- Sweden

- /

- Consumer Durables

- /

- OM:BONAV B

Bonava (OM:BONAV B): Losses Worsen, Challenging Turnaround Hopes Despite Bullish Revenue Forecasts

Reviewed by Simply Wall St

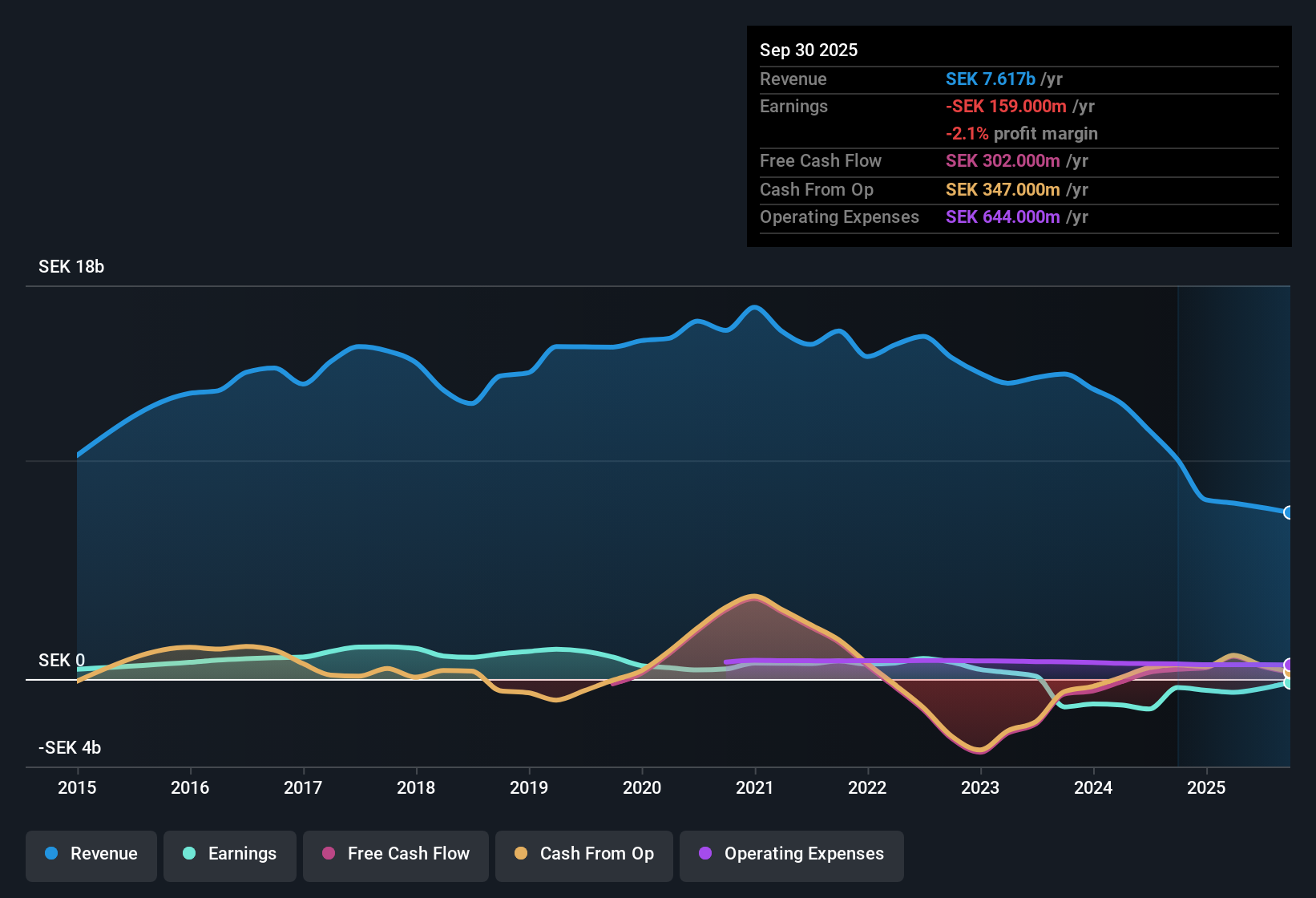

Bonava (OM:BONAV B) remains unprofitable, with net losses intensifying at a 53.9% annual rate over the last five years and no improvement to the net profit margin. Looking ahead, forecasts point to a sharp reversal. Earnings are expected to grow 128.12% per year on average, with profitability anticipated within three years and annual revenue growth of 14.9% outpacing the Swedish market’s 3.8%. Investors are likely considering these projections alongside Bonava’s competitive Price-To-Sales Ratio of 0.5x, though persistent losses and financial risks remain in focus for the coming quarters.

See our full analysis for Bonava.The next step is to see how this latest performance measures up against the most widely followed narratives about Bonava, where the numbers affirm expectations and where they might challenge them.

See what the community is saying about Bonava

Losses Rising Faster Than Peers

- Bonava’s annual net losses have increased at a dramatic 53.9% rate over the last five years, a much sharper deterioration than seen in the broader Swedish market.

- Higher ongoing losses create a tension with the prevailing analysis that expects Bonava to become profitable within the next three years.

- What’s surprising is that, despite these deepening losses, the outlook remains for a rapid turnaround, setting a high bar for future execution.

- Investors may watch closely to see if this optimism can hold if the company does not stem margin declines soon.

Sales Multiple Sits Well Below Industry

- With a Price-To-Sales Ratio of just 0.5x, Bonava trades at half the average peer multiple (1x) and at a significant discount to the broader European Consumer Durables industry (0.7x).

- This large valuation gap heavily supports the case that some investors see Bonava as a relative bargain, as long as it can deliver on the ambitious revenue and profit turnaround expected.

- The combination of the discounted multiple and forecasts for 14.9% annual revenue growth puts a spotlight on whether the market is underestimating the company’s future upside.

- However, this discount also signals persistent concern about unproven profitability and financial health.

Financial Resilience In Question

- Bonava is not considered to be in a strong financial position according to risk assessments based on the latest available data.

- Heavily flagged financial fragility challenges expectations for a smooth turnaround in profitability, raising the risk that even rapid top-line growth might not translate into lasting value for shareholders.

- Critics highlight that continued weak margins could outweigh revenue momentum if cost pressures persist.

- Ongoing losses put pressure on management to shore up the balance sheet or else risk further market skepticism.

The contrasting figures above set the stage for a heated debate about whether Bonava is a value play or a value trap. Track the full narrative to see how analysts are weighing the turnaround against ongoing risks. 📊 Read the full Bonava Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bonava on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something the data doesn’t show? Share your unique take and shape the conversation in just a few minutes. Do it your way

A great starting point for your Bonava research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite promising growth forecasts, Bonava’s steep and widening losses, along with financial fragility, raise real concerns about the reliability of its turnaround.

If you want to avoid stocks with shaky balance sheets, consider companies known for financial strength by starting your search with our solid balance sheet and fundamentals stocks screener (1987 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonava might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONAV B

Bonava

Operates as a residential developer in Germany, Sweden, Finland, Norway, Estonia, Latvia, and Lithuania.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives