- Sweden

- /

- Consumer Services

- /

- OM:ALBERT

eEducation Albert AB (publ) (STO:ALBERT) Might Not Be As Mispriced As It Looks After Plunging 30%

Unfortunately for some shareholders, the eEducation Albert AB (publ) (STO:ALBERT) share price has dived 30% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

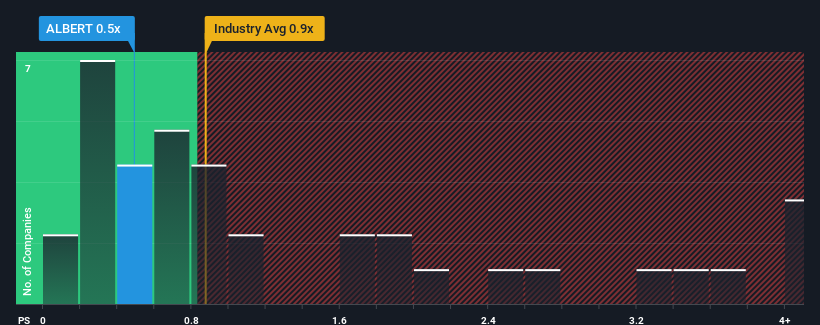

Even after such a large drop in price, there still wouldn't be many who think eEducation Albert's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Sweden's Consumer Services industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for eEducation Albert

How eEducation Albert Has Been Performing

Recent times have been advantageous for eEducation Albert as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on eEducation Albert will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like eEducation Albert's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 62%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 20%. With the rest of the industry predicted to shrink by 2.4%, that would be a fantastic result.

With this information, we find it odd that eEducation Albert is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for eEducation Albert looks to be in line with the rest of the Consumer Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We note that even though eEducation Albert trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for eEducation Albert (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on eEducation Albert, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ALBERT

eEducation Albert

Develops and markets digital educational services on a subscription basis to private individuals and schools in Sweden and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives