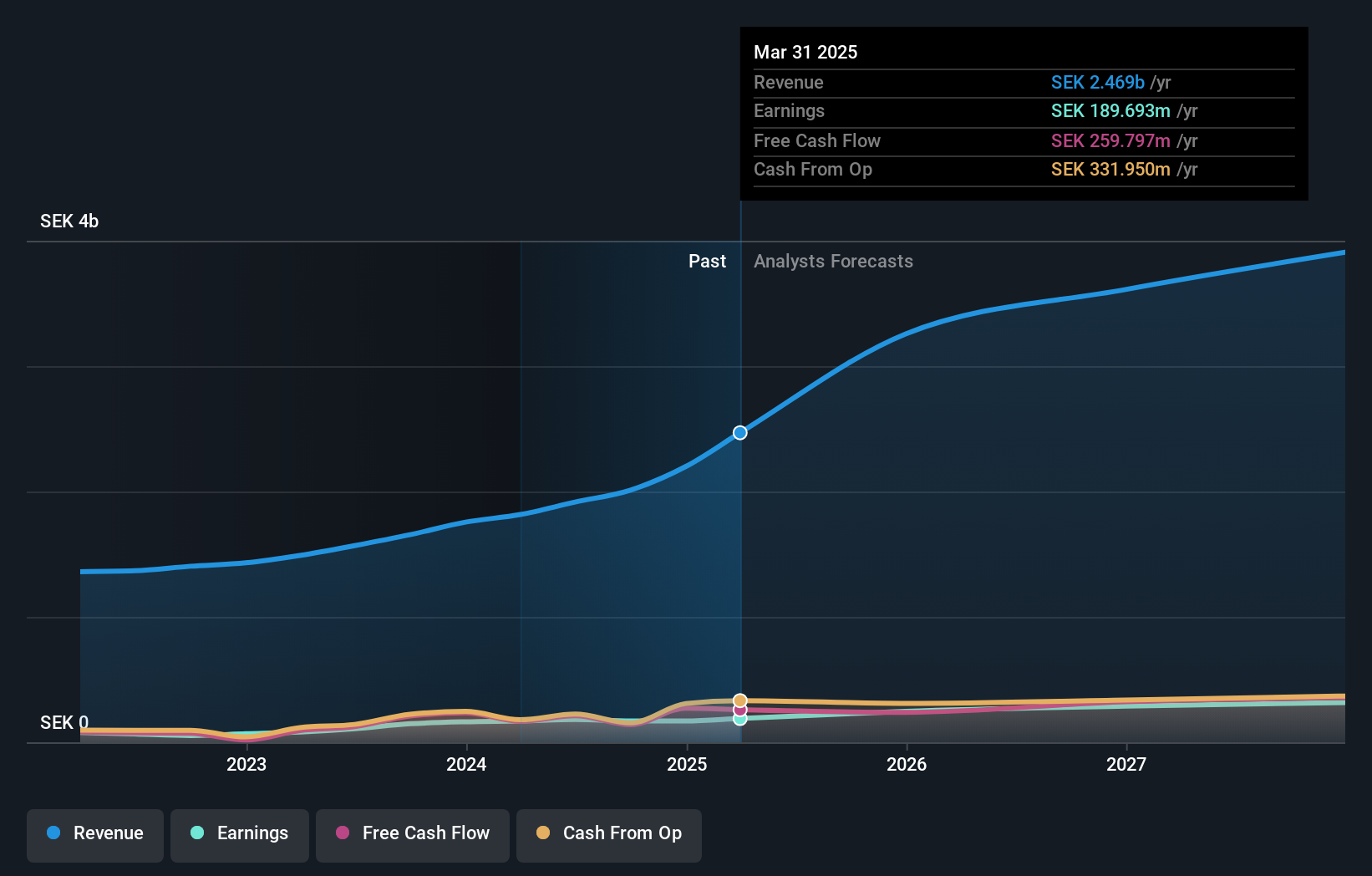

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ratos AB is a Swedish private equity firm focused on buyouts, turnarounds, and acquisitions in the middle market, with a market capitalization of SEK 12.80 billion.

