Investors Give Nimbus Group AB (Publ) (STO:BOAT) Shares A 28% Hiding

The Nimbus Group AB (Publ) (STO:BOAT) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

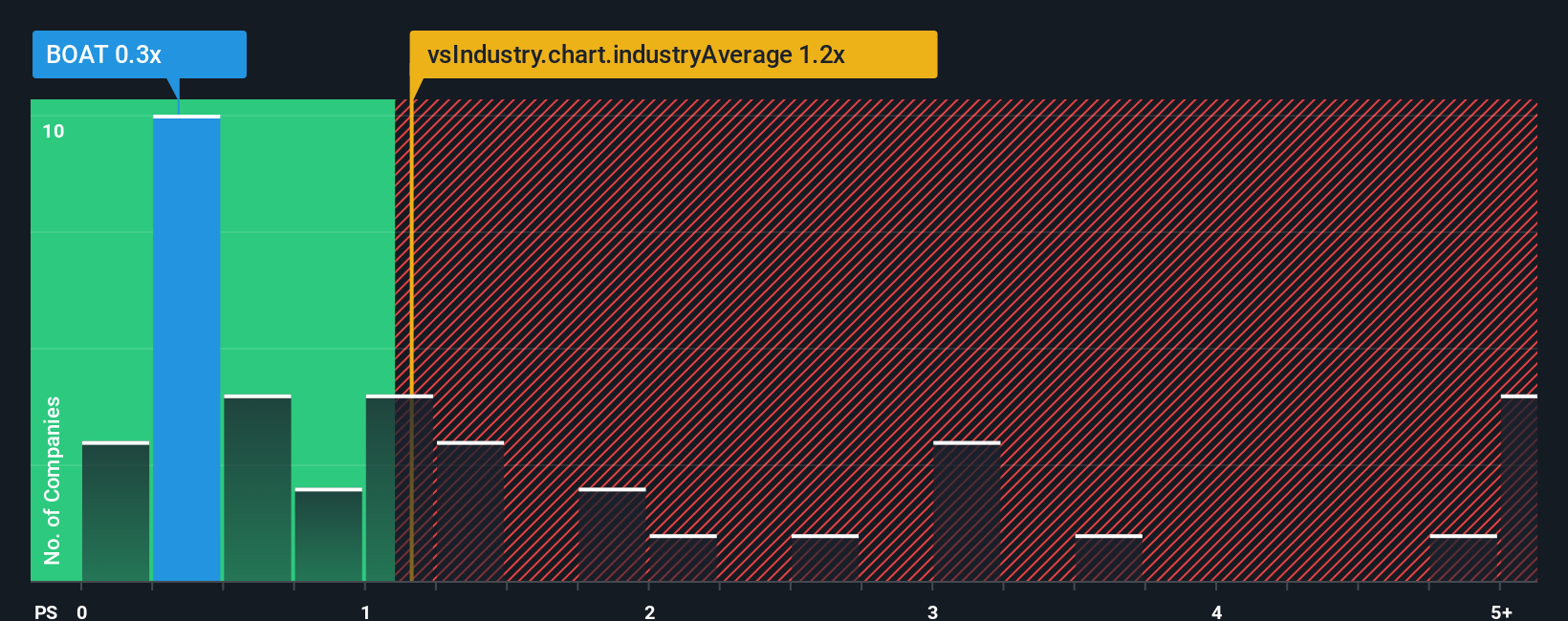

Since its price has dipped substantially, Nimbus Group's price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Leisure industry in Sweden, where around half of the companies have P/S ratios above 2.6x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Nimbus Group

What Does Nimbus Group's P/S Mean For Shareholders?

Nimbus Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nimbus Group.How Is Nimbus Group's Revenue Growth Trending?

Nimbus Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 30% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 5.6%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Nimbus Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Nimbus Group's P/S

Shares in Nimbus Group have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Nimbus Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 2 warning signs for Nimbus Group you should be aware of, and 1 of them makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nimbus Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BOAT

Nimbus Group

Designs, manufactures, and markets leisure motorboats in the Nordics, Europe, and the United States The company provides its products under the Nimbus, Alukin, Aquador, Bella, Falcon, Flipper, and Paragon Yachts brand names.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives