- Switzerland

- /

- Machinery

- /

- SWX:STGN

3 Reliable Dividend Stocks To Consider With Up To 6.7% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed economic signals, investors are keenly observing the performance of major indices. While the Nasdaq Composite has reached new heights, other indexes have faced declines amid expectations of further rate cuts from the Federal Reserve. In such a dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

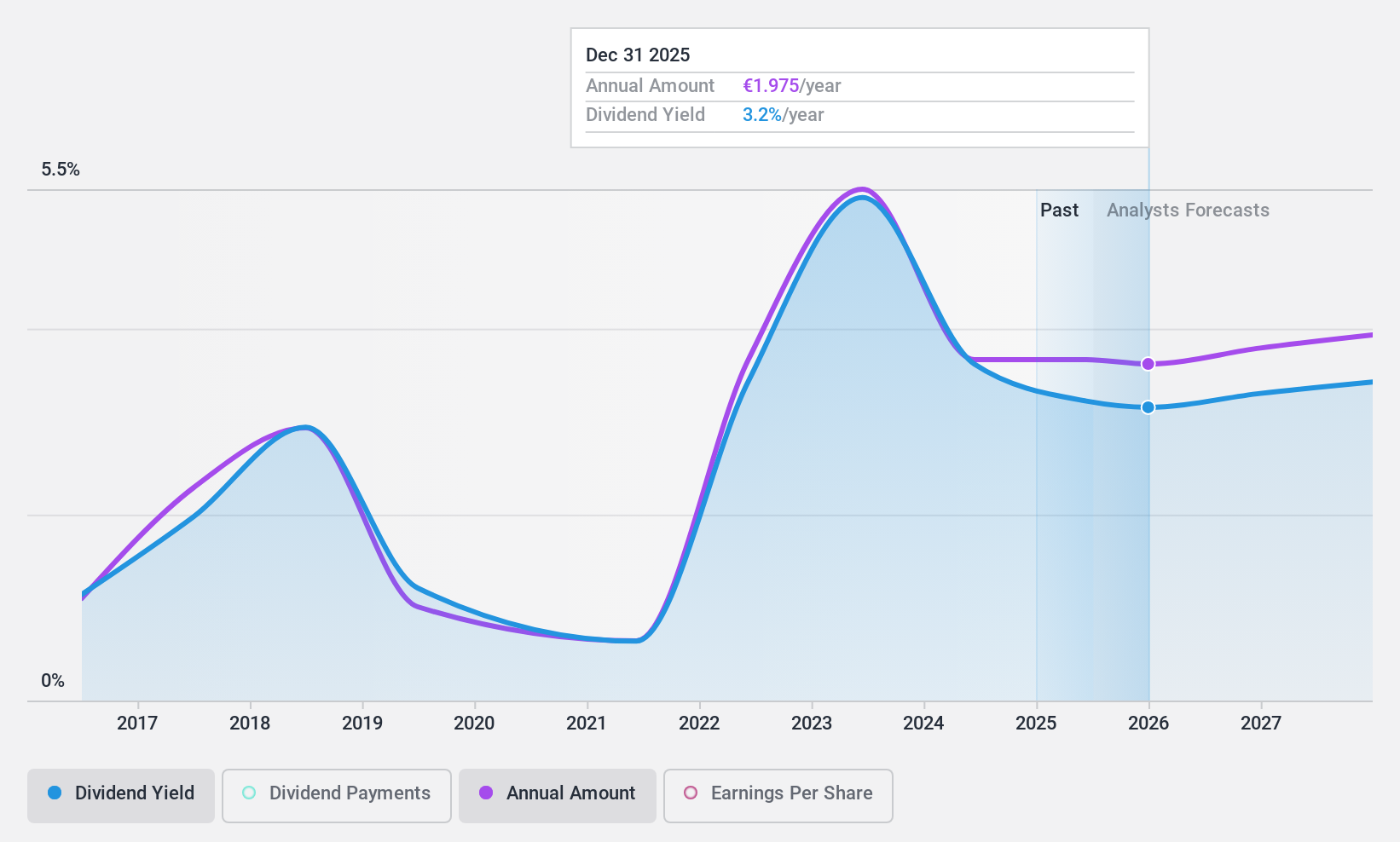

Sipef (ENXTBR:SIP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sipef NV is an agro-industrial company with a market capitalization of €590.68 million.

Operations: Sipef NV generates its revenue primarily from its Palm segment at $386.46 million, followed by Bananas and Horticulture at $38.59 million, Tea at $2.79 million, Rubber at $0.59 million, and Corporate activities contributing $1.37 million.

Dividend Yield: 3.5%

Sipef's Price-To-Earnings ratio of 9.3x suggests good value compared to the Belgian market average of 12.8x. Its dividends are well covered by earnings, with a payout ratio of 34.5%, and reasonably supported by cash flows at a cash payout ratio of 72.9%. However, Sipef's dividend history is marked by volatility and unreliability over the past decade, despite an overall increase in payments during this period. The current yield is lower than top-tier Belgian dividend payers at 3.48%.

