Stock Analysis

Discover Three Swedish Dividend Stocks With Yields Up To 7.5%

Reviewed by Simply Wall St

As global markets navigate through fluctuating conditions, with sectors like technology experiencing significant growth while others face challenges, investors are increasingly looking for stable returns amidst uncertainty. In this context, Swedish dividend stocks present an appealing option for those seeking to combine potential income generation with the relative stability of established companies in a mature market.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.16% | ★★★★★★ |

| Betsson (OM:BETS B) | 6.21% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.31% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.19% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.05% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.50% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.27% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.80% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.19% | ★★★★★☆ |

| AB Traction (OM:TRAC B) | 4.03% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB, along with its subsidiaries, provides savings, pension, and mortgage products primarily in Sweden and has a market capitalization of approximately SEK 43.16 billion.

Operations: Avanza Bank Holding generates its revenue primarily through commercial operations, which amounted to SEK 3.84 billion.

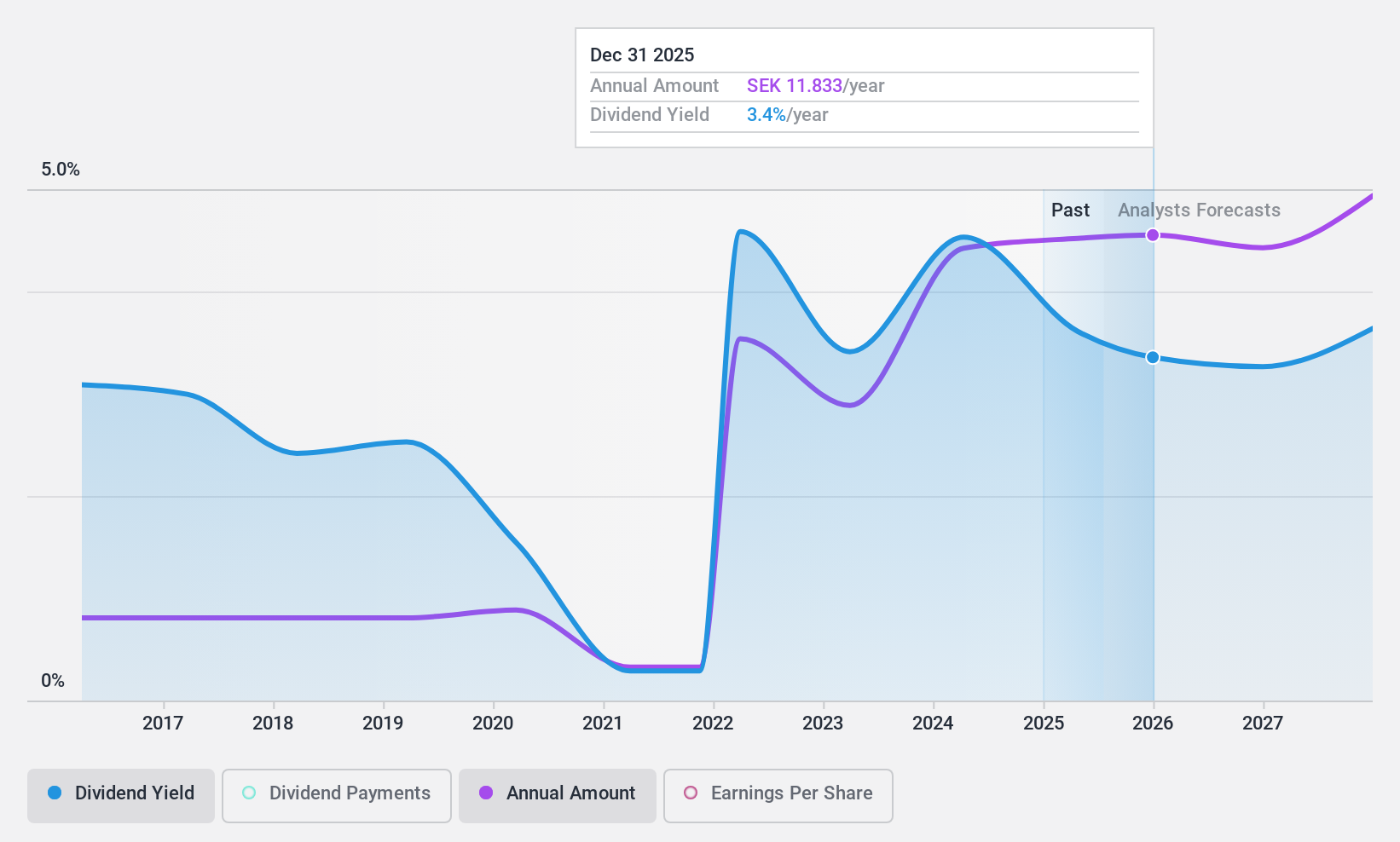

Dividend Yield: 4.2%

Avanza Bank Holding's recent dividend increase to SEK 11.50 reflects a positive trend, though its dividend history over the last decade shows volatility, with significant drops. The company reported a net income rise to SEK 555 million in Q1 2024 from SEK 501 million the previous year. Despite a high payout ratio of 88.6%, dividends are well-covered by earnings and cash flows, with a cash payout ratio at just 18.5%. This suggests sustainability, supported by an annual customer growth contributing to robust inflows.

- Click here and access our complete dividend analysis report to understand the dynamics of Avanza Bank Holding.

- In light of our recent valuation report, it seems possible that Avanza Bank Holding is trading beyond its estimated value.

Nordic Paper Holding (OM:NPAPER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates in the production and sale of natural greaseproof and kraft paper across Sweden, Italy, Germany, other European countries, the United States, and internationally, with a market cap of approximately SEK 3.55 billion.

Operations: Nordic Paper Holding AB generates revenue primarily through two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper with SEK 2.19 billion in sales.

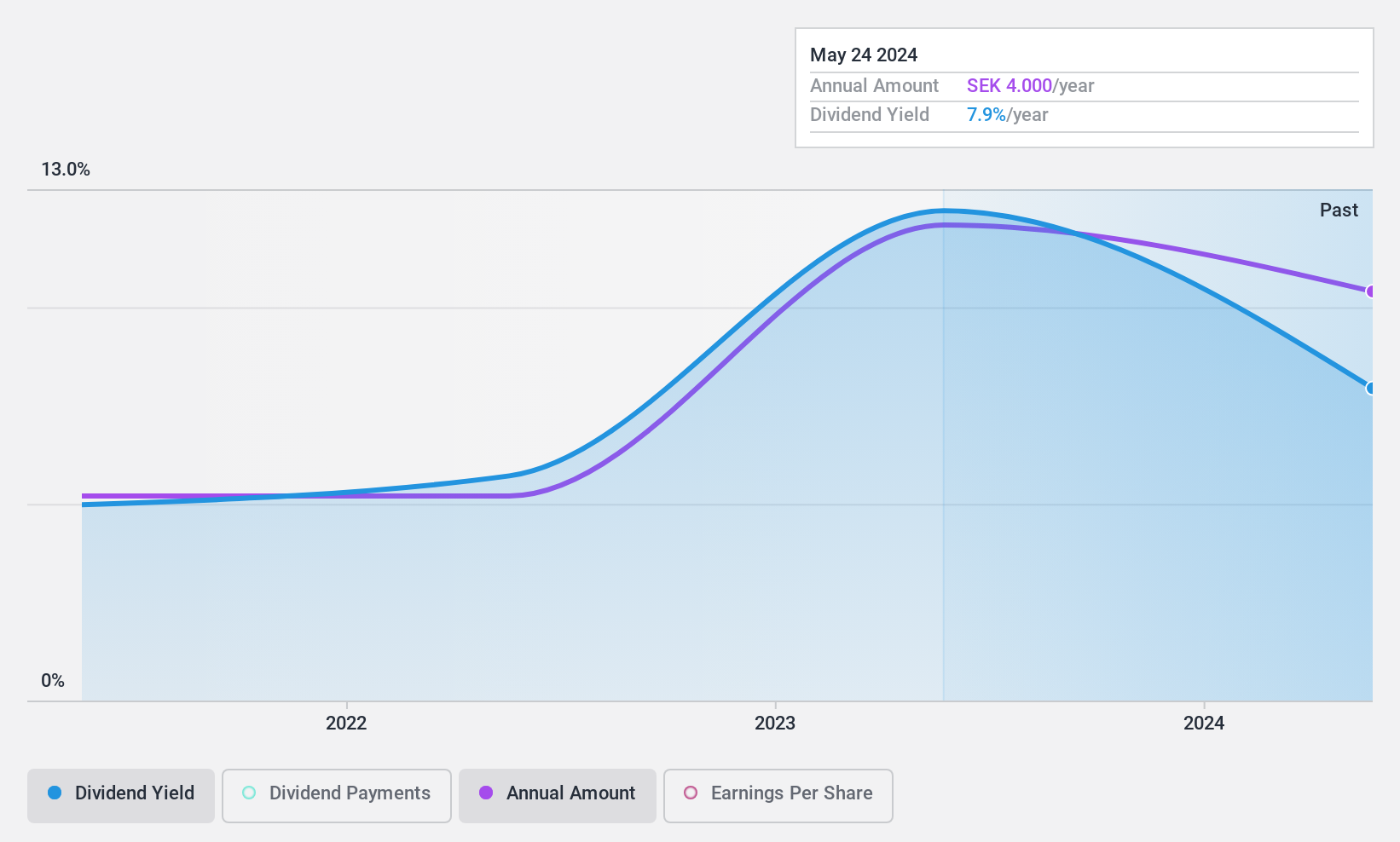

Dividend Yield: 7.5%

Nordic Paper Holding's dividend yield of 7.53% ranks in the top quartile in Sweden, despite a recent cut to SEK 4 per share as of May 2024. While dividends are supported by earnings with a payout ratio of 68.3% and cash flows at 78%, the company's dividend history is short and unstable, having initiated payments only three years ago. Additionally, recent financials show a decline in net income from SEK 173 million to SEK 149 million year-over-year for Q1 2024, suggesting potential challenges ahead in maintaining dividend growth.

- Click to explore a detailed breakdown of our findings in Nordic Paper Holding's dividend report.

- In light of our recent valuation report, it seems possible that Nordic Paper Holding is trading behind its estimated value.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates as a provider of non-life insurance products for private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.66 billion.

Operations: Solid Försäkringsaktiebolag generates revenue through three primary segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

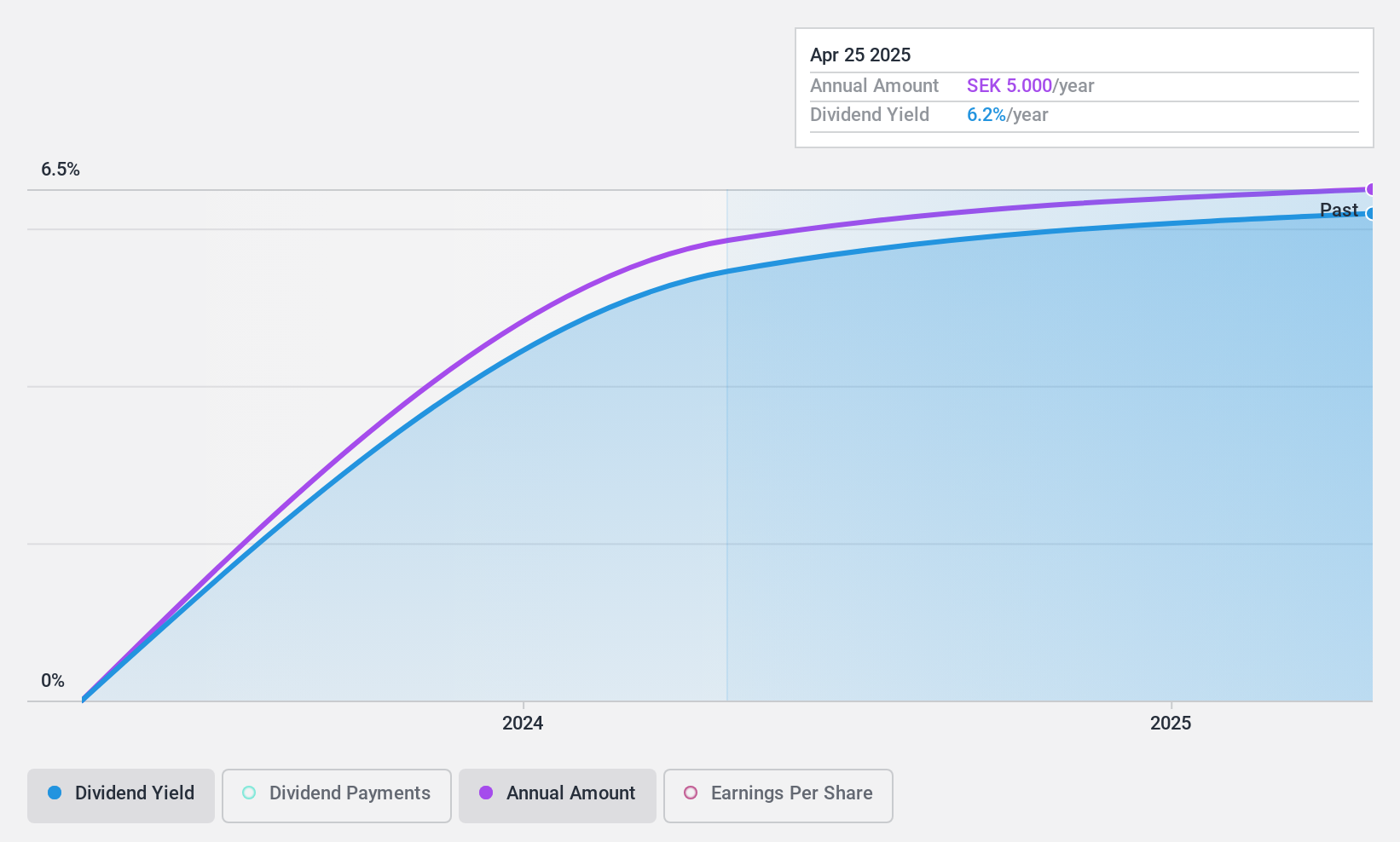

Dividend Yield: 5%

Solid Försäkringsaktiebolag recently declared a dividend of SEK 82.84 million, equating to SEK 4.50 per share, reflecting a commitment to shareholder returns amidst a positive earnings report for Q1 2024 with net income rising to SEK 45.04 million from SEK 41.51 million year-over-year. The company's dividends appear sustainable with an earnings coverage at 50.2% and cash flow coverage at 86.5%, though its dividend history is too brief to judge long-term stability or growth potential reliably.

- Delve into the full analysis dividend report here for a deeper understanding of Solid Försäkringsaktiebolag.

- The valuation report we've compiled suggests that Solid Försäkringsaktiebolag's current price could be quite moderate.

Summing It All Up

- Get an in-depth perspective on all 23 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Solid Försäkringsaktiebolag is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SFAB

Solid Försäkringsaktiebolag

Provides non-life insurance products for private individuals in Sweden, Denmark, Norway, Finland, and the rest of Europe.

Solid track record, good value and pays a dividend.