- Sweden

- /

- Capital Markets

- /

- OM:BURE

Bure Equity (OM:BURE): Assessing Valuation After Steep Revenue Drop and Turn to Losses

Reviewed by Simply Wall St

Bure Equity (OM:BURE) caught investor attention after reporting a sharp drop in quarterly and year-to-date revenue, with losses replacing the sizable profits seen in the prior year's results.

See our latest analysis for Bure Equity.

It’s been a challenging stretch for Bure Equity, with the latest earnings shock and recent share activity such as its incentive share issue highlighting a tough operating backdrop. The stock price has slid about 35% so far this year, and long-term shareholders have felt the pressure too. The one-year total shareholder return stands at -31%, even though those who bought three years ago are still up overall. Momentum remains weak for now as investors weigh both ongoing losses and the company’s shifting strategy.

If you’re watching how investment trends can change quickly, now may be the perfect time to broaden your search and spot fast growing stocks with high insider ownership.

The sharp downturn in Bure Equity’s financials and share price raises the question: are investors overlooking hidden value after recent losses, or has the market already accounted for the company’s future prospects, leaving little room for upside?

Price-to-Book of 0.9x: Is it justified?

Bure Equity’s shares are trading at a price-to-book (P/B) ratio of 0.9x, which stands out meaningfully when compared to the average peer multiples in the sector. With a recent close at SEK253.4, the company's market valuation looks low on this particular metric relative to its book value.

The price-to-book ratio compares a company's market price to its net assets, providing a quick sense of whether shares are trading below or above what the business “owns.” For an investment group like Bure Equity, which largely holds financial assets, this metric can be revealing since their reported book value is a major component of their valuation.

Bure Equity’s P/B ratio of 0.9x is attractively lower than the peer group average of 3.6x. This suggests the market is pricing in pessimism about Bure’s outlook or asset quality. However, considering the company is currently unprofitable, with increasing losses and negative returns, the discount may be a result of justified caution rather than a market oversight. It is notable that relative to the wider Swedish Capital Markets industry, Bure is in line at 0.9x as well, further highlighting that its low valuation aligns with industry realities.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.9x (UNDERVALUED)

However, continued unprofitability or further declines in asset values could reduce investor confidence, which may keep the shares trading at a discount.

Find out about the key risks to this Bure Equity narrative.

Another View: What Does the SWS DCF Model Indicate?

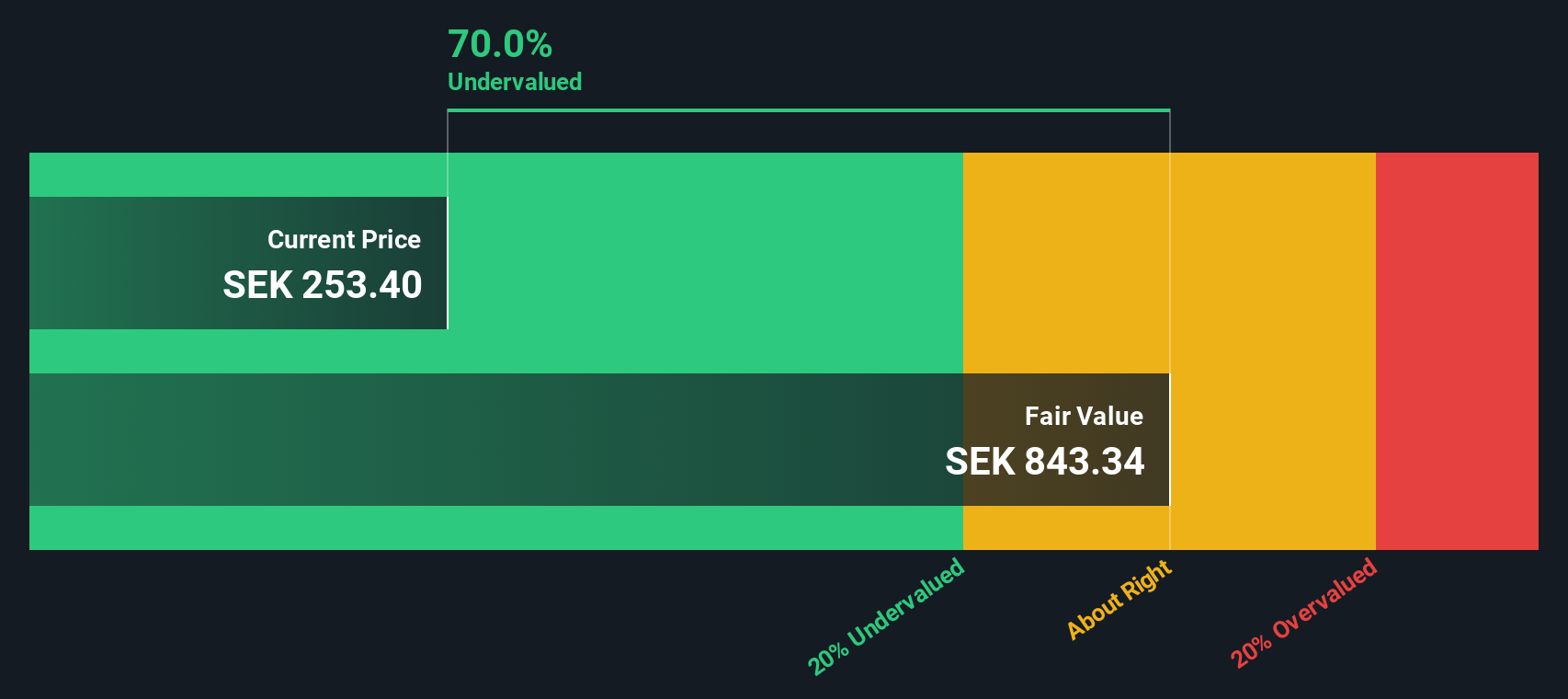

While the price-to-book ratio paints Bure Equity as undervalued compared to peers, our DCF model tells a similar but much stronger story. According to the SWS DCF model, the company is trading around 70% below its fair value, which suggests even more upside than the P/B ratio alone indicates. Could the market be overly pessimistic, or are there risks this model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bure Equity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 873 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bure Equity Narrative

Keep in mind, if the analysis above doesn’t reflect your own take or you’d rather dig into the numbers personally, you can construct your own perspective in just a few minutes. Do it your way.

A great starting point for your Bure Equity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your investing game and seize new opportunities before they hit the headlines. The best opportunities often emerge where you least expect them.

- Get ahead of the curve by targeting smart picks among these 873 undervalued stocks based on cash flows that the market might be missing right now.

- Unlock tomorrow's top performers when you scan these 24 AI penny stocks, which are packed with rapid growth and true innovation in artificial intelligence.

- Pocket extra income while building your portfolio by reviewing these 16 dividend stocks with yields > 3% to find healthy yields and steady rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bure Equity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BURE

Bure Equity

A private equity and venture capital firm specializing in secondary direct, later stage, middle market, mature, buyouts, mid venture, late venture, PIPES, bridge, industry consolidation, recapitalizations, growth capital, special situation and turnarounds.

Flawless balance sheet and fair value.

Market Insights

Community Narratives