- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

3 European Stocks Estimated To Be Trading Below Intrinsic Value By Up To 28.1%

Reviewed by Simply Wall St

Amid recent declines in major European stock indexes, such as the STOXX Europe 600 and Germany's DAX, investors are increasingly focused on finding opportunities that may be trading below their intrinsic value. In this environment of economic uncertainty and trade policy shifts, identifying stocks with strong fundamentals and potential for growth can be particularly beneficial.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK176.50 | NOK352.99 | 50% |

| Qt Group Oyj (HLSE:QTCOM) | €58.15 | €114.88 | 49.4% |

| Profoto Holding (OM:PRFO) | SEK21.80 | SEK42.88 | 49.2% |

| Pluxee (ENXTPA:PLX) | €17.29 | €33.91 | 49% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.68 | €23.34 | 50% |

| innoscripta (XTRA:1INN) | €99.70 | €195.02 | 48.9% |

| FDJ United (ENXTPA:FDJU) | €27.52 | €53.72 | 48.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.42 | €6.74 | 49.3% |

| Diagnostyka (WSE:DIA) | PLN184.70 | PLN362.30 | 49% |

| Cambi (OB:CAMBI) | NOK21.70 | NOK42.95 | 49.5% |

We're going to check out a few of the best picks from our screener tool.

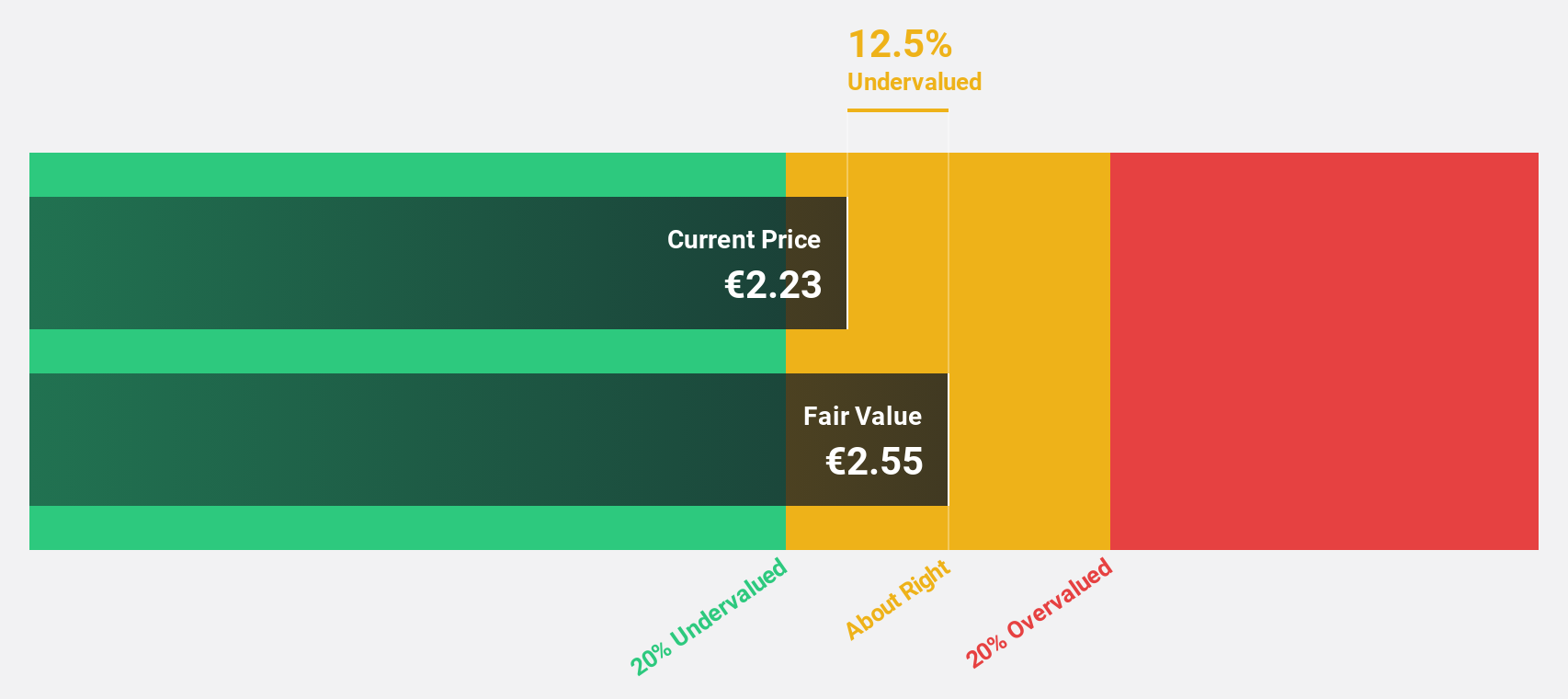

Permanent TSB Group Holdings (ISE:PTSB)

Overview: Permanent TSB Group Holdings plc is a financial institution that provides retail and SME banking services in the Republic of Ireland, with a market capitalization of approximately €1.13 billion.

Operations: The company generates revenue through its operations in the retail and SME banking sectors within the Republic of Ireland.

Estimated Discount To Fair Value: 27.4%

Permanent TSB Group Holdings appears undervalued, trading at €2.08, below its estimated fair value of €2.87. Despite recent earnings of €15 million for H1 2025 and NatWest's divestment plans, the company's earnings are forecast to grow significantly at 30.4% annually, outpacing the Irish market's average growth rate. However, while revenue growth is expected to be modest at 4.9%, one-off items have impacted financial results and future return on equity remains low at a forecasted 5.5%.

- The growth report we've compiled suggests that Permanent TSB Group Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Permanent TSB Group Holdings.

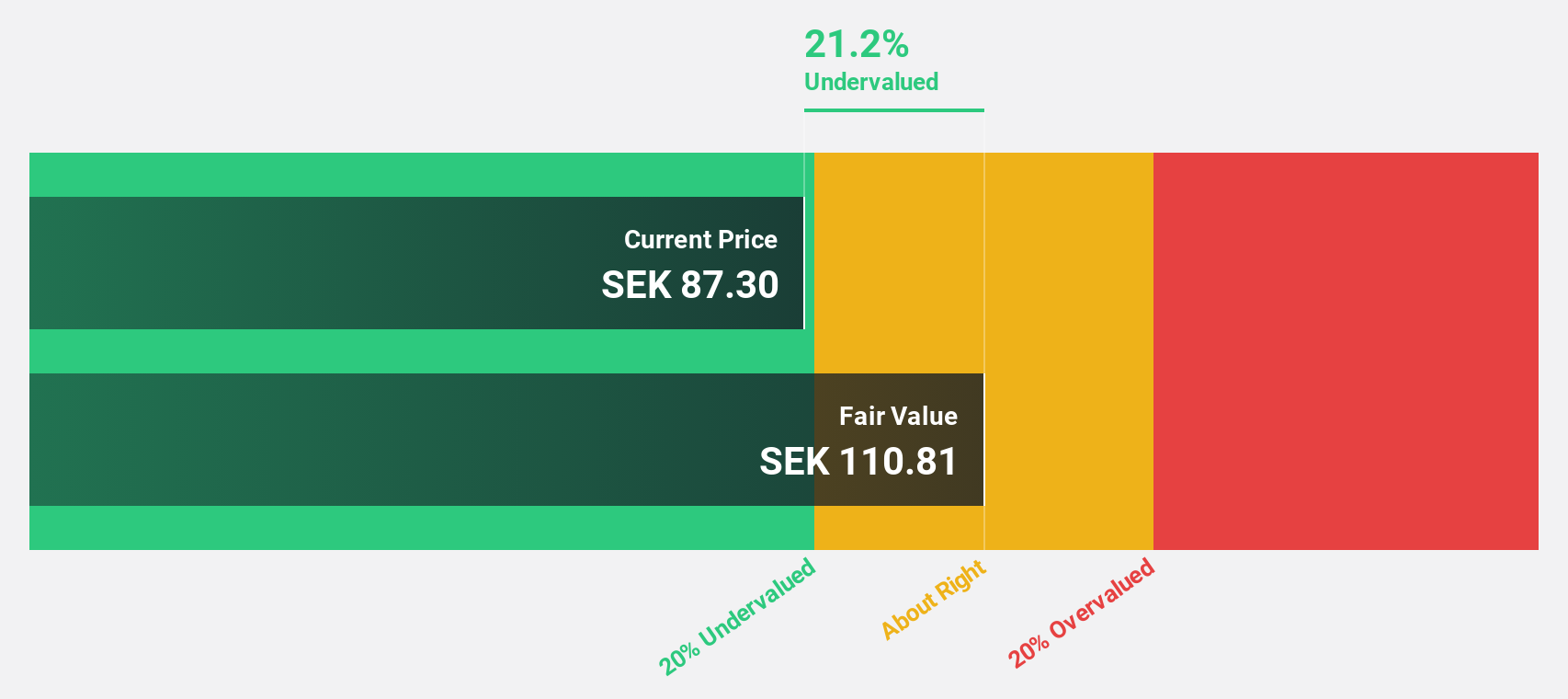

AcadeMedia (OM:ACAD)

Overview: AcadeMedia AB (publ) is an independent education provider operating in Sweden, Norway, the Netherlands, and Germany with a market cap of SEK8.84 billion.

Operations: The company's revenue is derived from several segments, including Adult Education (SEK1.89 billion), Compulsory School (SEK4.70 billion), Upper Secondary Schools (SEK6.54 billion), and Preschool & International (SEK7.88 billion).

Estimated Discount To Fair Value: 20%

AcadeMedia is trading at SEK 89.3, below its estimated fair value of SEK 111.66, indicating it may be undervalued based on cash flows. The company reported strong third-quarter earnings with net income rising to SEK 241 million from SEK 215 million the previous year, and revenue growth outpacing the Swedish market at a forecasted rate of 5.9% annually. Earnings are projected to grow significantly by over 20% per year, despite a modest return on equity forecasted at 14.9%.

- In light of our recent growth report, it seems possible that AcadeMedia's financial performance will exceed current levels.

- Take a closer look at AcadeMedia's balance sheet health here in our report.

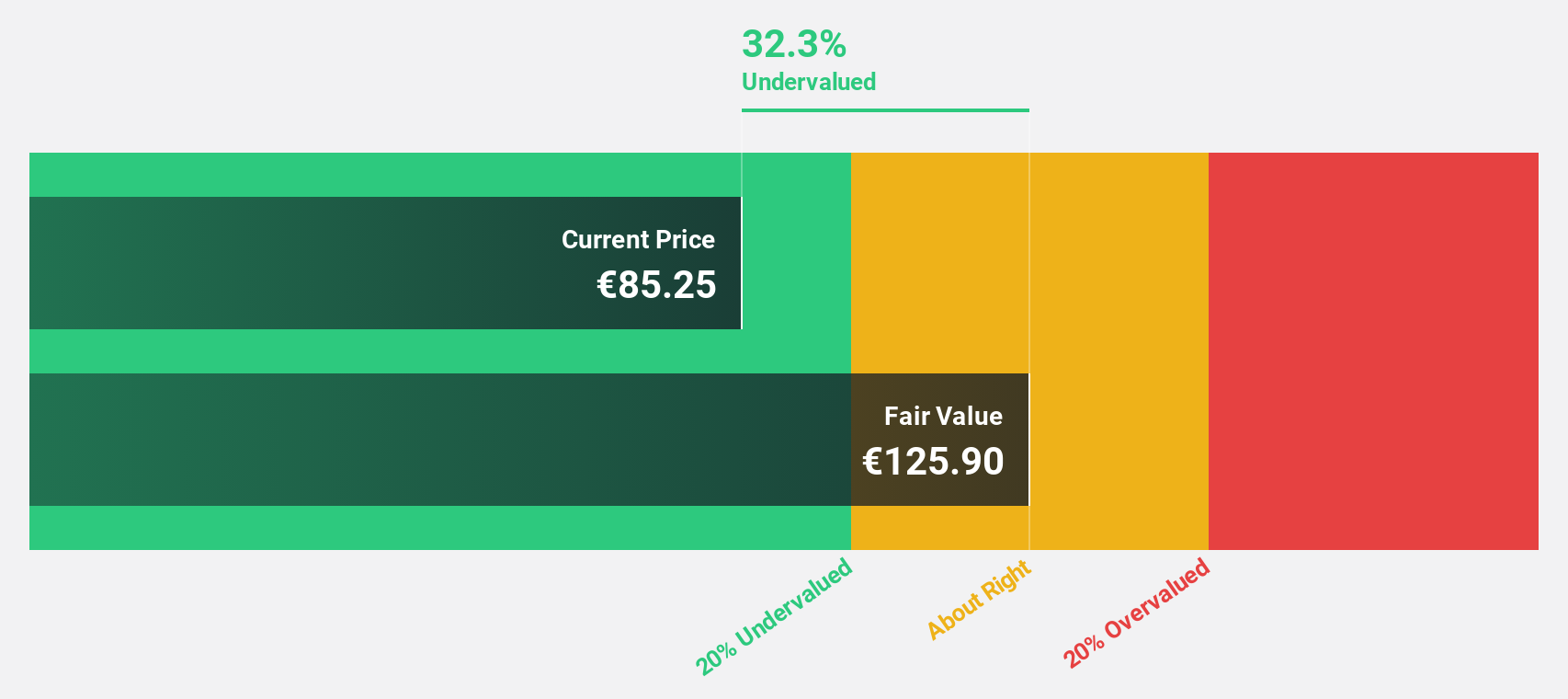

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, along with its subsidiaries, offers sensor solutions for defense and security applications globally and has a market cap of €10.59 billion.

Operations: Hensoldt's revenue is primarily derived from its Sensors segment, which generated €1.98 billion, followed by the Optronics segment with €374 million.

Estimated Discount To Fair Value: 28.1%

Hensoldt is trading at €91.65, below its estimated fair value of €127.39, highlighting potential undervaluation based on cash flows. Despite recent net losses, with a half-year loss of €42 million and increased sales to €944 million from the previous year, earnings are projected to grow significantly by over 32% annually. However, interest payments are not well covered by earnings and share price volatility remains high over the past three months.

- Our expertly prepared growth report on Hensoldt implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Hensoldt here with our thorough financial health report.

Make It Happen

- Dive into all 185 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives