- Sweden

- /

- Consumer Services

- /

- NGM:HOME B

HomeMaid AB (publ)'s (NGM:HOME B) Business Is Trailing The Market But Its Shares Aren't

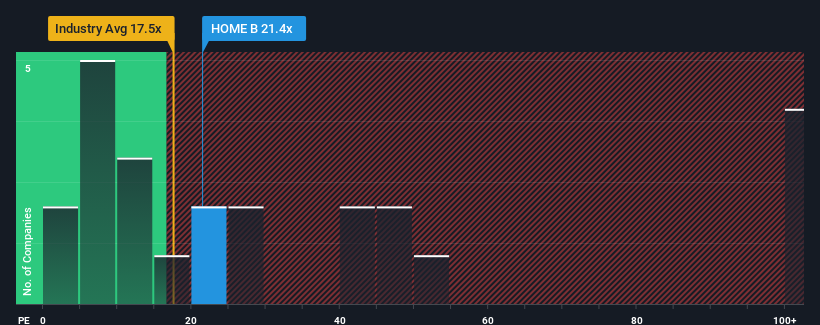

With a median price-to-earnings (or "P/E") ratio of close to 22x in Sweden, you could be forgiven for feeling indifferent about HomeMaid AB (publ)'s (NGM:HOME B) P/E ratio of 21.4x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For example, consider that HomeMaid's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for HomeMaid

Is There Some Growth For HomeMaid?

In order to justify its P/E ratio, HomeMaid would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 7.4% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 30% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that HomeMaid is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that HomeMaid currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - HomeMaid has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HomeMaid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:HOME B

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives