- Sweden

- /

- Hospitality

- /

- OM:BETS B

3 Swedish Dividend Stocks Offering Yields Up To 5.7%

Reviewed by Simply Wall St

Amidst the cautious sentiment in European markets due to escalating Middle East tensions, Swedish dividend stocks continue to attract attention for their potential steady income streams. In the current environment, a good dividend stock is often characterized by a reliable payout history and resilience in times of geopolitical uncertainty, offering investors a measure of stability.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.53% | ★★★★★★ |

| Nordea Bank Abp (OM:NDA SE) | 8.85% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.21% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.79% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.66% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.73% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.76% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.02% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.80% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates an online gaming business through its subsidiaries, focusing on markets in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK35.15 billion.

Operations: Betsson AB's revenue primarily comes from its Casinos & Resorts segment, which generated €1.01 billion.

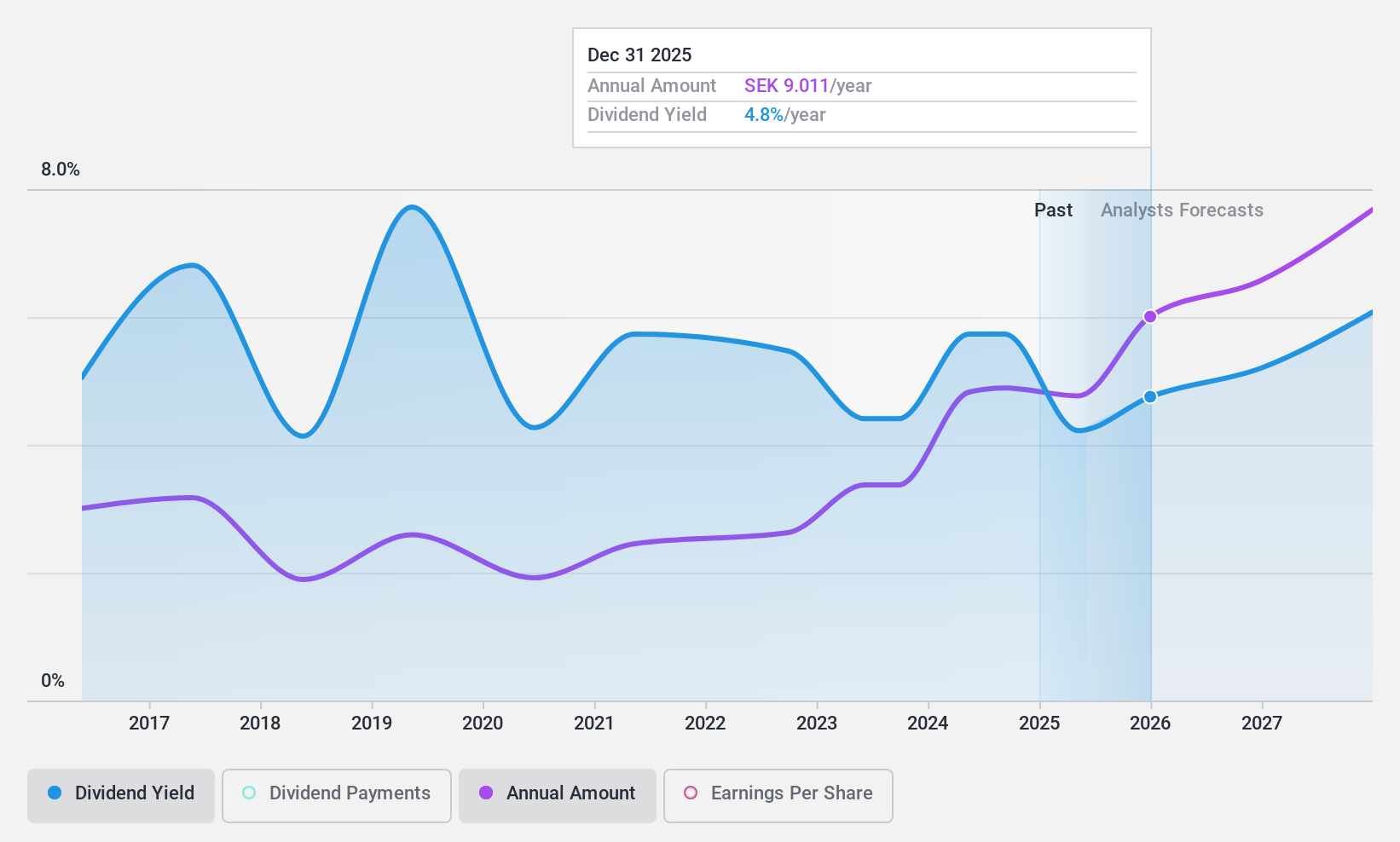

Dividend Yield: 5.8%

Betsson's dividend yield of 5.78% ranks in the top quartile among Swedish dividend payers, but its sustainability is questionable due to a high cash payout ratio of 101.7%. While earnings have grown by 12.2% over the past year, dividends are not well covered by free cash flows and have been volatile over the last decade. Recent debt refinancing activities may impact future financial flexibility, though they indicate proactive capital management strategies.

- Navigate through the intricacies of Betsson with our comprehensive dividend report here.

- Our valuation report unveils the possibility Betsson's shares may be trading at a discount.

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors across various international markets with a market cap of SEK14.62 billion.

Operations: New Wave Group AB's revenue is comprised of SEK4.68 billion from the Corporate segment, SEK3.91 billion from Sports & Leisure, and SEK877.40 million from Gifts & Home Furnishings.

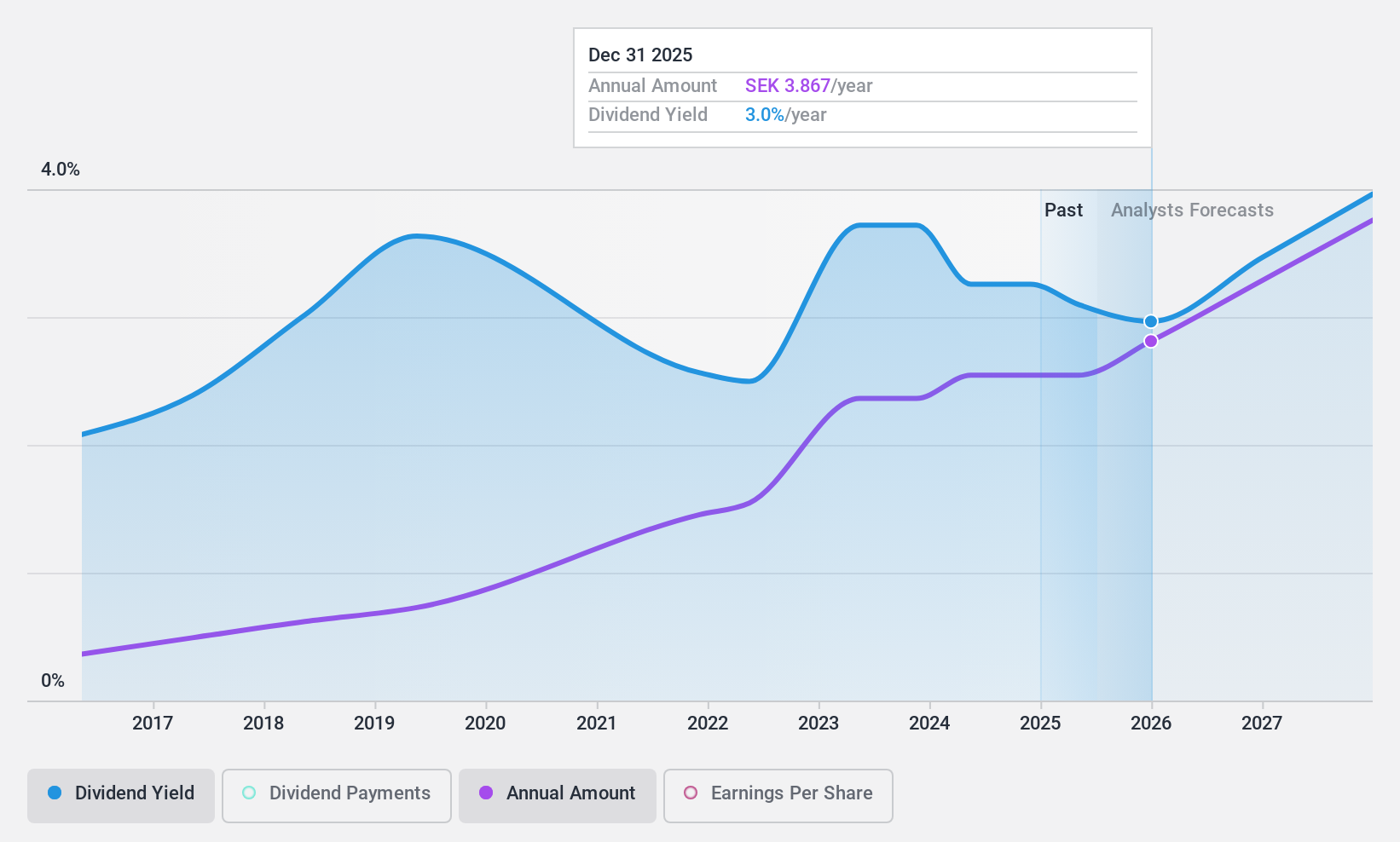

Dividend Yield: 3.2%

New Wave Group's dividend yield of 3.18% is below the Swedish market's top quartile, yet dividends are well covered by earnings and cash flows with payout ratios of 47.9% and 37.8%, respectively. Despite a history of volatility, dividends have grown over the past decade. Recent executive changes may affect future stability, as CFO Lars Jönsson plans to depart in early 2025. Earnings for H1 2024 declined compared to last year, indicating potential challenges ahead.

