- Sweden

- /

- Consumer Durables

- /

- OM:ELUX B

AB Electrolux (publ) (STO:ELUX B) Might Not Be As Mispriced As It Looks

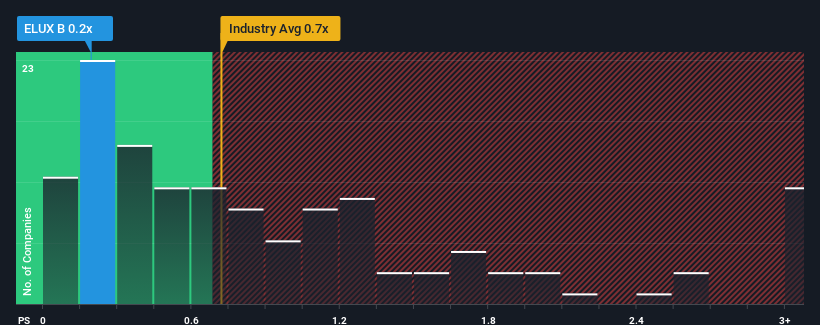

When you see that almost half of the companies in the Consumer Durables industry in Sweden have price-to-sales ratios (or "P/S") above 0.9x, AB Electrolux (publ) (STO:ELUX B) looks to be giving off some buy signals with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for AB Electrolux

How AB Electrolux Has Been Performing

AB Electrolux hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on AB Electrolux will help you uncover what's on the horizon.How Is AB Electrolux's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as AB Electrolux's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 1.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.0% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 1.6%. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.5%, that would be a solid result.

With this in consideration, we find it intriguing that AB Electrolux's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of AB Electrolux's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for AB Electrolux you should be aware of.

If you're unsure about the strength of AB Electrolux's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ELUX B

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026