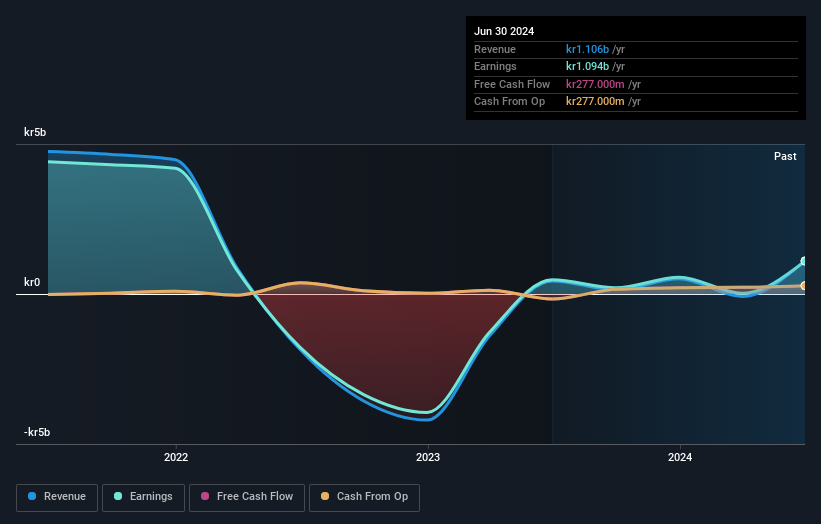

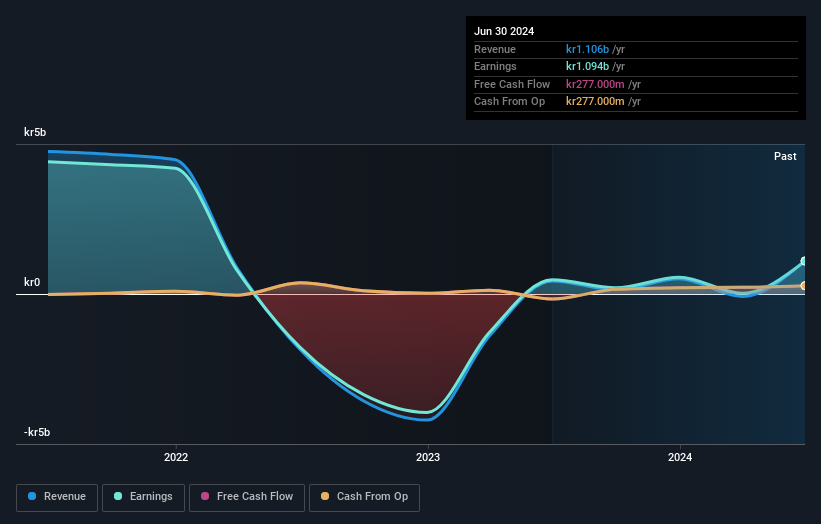

Operations: This company operates across multiple sectors including consumer, industry, and construction & services, generating a significant portion of its revenue from the latter (SEK 17.31 billion). With a gross profit margin that has seen fluctuations over recent years, the firm recorded SEK 14.79 billion in gross profits as of the latest reporting period.

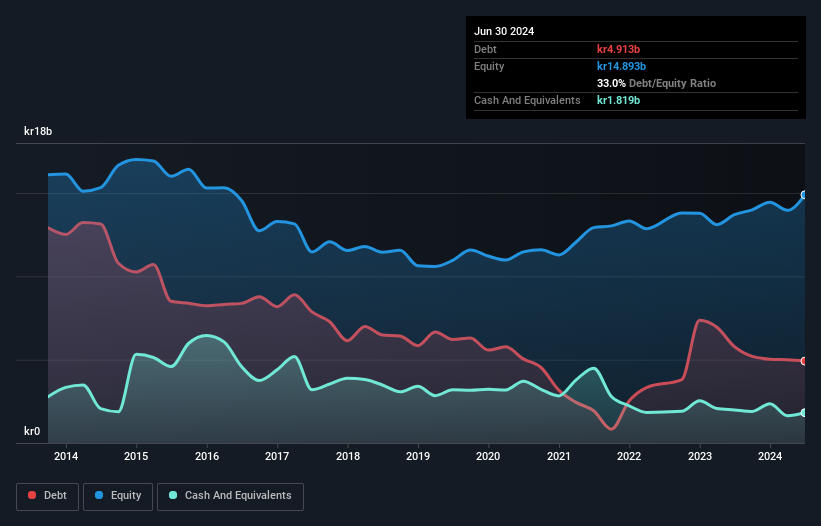

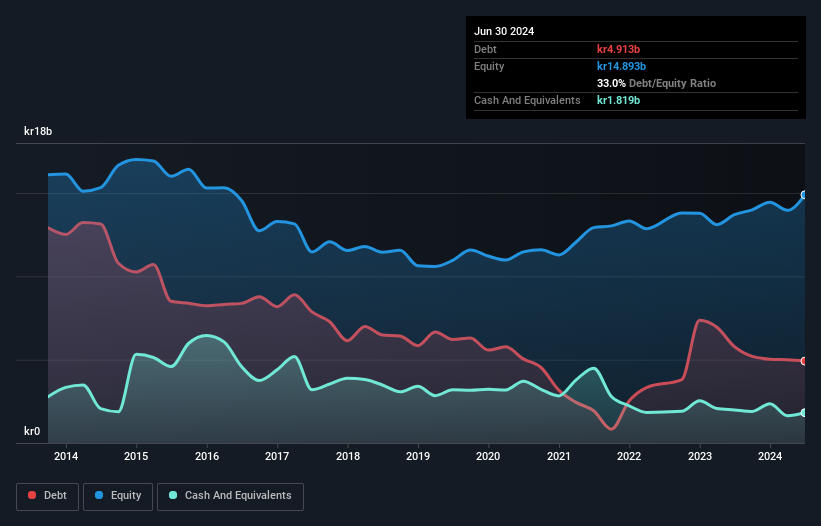

Ratos, a notable player in the Swedish market, has recently secured significant contracts totaling SEK 1.1 billion, bolstering its construction portfolio in key regions like Stockholm and Gothenburg. Financially, the firm is on a strong trajectory with a 72.4% earnings growth surpassing its industry's decline of 6%. Its debt to equity ratio improved impressively from 62.9% to 35.8% over five years, reflecting robust financial management and strategic operations that enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Ratos' health report.

Gain insights into Ratos' past trends and performance with our Past report.

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ratos AB is a Swedish private equity firm focused on buyouts, turnarounds, and acquisitions in the middle market, with a market capitalization of SEK 12.80 billion.

Operations: This company operates across multiple sectors including consumer, industry, and construction & services, generating a significant portion of its revenue from the latter (SEK 17.31 billion). With a gross profit margin that has seen fluctuations over recent years, the firm recorded SEK 14.79 billion in gross profits as of the latest reporting period.

Ratos, a notable player in the Swedish market, has recently secured significant contracts totaling SEK 1.1 billion, bolstering its construction portfolio in key regions like Stockholm and Gothenburg. Financially, the firm is on a strong trajectory with a 72.4% earnings growth surpassing its industry's decline of 6%. Its debt to equity ratio improved impressively from 62.9% to 35.8% over five years, reflecting robust financial management and strategic operations that enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Ratos' health report.

Gain insights into Ratos' past trends and performance with our Past report.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

Overview: Zinzino AB (publ) is a Sweden-based direct sales company that offers dietary supplements and skincare products globally, with a market capitalization of SEK 2.73 billion.

Operations: Zinzino generates its primary revenue from direct sales, including VMA Life products, totaling SEK 1.74 billion. The company's gross profit margin has shown an upward trend, reaching 27.45% in the latest reported period.

Zinzino, a notable player in the retail distribution sector, has demonstrated robust financial health and strategic growth. With earnings growth of 107.6% last year outpacing its industry's 10.3%, the company shows promise. It operates debt-free, enhancing its investment appeal as it trades at 60.4% below estimated fair value. Recent expansions into Serbia and targeted acquisitions in the US and Asia underscore its proactive approach to capturing new markets, leveraging digital commerce effectively to boost its global footprint.

- Take a closer look at Zinzino's potential here in our health report.

Review our historical performance report to gain insights into Zinzino's's past performance.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

Overview: Zinzino AB (publ) is a Sweden-based direct sales company that offers dietary supplements and skincare products globally, with a market capitalization of SEK 2.73 billion.

Operations: Zinzino generates its primary revenue from direct sales, including VMA Life products, totaling SEK 1.74 billion. The company's gross profit margin has shown an upward trend, reaching 27.45% in the latest reported period.

Zinzino, a notable player in the retail distribution sector, has demonstrated robust financial health and strategic growth. With earnings growth of 107.6% last year outpacing its industry's 10.3%, the company shows promise. It operates debt-free, enhancing its investment appeal as it trades at 60.4% below estimated fair value. Recent expansions into Serbia and targeted acquisitions in the US and Asia underscore its proactive approach to capturing new markets, leveraging digital commerce effectively to boost its global footprint.

- Take a closer look at Zinzino's potential here in our health report.

Review our historical performance report to gain insights into Zinzino's's past performance.

Next Steps

- Unlock our comprehensive list of 53 Swedish Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Ratos is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RATO B

Ratos

A private equity firm specializing in buyouts, turnarounds, add on acquisitions, and middle market transactions.

Good value with proven track record.