- Sweden

- /

- Hospitality

- /

- OM:RAKE

Raketech Group Holding PLC's (STO:RAKE) Shares Bounce 26% But Its Business Still Trails The Industry

Raketech Group Holding PLC (STO:RAKE) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 68% share price drop in the last twelve months.

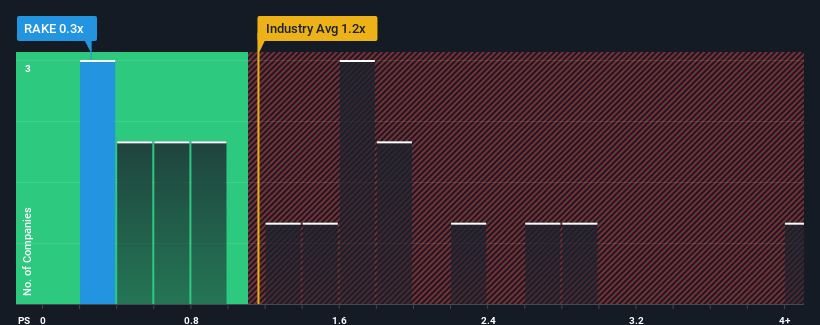

In spite of the firm bounce in price, it would still be understandable if you think Raketech Group Holding is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Sweden's Hospitality industry have P/S ratios above 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Raketech Group Holding. View them for free.View our latest analysis for Raketech Group Holding

How Raketech Group Holding Has Been Performing

Raketech Group Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Raketech Group Holding's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Raketech Group Holding?

In order to justify its P/S ratio, Raketech Group Holding would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 59% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 5.1% each year during the coming three years according to the dual analysts following the company. With the industry predicted to deliver 8.1% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Raketech Group Holding's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Raketech Group Holding's P/S

Raketech Group Holding's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Raketech Group Holding's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 1 warning sign for Raketech Group Holding you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RAKE

Raketech Group Holding

Operates as an affiliate and performance marketing company worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives