Stock Analysis

Discovering Three Swedish Dividend Stocks With Yields Up To 5.6%

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Sweden's recent interest rate cut by the Riksbank reflects a strategic adjustment in response to anticipated inflation trends, setting a distinct economic backdrop. In this context, exploring dividend stocks in Sweden becomes particularly compelling as investors look for yields that can potentially offset inflationary pressures and provide steady income in uncertain times.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.87% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.63% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.59% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.11% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.51% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.58% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.35% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.13% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.47% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.99% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB operates in Sweden, Norway, Denmark, and Finland, offering technical services and installations for buildings and industrial facilities with a market capitalization of SEK 16.72 billion.

Operations: Bravida Holding AB generates its revenue through providing technical services and installations across Sweden, Norway, Denmark, and Finland.

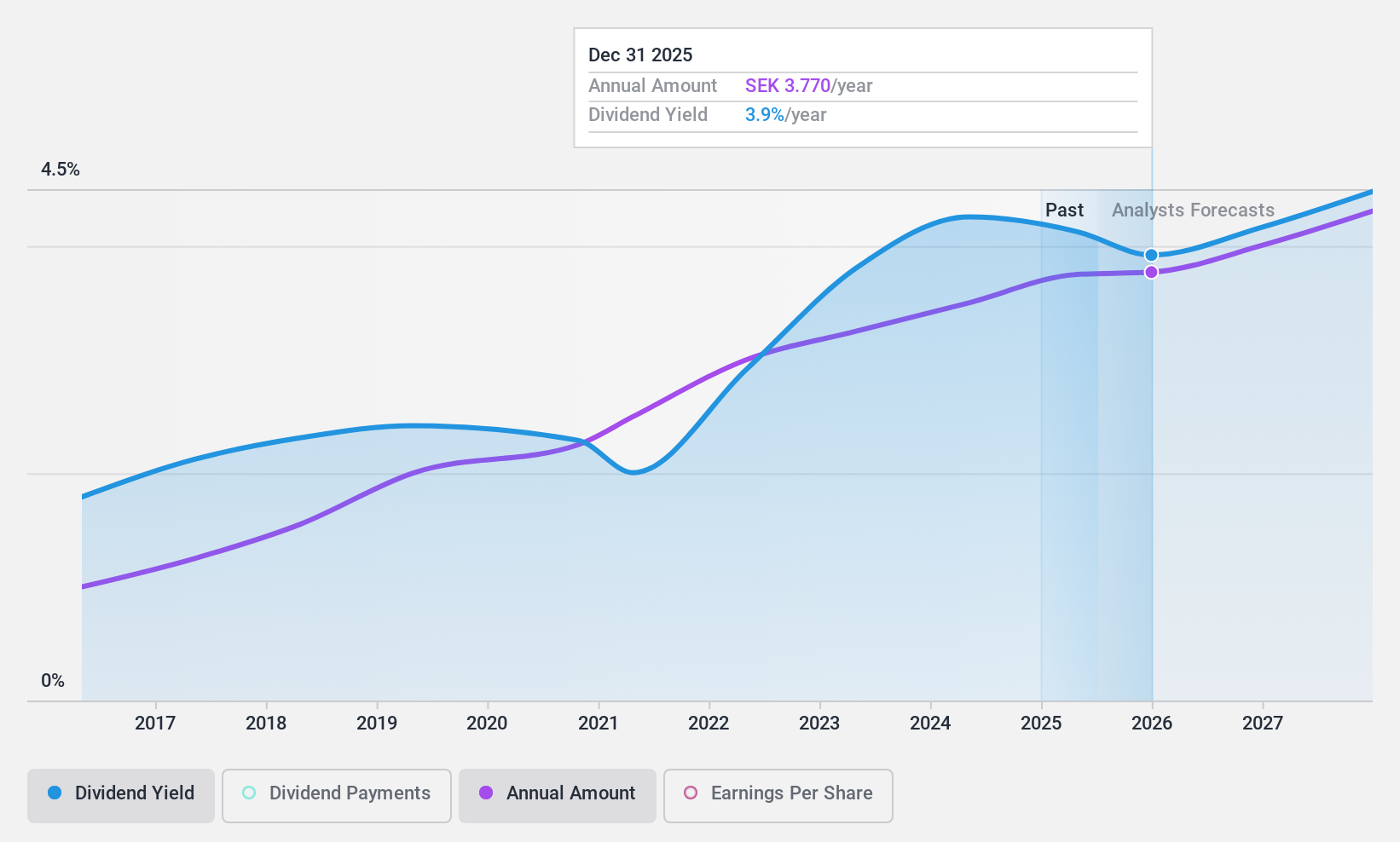

Dividend Yield: 4.3%

Bravida Holding AB, with a payout ratio of 61.7%, maintains a sustainable dividend, supported by both earnings and a cash payout ratio of 43.5%. Despite its short dividend history of under 10 years and recent unstable track record, the company's dividend yield stands in the top 25% in Sweden at 4.27%. Recent board changes and an internal investigation into overbilling issues highlight potential governance concerns, though Bravida continues to secure significant contracts like the SEK 500 million data center project.

- Take a closer look at Bravida Holding's potential here in our dividend report.

- The valuation report we've compiled suggests that Bravida Holding's current price could be quite moderate.

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB operates in designing, acquiring, and developing brands and products across corporate, sports, gifts, and home furnishings sectors globally with a market capitalization of SEK 14.53 billion.

Operations: New Wave Group AB generates revenue through three primary segments: Corporate (SEK 4.68 billion), Sports & Leisure (SEK 3.82 billion), and Gifts & Home Furnishings (SEK 0.87 billion).

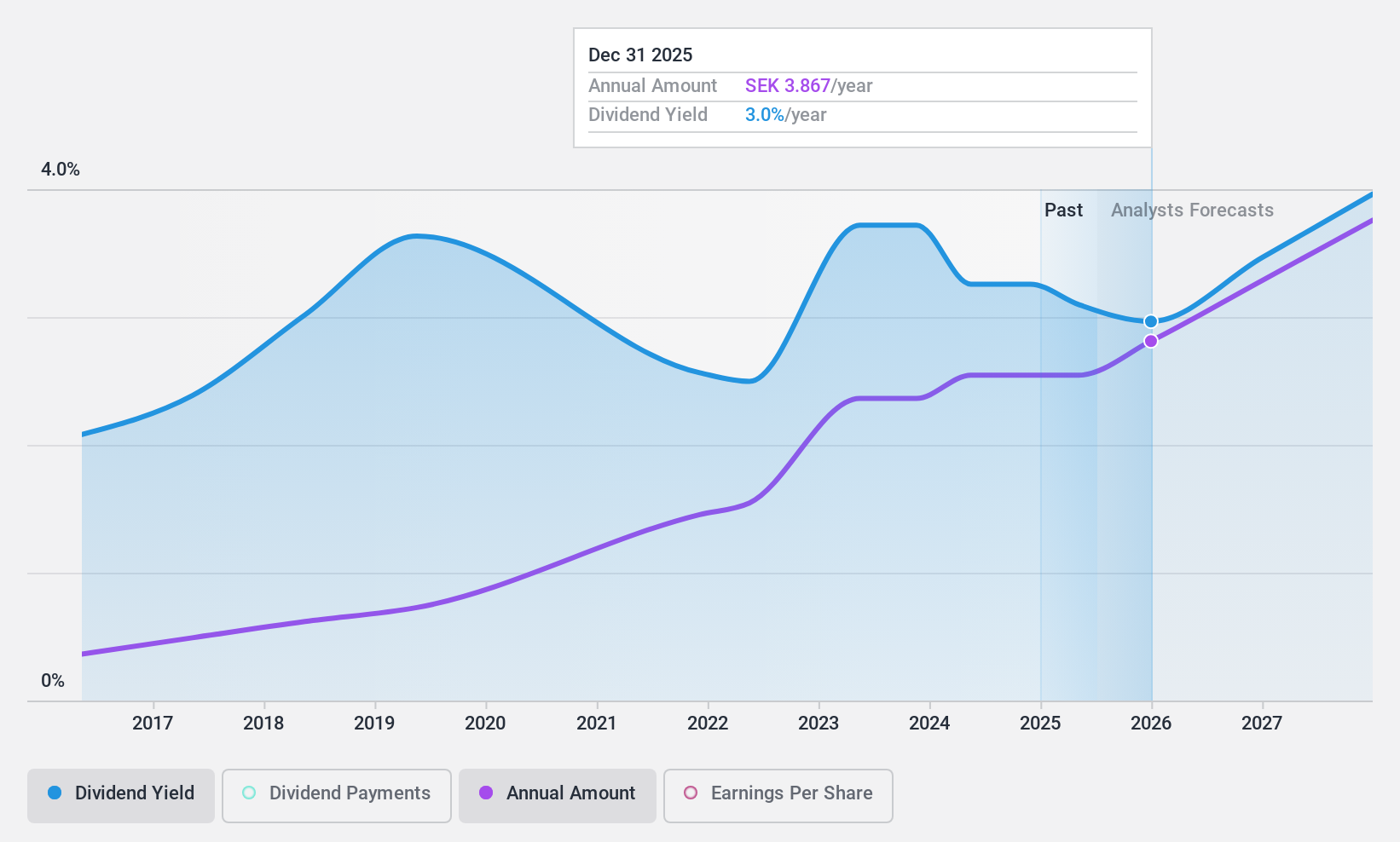

Dividend Yield: 3.2%

New Wave Group AB, despite a recent dip in Q1 2024 sales to SEK 1.99 billion and net income to SEK 121.3 million, maintains a conservative payout ratio of 45.6%, ensuring dividends are well-covered by earnings and cash flows (Cash Payout Ratio: 42.6%). However, its dividend yield at 3.2% is below the top quartile in Sweden's market and has shown volatility over the past decade, reflecting some instability in payouts despite being priced at a significant discount to fair value.

- Delve into the full analysis dividend report here for a deeper understanding of New Wave Group.

- In light of our recent valuation report, it seems possible that New Wave Group is trading behind its estimated value.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates as a provider of non-life insurance products for private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.47 billion.

Operations: Solid Försäkringsaktiebolag generates revenue through three primary segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

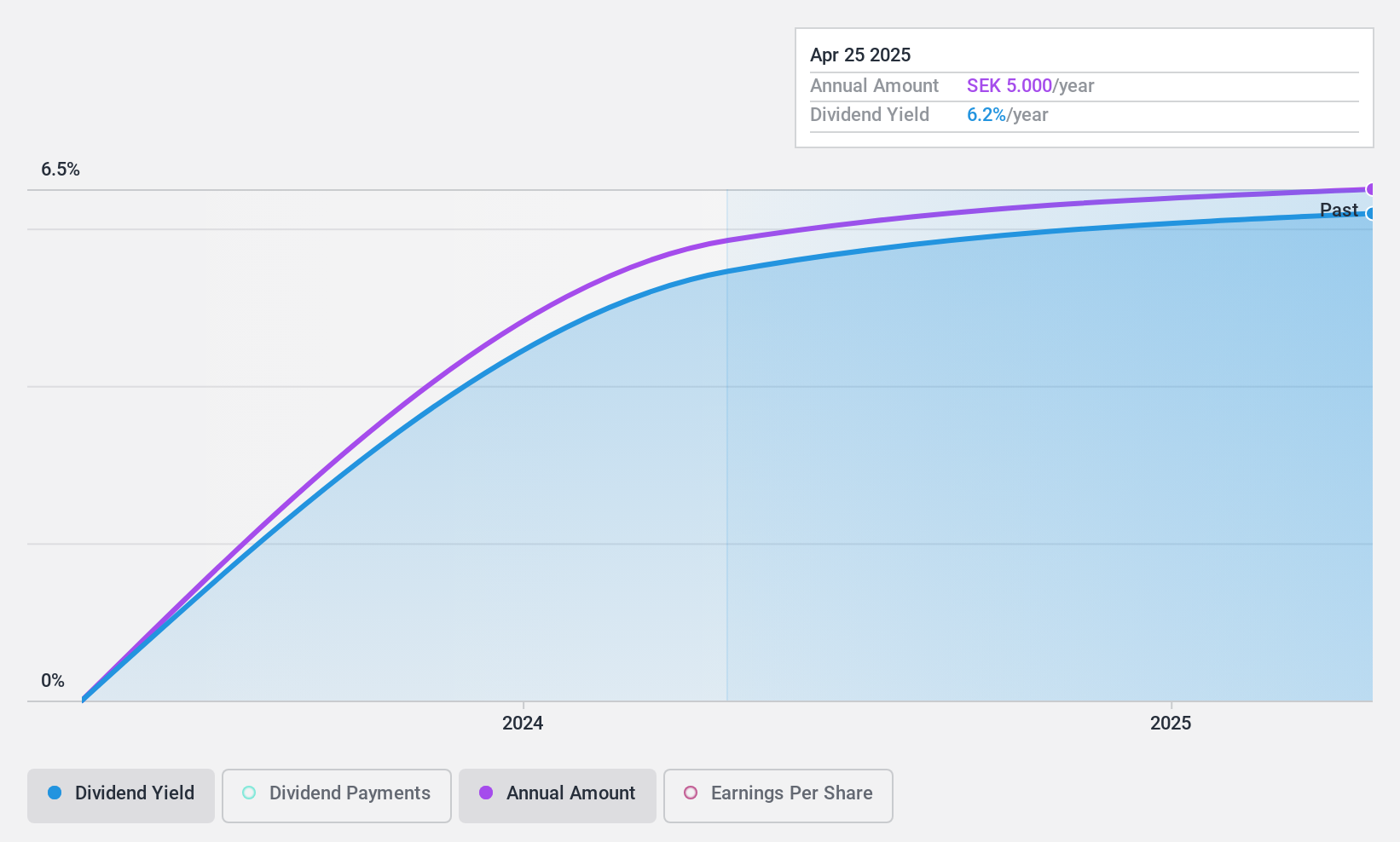

Dividend Yield: 5.7%

Solid Försäkringsaktiebolag offers a dividend yield of 5.7%, ranking it in the top 25% in Sweden's market. Although it has recently initiated dividends, making its stability and growth prospects unclear, the company's dividends are well-supported by both earnings and cash flows with payout ratios of 50.2% and 87.4%, respectively. Recent board changes could influence future strategies, but the firm is trading at a significant discount (50.9%) to estimated fair value, suggesting potential undervaluation despite an unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Solid Försäkringsaktiebolag.

- Our comprehensive valuation report raises the possibility that Solid Försäkringsaktiebolag is priced lower than what may be justified by its financials.

Key Takeaways

- Discover the full array of 23 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether New Wave Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.