- Sweden

- /

- Capital Markets

- /

- OM:CASE

Case Group AB (publ)'s (STO:CASE) P/S Is Still On The Mark Following 42% Share Price Bounce

Despite an already strong run, Case Group AB (publ) (STO:CASE) shares have been powering on, with a gain of 42% in the last thirty days. The annual gain comes to 108% following the latest surge, making investors sit up and take notice.

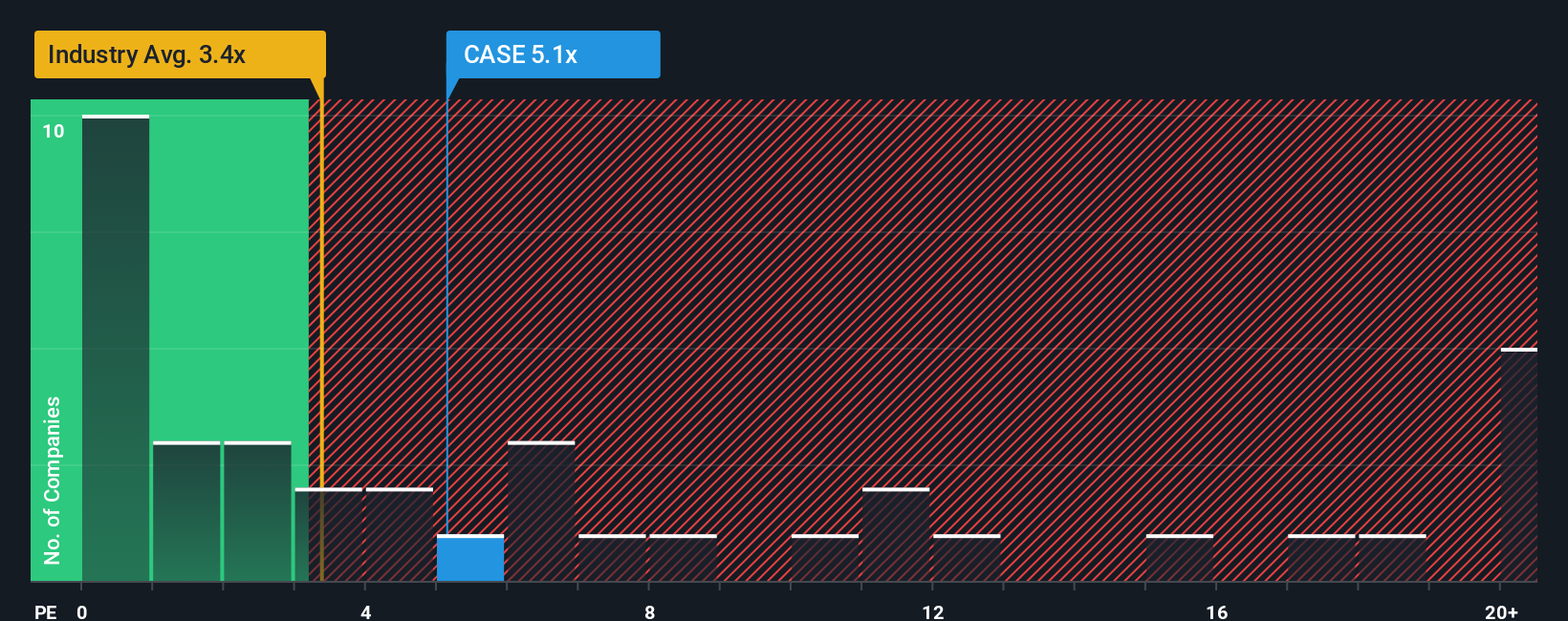

Following the firm bounce in price, Case Group may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.1x, when you consider almost half of the companies in the Capital Markets industry in Sweden have P/S ratios under 3.4x and even P/S lower than 1.1x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Case Group

How Case Group Has Been Performing

Recent times have been quite advantageous for Case Group as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Case Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Case Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. The latest three year period has also seen an excellent 156% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.0% shows it's noticeably more attractive.

In light of this, it's understandable that Case Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Case Group's P/S Mean For Investors?

Case Group's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Case Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Case Group has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CASE

Case Group

Provides wealth management services for private clients in Sweden.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives