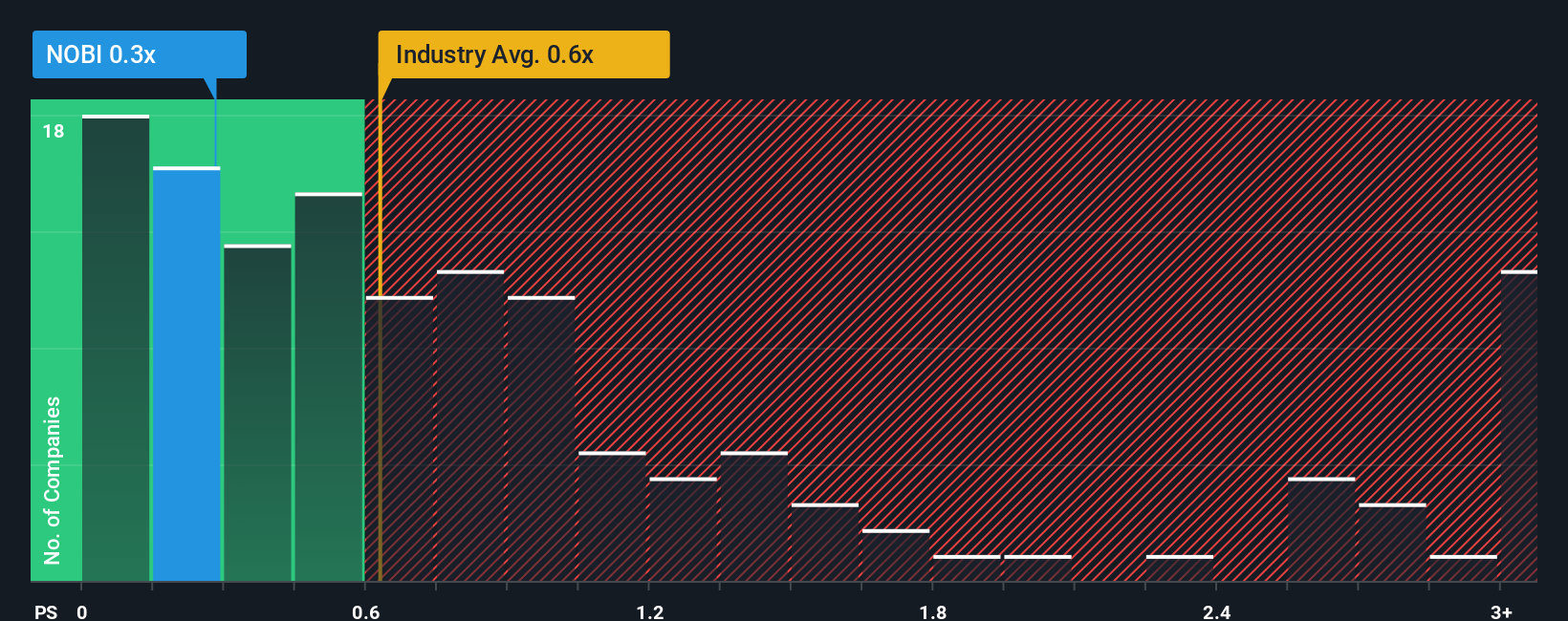

There wouldn't be many who think Nobia AB (publ)'s (STO:NOBI) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Consumer Durables industry in Sweden is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Nobia

What Does Nobia's P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Nobia has been doing relatively well. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Nobia's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Nobia?

In order to justify its P/S ratio, Nobia would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.4%. As a result, revenue from three years ago have also fallen 32% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 0.2% as estimated by the two analysts watching the company. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Nobia's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Nobia's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Nobia's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You always need to take note of risks, for example - Nobia has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Nobia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nobia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOBI

Nobia

Engages in the development, manufacture, and sale of kitchen solutions in Sweden, Denmark, Norway, Finland, the United Kingdom, Germany, the Netherlands, Austria, Iceland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026