- Click here to discover the nuances of New Wave Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of New Wave Group shares in the market.

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company offering dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK3.20 billion.

Operations: Zinzino AB generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which accounts for SEK1.83 billion, along with an additional contribution of SEK170.31 million from the Faun segment.

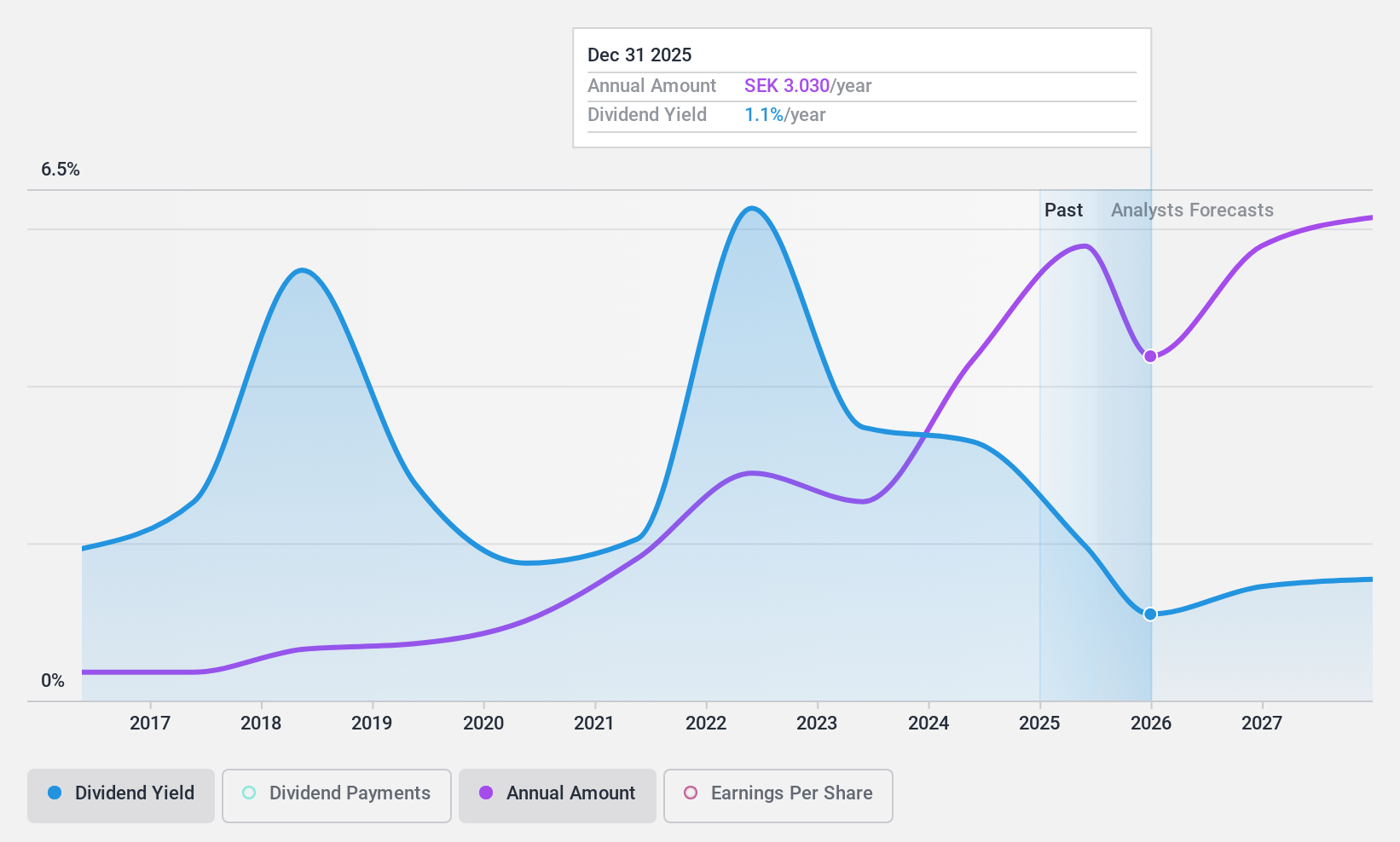

Dividend Yield: 3.2%

Zinzino's dividend yield of 3.21% is lower than the top quartile in Sweden, but dividends are securely backed by earnings and cash flows with payout ratios of 56.3% and 47.4%, respectively. The company has consistently increased its dividend over the last decade without volatility. Recent inclusion in the S&P Global BMI Index and strong revenue growth—up 39% year-over-year to SEK 178.7 million for August—highlight positive financial momentum supporting future payouts.

- Take a closer look at Zinzino's potential here in our dividend report.

- The analysis detailed in our Zinzino valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Get an in-depth perspective on all 22 Top Swedish Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives