- Sweden

- /

- Consumer Services

- /

- OM:ALBERT

Not Many Are Piling Into eEducation Albert AB (publ) (STO:ALBERT) Stock Yet As It Plummets 26%

Unfortunately for some shareholders, the eEducation Albert AB (publ) (STO:ALBERT) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

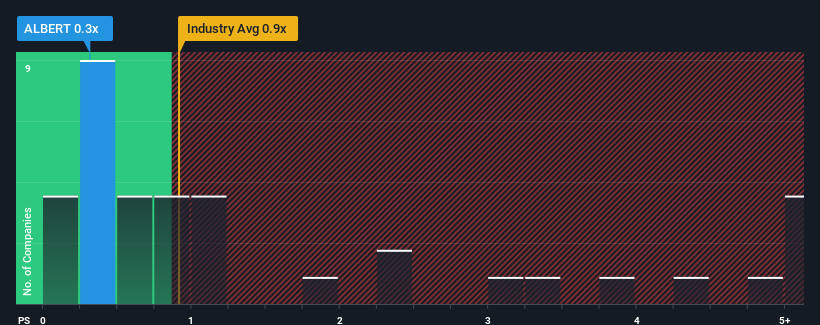

In spite of the heavy fall in price, it's still not a stretch to say that eEducation Albert's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Consumer Services industry in Sweden, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for eEducation Albert

What Does eEducation Albert's P/S Mean For Shareholders?

Recent revenue growth for eEducation Albert has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think eEducation Albert's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For eEducation Albert?

There's an inherent assumption that a company should be matching the industry for P/S ratios like eEducation Albert's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 215% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 8.0% per year as estimated by the two analysts watching the company. With the industry only predicted to deliver 5.4% per year, the company is positioned for a stronger revenue result.

In light of this, it's curious that eEducation Albert's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for eEducation Albert looks to be in line with the rest of the Consumer Services industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at eEducation Albert's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for eEducation Albert (of which 1 is concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ALBERT

eEducation Albert

Develops and markets digital educational services on a subscription basis to private individuals and schools in Sweden and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives