New Wave Group (STO:NEWA B) Is Doing The Right Things To Multiply Its Share Price

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at New Wave Group (STO:NEWA B) so let's look a bit deeper.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on New Wave Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.18 = kr1.6b ÷ (kr11b - kr1.9b) (Based on the trailing twelve months to March 2023).

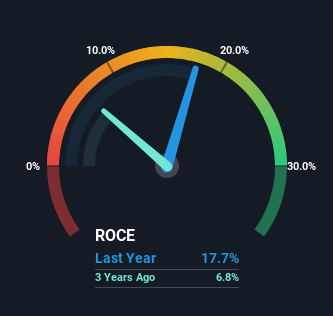

So, New Wave Group has an ROCE of 18%. In absolute terms, that's a satisfactory return, but compared to the Luxury industry average of 13% it's much better.

Check out our latest analysis for New Wave Group

In the above chart we have measured New Wave Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for New Wave Group.

SWOT Analysis for New Wave Group

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Dividend is low compared to the top 25% of dividend payers in the Luxury market.

- Annual revenue is forecast to grow faster than the Swedish market.

- Good value based on P/E ratio and estimated fair value.

- Significant insider buying over the past 3 months.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

How Are Returns Trending?

Investors would be pleased with what's happening at New Wave Group. The data shows that returns on capital have increased substantially over the last five years to 18%. The amount of capital employed has increased too, by 77%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

What We Can Learn From New Wave Group's ROCE

All in all, it's terrific to see that New Wave Group is reaping the rewards from prior investments and is growing its capital base. And a remarkable 286% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

One more thing: We've identified 3 warning signs with New Wave Group (at least 2 which are a bit unpleasant) , and understanding these would certainly be useful.

While New Wave Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives