- Sweden

- /

- Hospitality

- /

- NGM:FABLE

Can Future Gaming Group International AB (publ) (NGM:FGG) Maintain Its Strong Returns?

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is for those who would like to learn about Return On Equity (ROE). By way of learning-by-doing, we'll look at ROE to gain a better understanding of Future Gaming Group International AB (publ) (NGM:FGG).

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Future Gaming Group International

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Future Gaming Group International is:

79% = kr38m ÷ kr48m (Based on the trailing twelve months to June 2023).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every SEK1 worth of equity, the company was able to earn SEK0.79 in profit.

Does Future Gaming Group International Have A Good ROE?

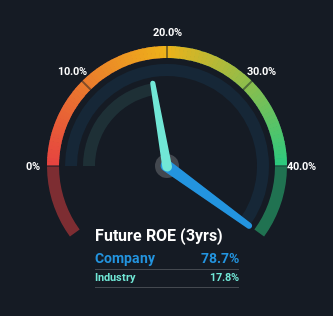

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As you can see in the graphic below, Future Gaming Group International has a higher ROE than the average (18%) in the Hospitality industry.

That's what we like to see. Bear in mind, a high ROE doesn't always mean superior financial performance. A higher proportion of debt in a company's capital structure may also result in a high ROE, where the high debt levels could be a huge risk . To know the 4 risks we have identified for Future Gaming Group International visit our risks dashboard for free.

How Does Debt Impact ROE?

Companies usually need to invest money to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. That will make the ROE look better than if no debt was used.

Future Gaming Group International's Debt And Its 79% ROE

It's worth noting the high use of debt by Future Gaming Group International, leading to its debt to equity ratio of 1.88. While no doubt that its ROE is impressive, we would have been even more impressed had the company achieved this with lower debt. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it.

Conclusion

Return on equity is useful for comparing the quality of different businesses. Companies that can achieve high returns on equity without too much debt are generally of good quality. If two companies have the same ROE, then I would generally prefer the one with less debt.

But ROE is just one piece of a bigger puzzle, since high quality businesses often trade on high multiples of earnings. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. Check the past profit growth by Future Gaming Group International by looking at this visualization of past earnings, revenue and cash flow.

Of course Future Gaming Group International may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:FABLE

Fable Media Group

Invests in, develops, and offers performance-based marketing services.

Good value slight.