- Sweden

- /

- Medical Equipment

- /

- OM:CEVI

CellaVision And 2 Other Swedish Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As European inflation nears the central bank's target, the pan-European STOXX Europe 600 Index has reached record highs, suggesting a favorable environment for value investors. In this context, identifying undervalued stocks becomes crucial for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK41.70 | SEK80.21 | 48% |

| CTT Systems (OM:CTT) | SEK273.00 | SEK499.55 | 45.4% |

| QleanAir (OM:QAIR) | SEK26.60 | SEK51.33 | 48.2% |

| Concentric (OM:COIC) | SEK226.50 | SEK411.51 | 45% |

| Dometic Group (OM:DOM) | SEK65.40 | SEK130.38 | 49.8% |

| Nolato (OM:NOLA B) | SEK55.00 | SEK99.23 | 44.6% |

| Mentice (OM:MNTC) | SEK26.10 | SEK50.98 | 48.8% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| BHG Group (OM:BHG) | SEK14.75 | SEK27.09 | 45.5% |

| MilDef Group (OM:MILDEF) | SEK82.60 | SEK162.75 | 49.2% |

Underneath we present a selection of stocks filtered out by our screen.

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of SEK6.32 billion.

Operations: CellaVision's revenue from automated microscopy systems and reagents in the field of hematology amounts to SEK726.40 million.

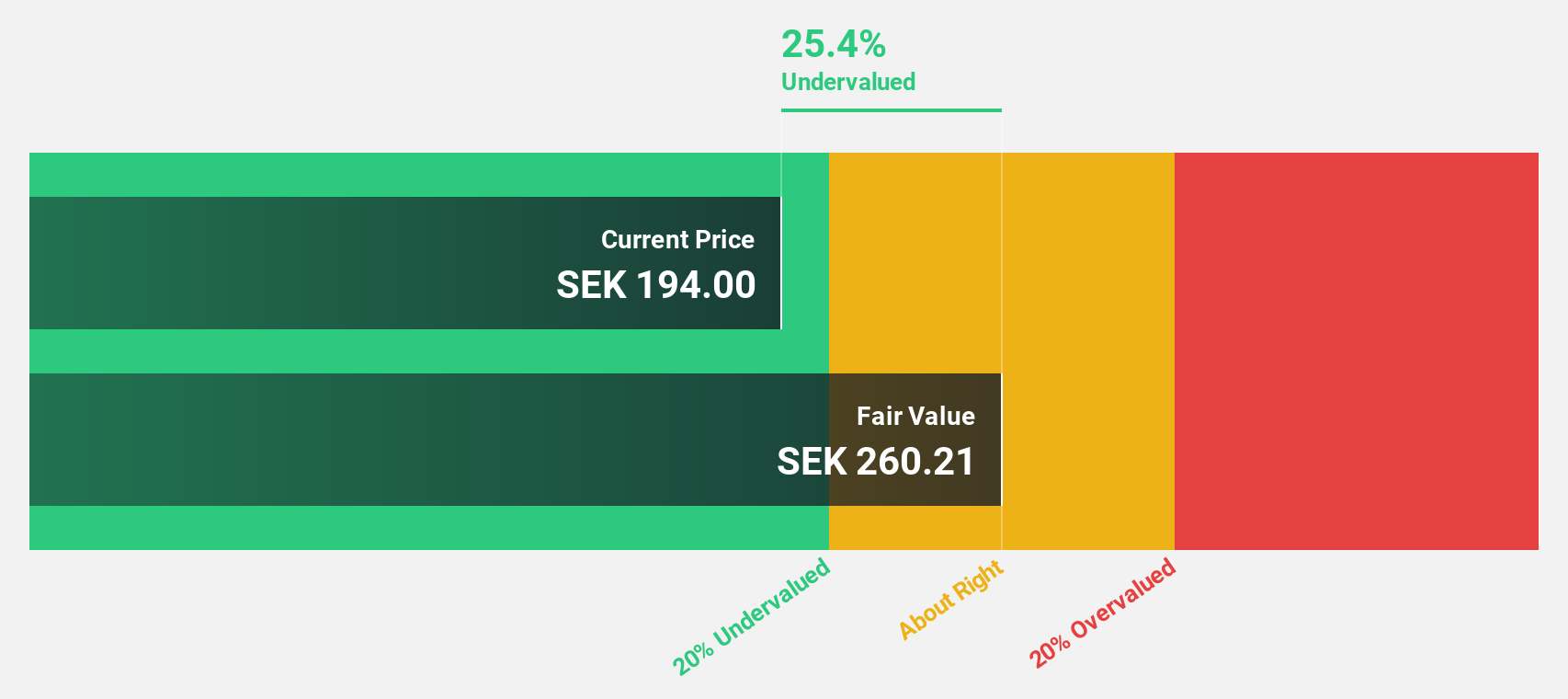

Estimated Discount To Fair Value: 27.1%

CellaVision is trading at SEK265, 27.1% below its fair value estimate of SEK363.44, and shows significant earnings growth potential with a forecasted annual increase of 24.09%. Recent earnings reports indicate strong performance, with Q2 sales rising to SEK187.79 million from SEK169.67 million a year ago and net income increasing to SEK38.55 million from SEK34.71 million. Revenue growth is expected at 13.6% per year, outpacing the Swedish market's 0.9%.

- Our expertly prepared growth report on CellaVision implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of CellaVision with our comprehensive financial health report here.

Thule Group (OM:THULE)

Overview: Thule Group AB (publ) is a sports and outdoor company based in Sweden with international operations, and it has a market cap of SEK32.25 billion.

Operations: Thule Group generates revenue primarily from its Outdoor & Bags segment, which accounts for SEK9.40 billion.

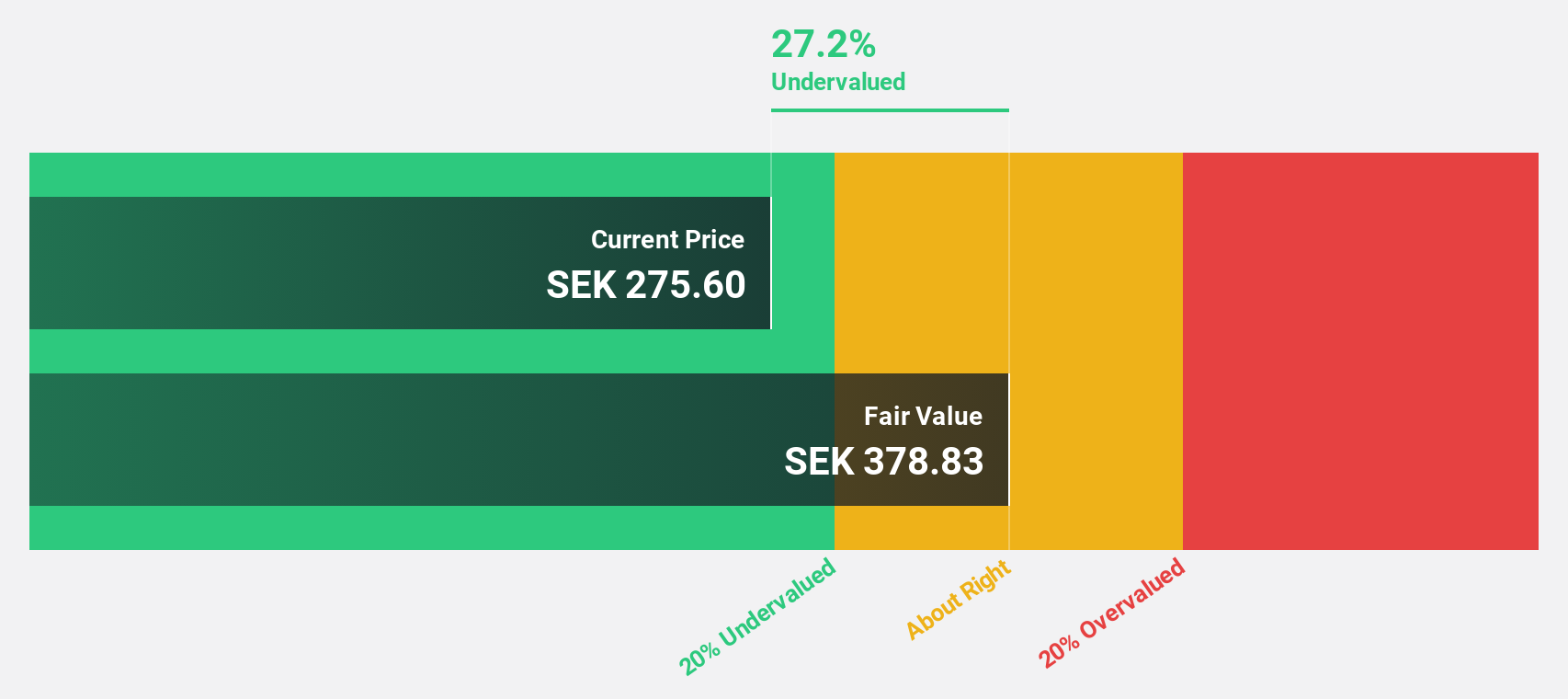

Estimated Discount To Fair Value: 10.7%

Thule Group is trading at SEK305, approximately 10.7% below its fair value estimate of SEK341.55. Recent earnings reports show solid performance, with Q2 sales rising to SEK3.1 billion from SEK3 billion a year ago and net income increasing to SEK559 million from SEK539 million. Thule's earnings are forecasted to grow at 15% annually, outpacing the Swedish market’s 14.9%, while revenue growth is expected at 6.1% per year.

- Our growth report here indicates Thule Group may be poised for an improving outlook.

- Take a closer look at Thule Group's balance sheet health here in our report.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK22.34 billion.

Operations: The company's revenue segments in millions of euros are Medtech (€111.91M), Diagnostics (€20.63M), Specialty Pharma (€158.39M), and Veterinary Services (€53.95M).

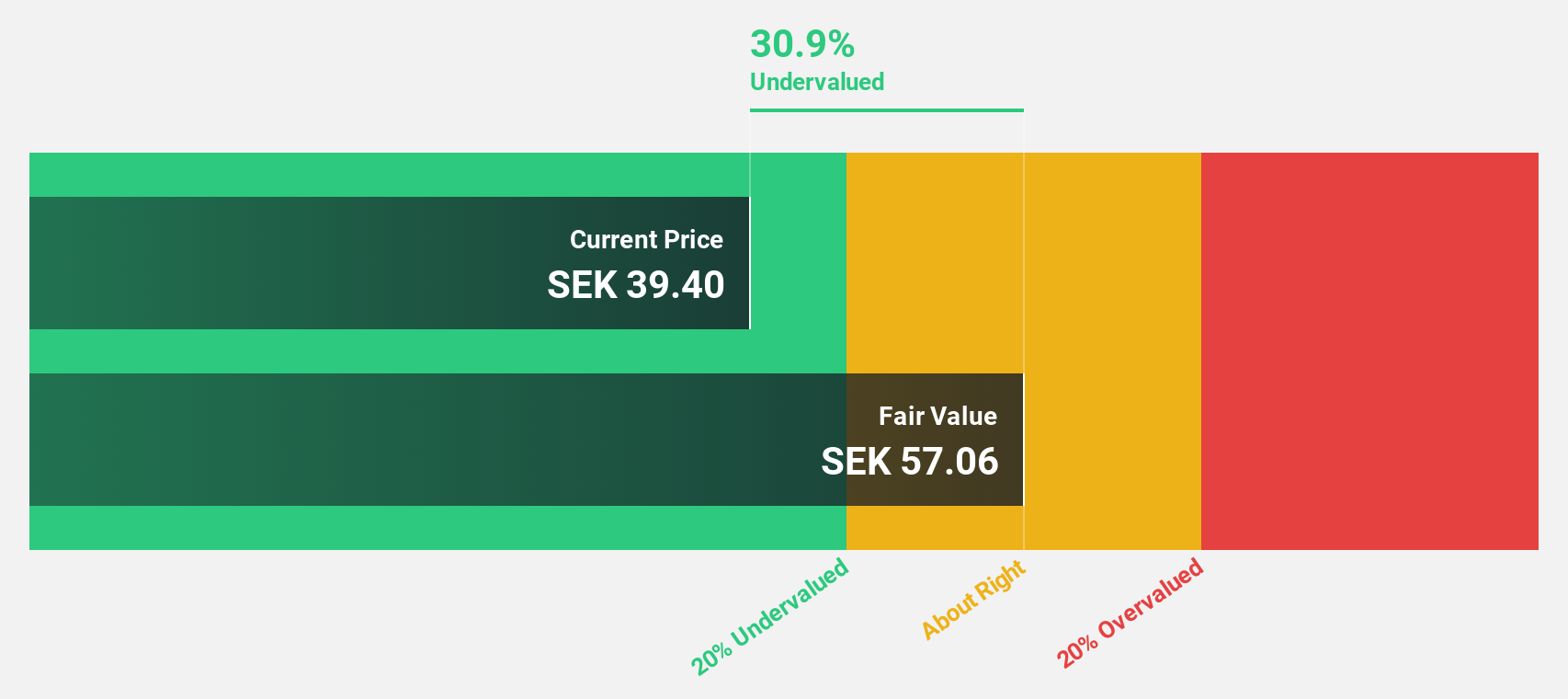

Estimated Discount To Fair Value: 30.7%

Vimian Group (SEK42.75) is trading 30.7% below its fair value estimate of SEK61.67, suggesting it may be highly undervalued based on discounted cash flow analysis. The company's earnings are forecast to grow significantly at 62.9% per year, far outpacing the Swedish market's 14.9%. Recent Q2 results show sales increased to €90.99 million from €81.31 million a year ago, with net income rising to €4.87 million from €2.99 million, despite some large one-off items impacting financial results.

- Our comprehensive growth report raises the possibility that Vimian Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Vimian Group stock in this financial health report.

Summing It All Up

- Access the full spectrum of 43 Undervalued Swedish Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CEVI

CellaVision

Develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally.

High growth potential with solid track record.