- Finland

- /

- Capital Markets

- /

- HLSE:EVLI

Three Undiscovered European Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid recent global market turmoil triggered by unexpected U.S. trade tariffs, European indices have seen significant declines, with the STOXX Europe 600 Index experiencing its largest drop in five years. In this challenging environment, identifying resilient and innovative small-cap stocks can be crucial for investors seeking to enhance their portfolios with potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Alantra Partners | NA | -3.99% | -23.83% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Antibiotice (BVB:ATB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Antibiotice S.A. is a Romanian company that produces and sells medicinal products, with a market capitalization of RON1.45 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to RON686.57 million.

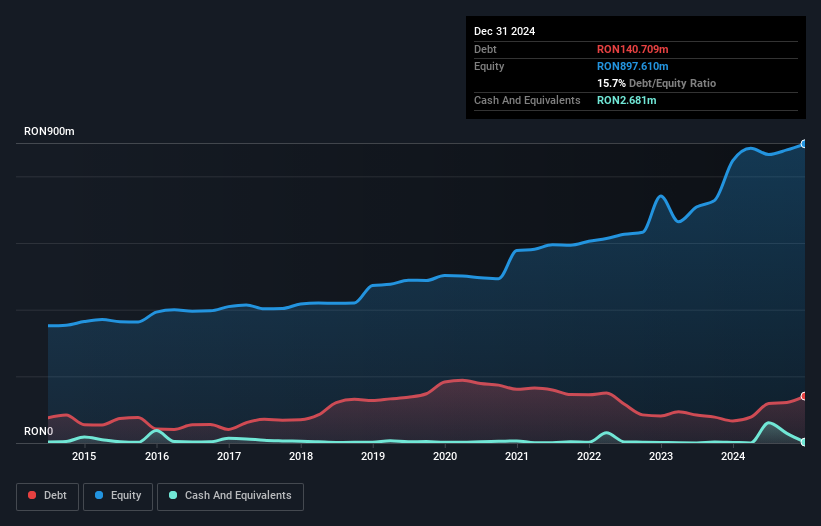

Antibiotice, a pharmaceutical player in Romania, showcases a solid financial position with a net debt to equity ratio of 15.4%, deemed satisfactory. Its price-to-earnings ratio of 14.6x is attractive compared to the industry average of 20.4x, indicating potential value for investors. Despite earnings growth outpacing the industry at 22.6% last year, future projections suggest challenges ahead with expected declines averaging 149.6% annually over three years. Recent results highlighted RON 11.12 million in sales and RON 99.42 million net income for the full year ending December 2024, reflecting its profitability despite revenue contraction from RON 13.38 million previously.

- Click to explore a detailed breakdown of our findings in Antibiotice's health report.

Assess Antibiotice's past performance with our detailed historical performance reports.

Evli Oyj (HLSE:EVLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Evli Oyj is an asset management company that, along with its subsidiaries, provides services to corporate, institutional, and private clients across Finland, Sweden, and internationally; it has a market capitalization of €466.08 million.

Operations: Evli Oyj generates revenue primarily from Wealth Management and Investor Clients (€96.40 million), followed by Group Operations (€20.50 million) and Advisory and Corporate Clients (€9.90 million). The company's financial performance is characterized by its net profit margin, which reflects the efficiency of its operations in converting revenue into profit.

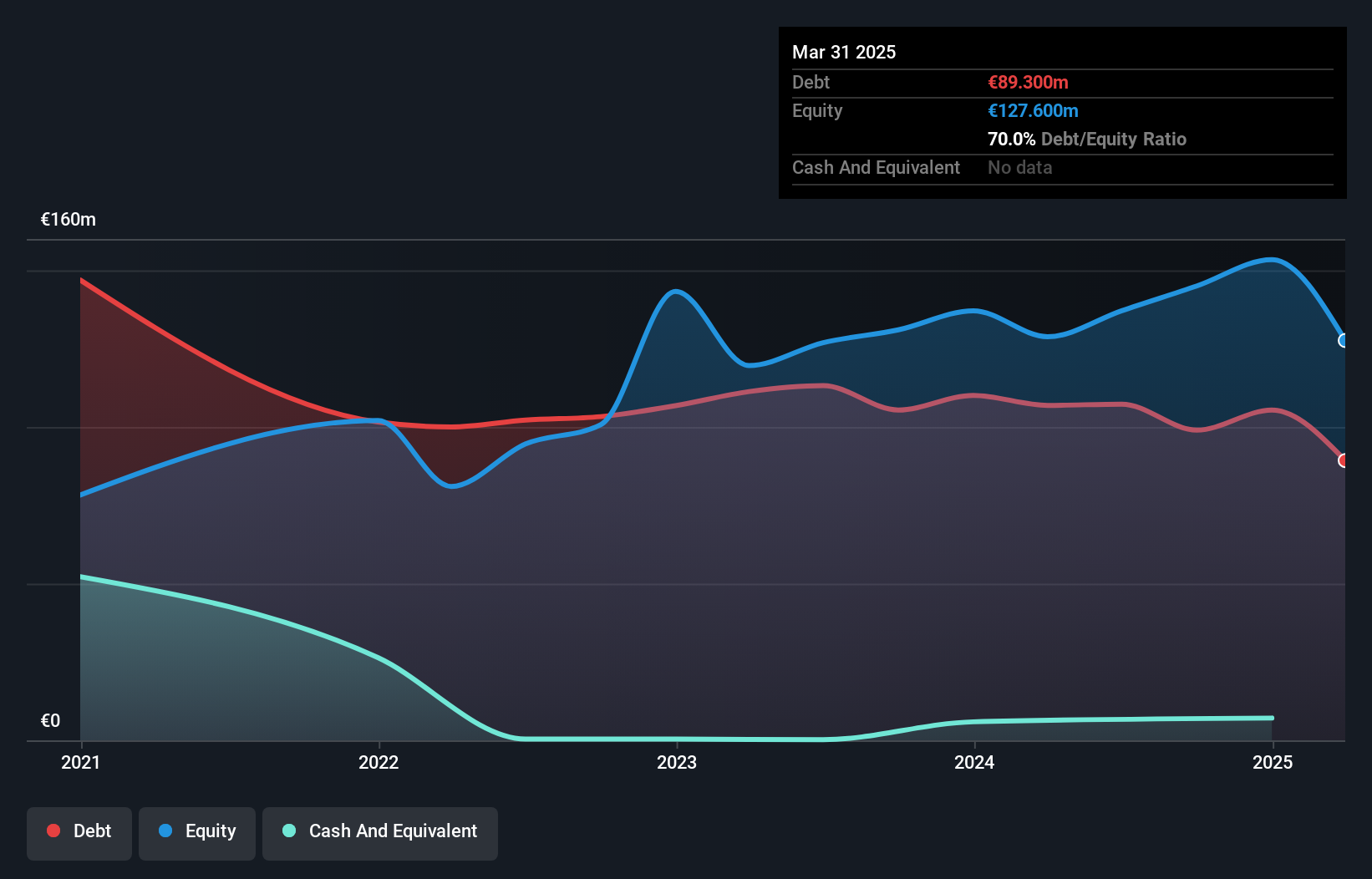

Evli Oyj, a financial entity in Europe, has shown impressive earnings growth of 54.9% over the past year, outpacing the Capital Markets industry average of 22.1%. Trading at approximately 32.7% below its estimated fair value, it offers potential for value seekers despite its high net debt to equity ratio of 64.1%. The company's interest payments are well covered by EBIT at a robust 13.2x coverage, reflecting sound financial management amidst challenges like geopolitical risks and economic uncertainties. With a diverse product range and customer base supporting growth, Evli's market position remains strong even as earnings are forecasted to decline slightly by an average of 1.4% annually over the next three years.

Kambi Group (OM:KAMBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Kambi Group plc is an independent provider of sports betting technology and services to the betting and gaming industry across Europe, the Americas, and internationally, with a market cap of SEK2.98 billion.

Operations: Kambi Group generates revenue primarily through the provision of managed sports betting services, amounting to €176.42 million.

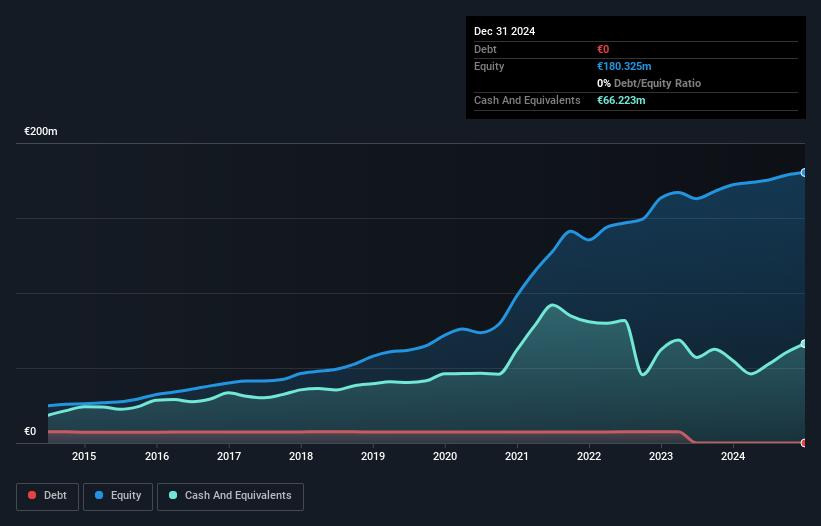

Kambi Group, a nimble player in the sports betting industry, is leveraging strategic partnerships with Stake and Hard Rock Digital to expand its footprint in Brazil and the U.S. Despite facing challenges like client losses and regulatory impacts, Kambi's innovative AI-driven solutions aim to boost efficiency. The company reported annual sales of €176.42 million for 2024, a slight increase from €173.3 million the previous year, while net income rose to €15.45 million from €14.9 million. Trading at a significant discount of 42% below its estimated fair value suggests potential upside for investors considering this opportunity amidst market volatility.

Seize The Opportunity

- Gain an insight into the universe of 340 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evli Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:EVLI

Evli Oyj

Operates as an asset manager serving corporate, institutional, and private clients in Finland, Sweden, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives