- Sweden

- /

- Capital Markets

- /

- NGM:SPLTN

June 2025's Top Undervalued European Small Caps With Insider Action

Reviewed by Simply Wall St

Amid heightened geopolitical tensions and fluctuating trade policies, the European market has experienced a downturn, with the STOXX Europe 600 Index falling by 1.57% in June 2025. As economic uncertainties persist, identifying promising small-cap stocks requires careful consideration of factors such as financial stability and growth potential in volatile conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.9x | 0.5x | 34.40% | ★★★★★☆ |

| Tristel | 28.9x | 4.1x | 10.18% | ★★★★☆☆ |

| Sabre Insurance Group | 9.5x | 1.6x | -0.75% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 36.46% | ★★★★☆☆ |

| Absolent Air Care Group | 22.4x | 1.8x | 49.15% | ★★★☆☆☆ |

| Italmobiliare | 11.4x | 1.5x | -206.40% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -31.23% | ★★★☆☆☆ |

| Fintel | 46.4x | 3.5x | 35.06% | ★★★☆☆☆ |

| H+H International | 32.7x | 0.8x | 45.99% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 47.43% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

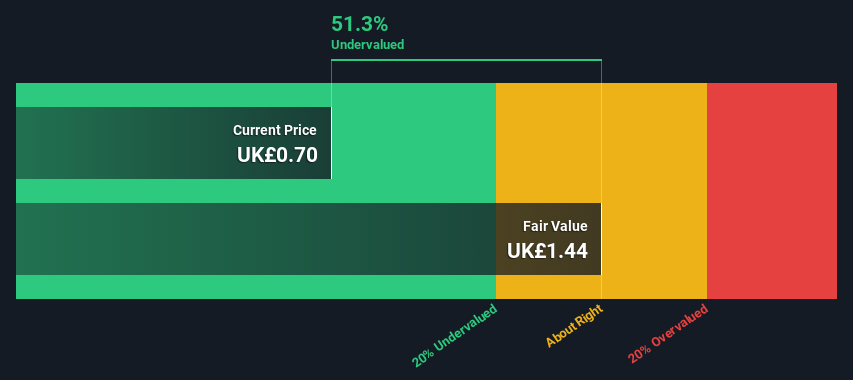

Social Housing REIT (LSE:SOHO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Social Housing REIT focuses on investing in residential properties within the social housing sector, with a market capitalization of approximately £0.38 billion.

Operations: The company's revenue is primarily generated from its residential REIT segment, with recent figures showing £39.18 million. The cost of goods sold (COGS) was £7.81 million, resulting in a gross profit margin of 80.06%. Operating expenses include significant general and administrative costs, which were £6.72 million in the latest period reported. Non-operating expenses have notably impacted net income, contributing to a negative net income margin of -92.88% as of the most recent data point available.

PE: -7.8x

Social Housing REIT, a smaller player in the European market, is drawing attention due to its recent dividend increase. The company announced an interim dividend of £0.014055 per share for Q1 2025, with a target of £0.05622 per share for the full year—a 3% rise from 2024. Despite facing a net loss of £36.39 million in 2024 and relying on riskier external borrowing, insider confidence has been evident with purchases made over the past six months. This suggests potential faith in future growth prospects driven by improved earnings and strategic management changes such as reduced costs through Atrato Partners Limited's appointment as Investment Manager.

- Click to explore a detailed breakdown of our findings in Social Housing REIT's valuation report.

Gain insights into Social Housing REIT's past trends and performance with our Past report.

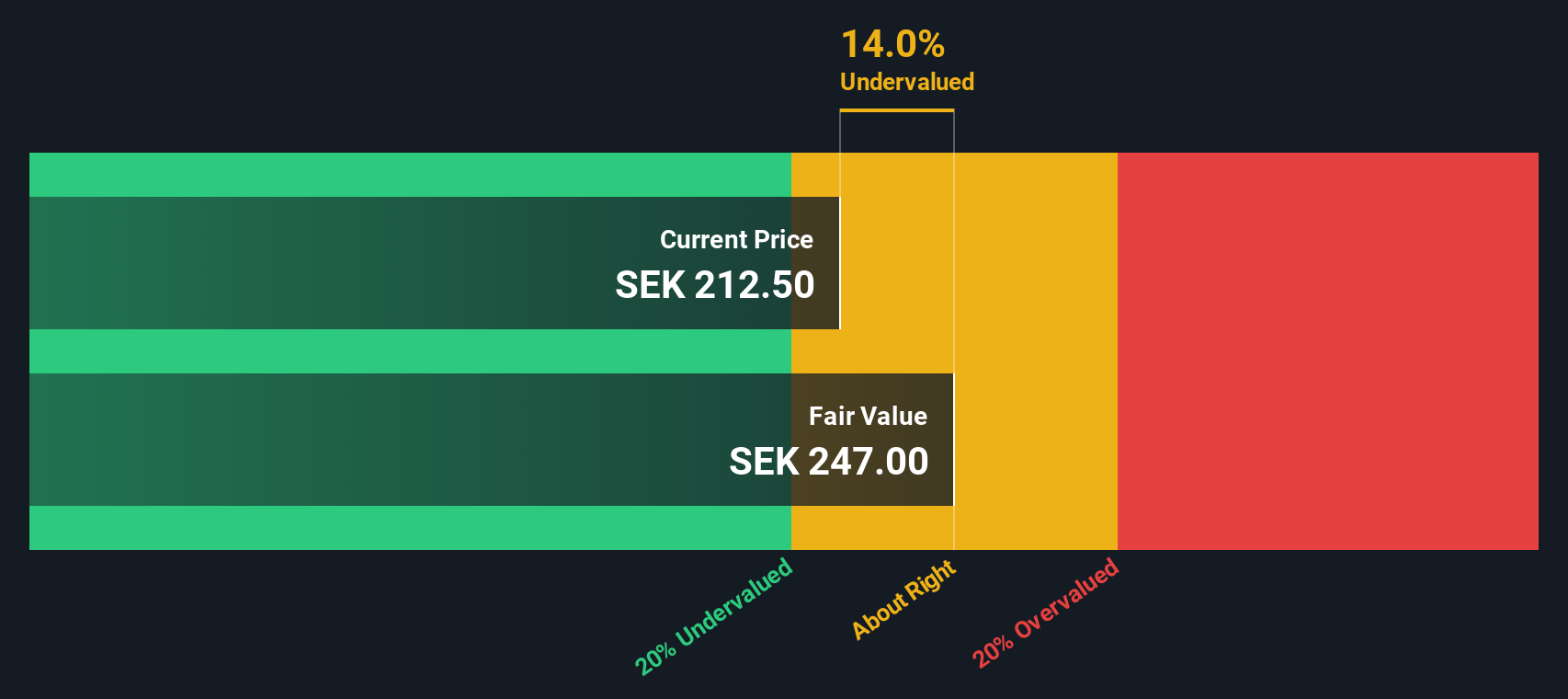

Investment AB Spiltan (NGM:SPLTN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Investment AB Spiltan is a Swedish investment company that focuses on long-term investments in both listed and unlisted companies, with a market capitalization of approximately SEK 9.28 billion.

Operations: Investment AB Spiltan generates revenue from its operations, with recent data showing fluctuations in revenue and net income figures. The company consistently reports a gross profit margin of 100%, indicating that it incurs no cost of goods sold. Operating expenses are primarily driven by general and administrative costs, which have varied over time but generally remain below SEK 35 million per period. Net income margins have shown variability, at times exceeding 100%, reflecting the impact of non-operating expenses on overall profitability.

PE: -104.3x

Investment AB Spiltan, a small player in the European market, has seen its earnings decline by 39% annually over five years. Despite generating less than US$1 million in revenue, insider confidence is evident with significant share purchases made over recent months. The company relies solely on external borrowing for funding, which poses higher risks. Recent reports show increased negative revenue of SEK 377 million and a net loss of SEK 374 million for Q1 2025. As they presented at ABGSC Investor Days in May, the focus remains on navigating financial challenges while seeking growth opportunities.

- Delve into the full analysis valuation report here for a deeper understanding of Investment AB Spiltan.

Assess Investment AB Spiltan's past performance with our detailed historical performance reports.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing properties primarily in northern Sweden, with a market capitalization of approximately SEK 9.5 billion.

Operations: The company's revenue streams are primarily derived from regional operations, with notable contributions from areas such as Luleå and Dalarna. Operating expenses have generally been stable, but non-operating expenses have shown significant fluctuations over the periods. The gross profit margin has experienced a gradual increase, reaching 68.58% by the end of 2024.

PE: 15.8x

Diös Fastigheter, a European property company, is undergoing significant developments. Recent insider confidence is evident as an independent director purchased 15,000 shares for approximately SEK 987,450 between March and June 2025. This aligns with strategic moves like a SEK 117 million investment in Falun's city center to convert retail space into educational facilities and expand leasing agreements. Despite challenges with interest coverage due to reliance on external borrowing, earnings are projected to grow by over 16% annually.

Key Takeaways

- Investigate our full lineup of 75 Undervalued European Small Caps With Insider Buying right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:SPLTN

Investment AB Spiltan

A venture capital and private equity firm specializing in providing multi stage financing with a focus on startups and growth companies.

Adequate balance sheet and fair value.

Market Insights

Community Narratives