- Take a closer look at Sipef's potential here in our dividend report.

- Upon reviewing our latest valuation report, Sipef's share price might be too pessimistic.

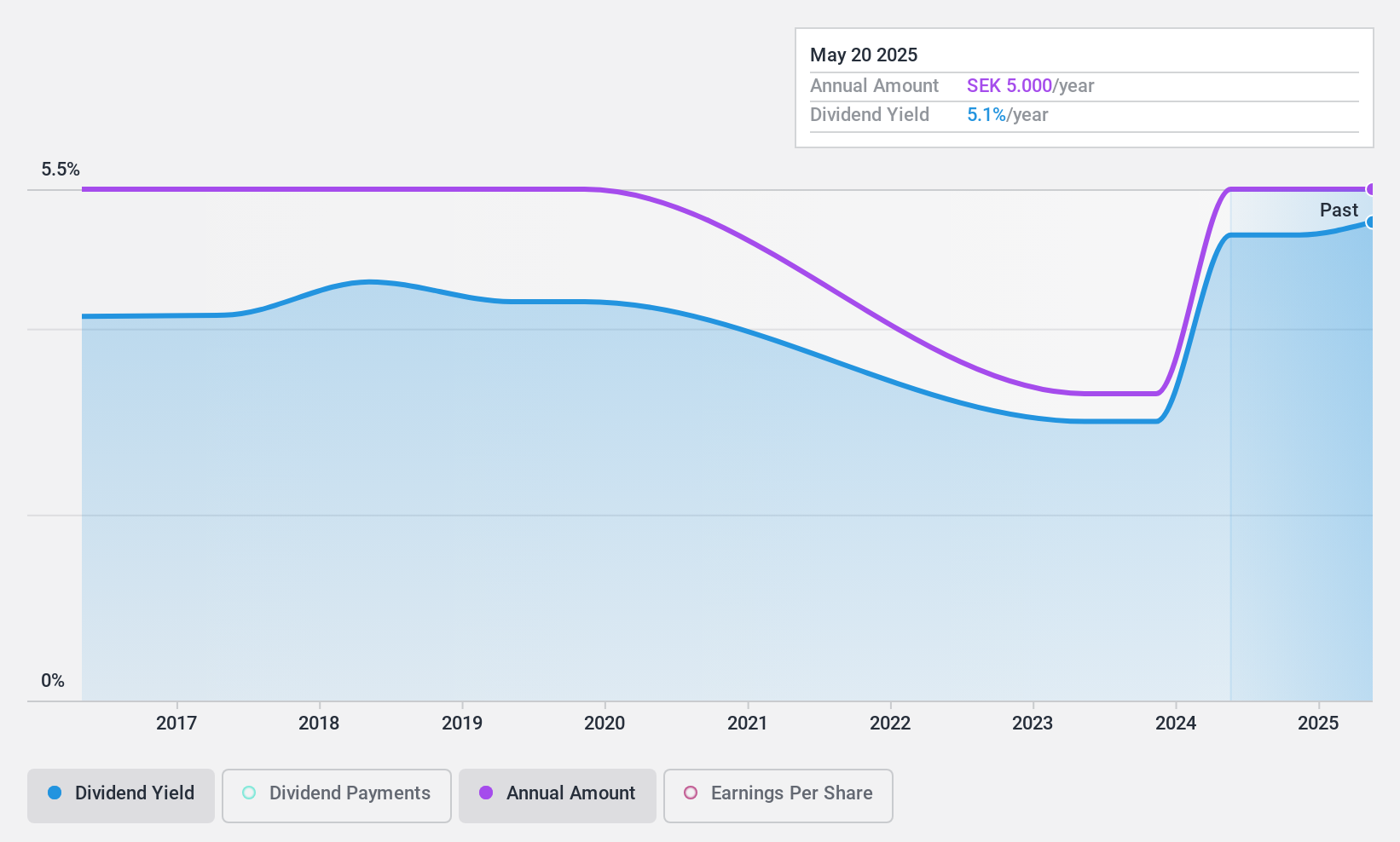

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Duni AB (publ) develops, manufactures, and sells meal serving, take-away, and packaging products in Sweden and internationally with a market cap of SEK4.11 billion.

Operations: Duni AB's revenue is comprised of SEK4.43 billion from dining solutions and SEK3.11 billion from food packaging solutions.

Dividend Yield: 5.5%

Duni's dividend yield of 5.52% ranks among the top 25% in Sweden, yet its dividends are not well covered by earnings due to a high payout ratio of 100.4%. While cash flows support dividend payments with a cash payout ratio of 57.5%, the company's dividends have been volatile and unreliable over the past decade. Recent earnings showed a decline, with net income dropping to SEK 157 million for nine months ending September 2024, impacting dividend sustainability.

- Click here to discover the nuances of Duni with our detailed analytical dividend report.

- Our valuation report here indicates Duni may be overvalued.

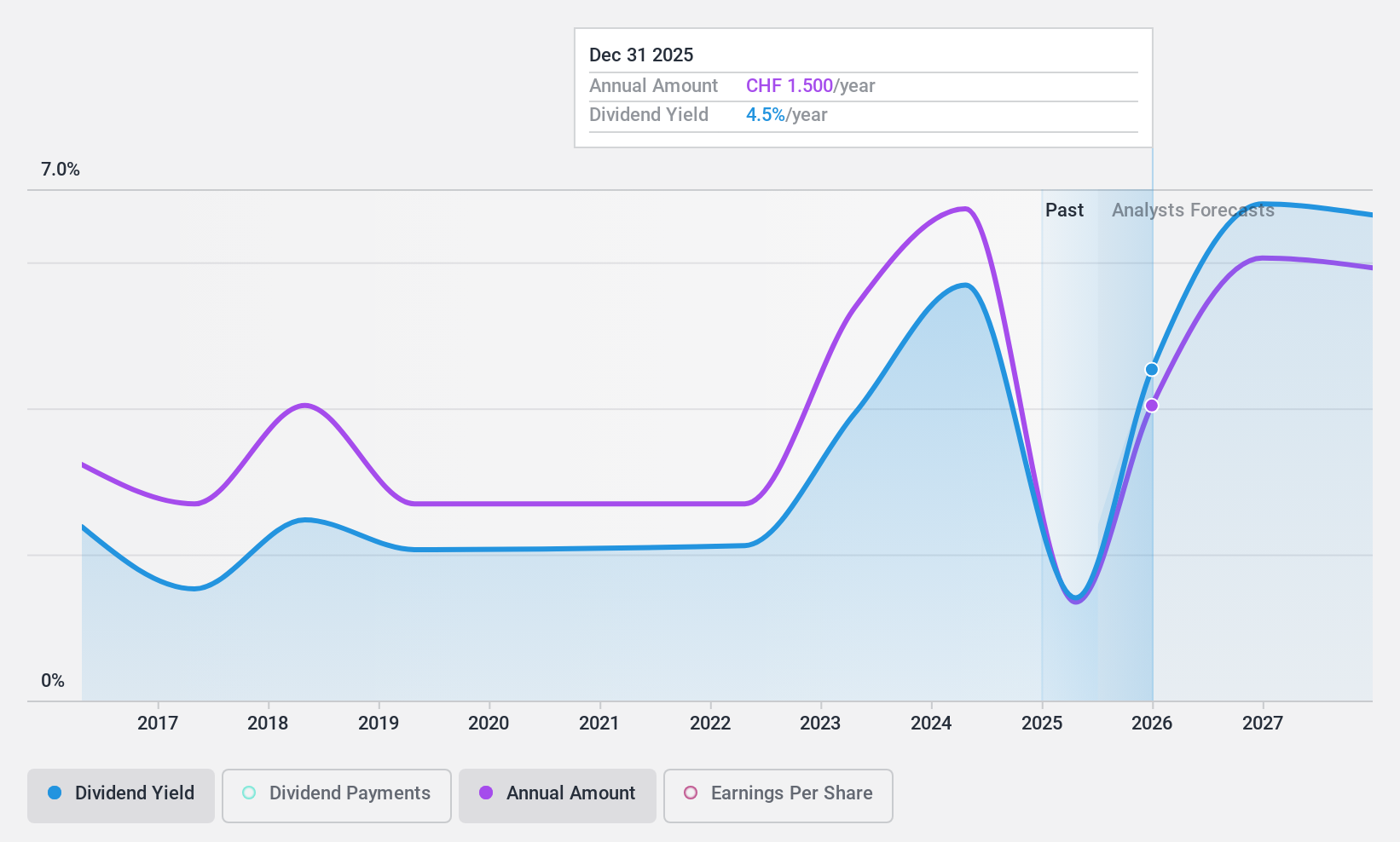

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG specializes in the development, manufacturing, and distribution of precision machine tools for milling, turning, boring, grinding, and machining various materials with a market cap of CHF195.70 million.

Operations: StarragTornos Group AG generates revenue from its precision machine tools designed for the milling, turning, boring, grinding, and machining of metal, composite materials, and ceramics.

Dividend Yield: 6.7%

StarragTornos Group's dividend yield of 6.72% is in the top 25% for Swiss stocks but is not supported by free cash flows, raising concerns about sustainability. Despite a reasonable payout ratio of 62.7%, dividends have been volatile and unreliable over the past decade. Recent executive changes, including Markus Jäger as CFO, may impact financial strategies moving forward. The stock trades significantly below its estimated fair value, with analysts predicting a price increase of 44.3%.

- Get an in-depth perspective on StarragTornos Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of StarragTornos Group shares in the market.

Make It Happen

- Unlock our comprehensive list of 1858 Top Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STGN

StarragTornos Group

Develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of work pieces of metal, composite materials, and ceramics.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives