- Sweden

- /

- Consumer Durables

- /

- OM:BESQAB

Besqab (OM:BESQAB): Surge in Premium Valuation Tests Optimism on Forecast 84% Annual Earnings Growth

Reviewed by Simply Wall St

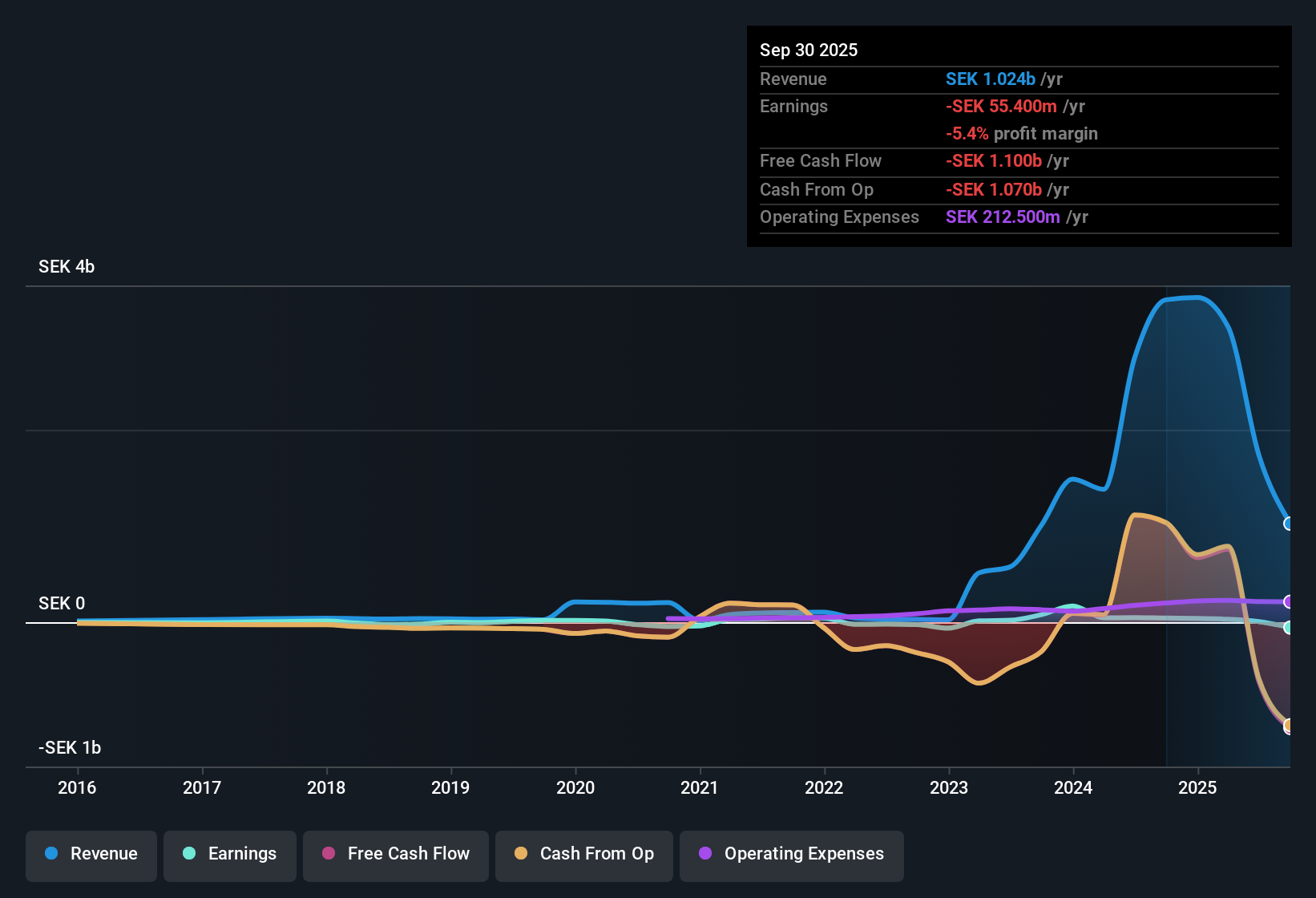

Besqab (OM:BESQAB) remains unprofitable, with no improvement in net profit margins over the past year. However, analysts are projecting explosive earnings growth of 84.03% annually and expect the company to reach profitability within the next three years. This far exceeds the market average. Revenue is forecast to grow at a rapid 38.4% per year, outpacing sector peers. Losses have decreased by an average of 17.8% annually over the past five years. The market’s attention is on the balance between Besqab’s ongoing losses and its strong projected growth, especially given its significant premium valuation compared to peers.

See our full analysis for Besqab.Next, we will see how these headline figures match up with the stories that investors and market watchers are telling about the stock. Some expectations may get confirmed, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium Price-to-Sales Ratio Signals Market Momentum

- Besqab trades at a price-to-sales ratio of 2.4x, which is more than triple the sector and direct peer averages of 0.7x and 0.6x respectively. This highlights the market’s willingness to pay a significant premium for its projected growth.

- Investors following the prevailing market view often point to this premium as a reflection of strong confidence in future revenue and profit expansion.

- Price multiples well above sector norms underline market faith in Besqab’s forward trajectory, despite ongoing unprofitability.

- However, this valuation leaves little room for disappointment if aggressive growth forecasts do not materialize.

Loss Reduction Trend Underpins Growth Story

- Losses have contracted by an average of 17.8% annually over the last five years, even though the company has yet to turn a profit or improve its net margin in the past year.

- Prevailing market analysis claims this trajectory could support a turnaround narrative.

- Becoming profitable within three years relies on outsized 84.03% annual earnings growth expectations, which are far above sector norms.

- But continued unprofitability to date leaves execution risk and amplifies pressure to maintain cost discipline as revenue scales up.

Current Share Price Outpaces DCF Fair Value

- With a share price of 24.00, Besqab trades well above its DCF fair value estimate of 4.44. This suggests the stock’s valuation builds in aggressive optimism about future performance.

- The prevailing market take views this gap as a clear marker of both confidence and risk.

- The premium versus discounted cash flow fair value reflects a bet that forecasted growth and margin recovery will deliver outsized returns.

- If growth rates slip or profitability stalls, the current price level could prove difficult to justify in future quarters.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Besqab's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Besqab’s valuation premium relies on ambitious growth projections. However, ongoing losses and a high price-to-sales ratio highlight real execution risk if expectations are missed.

If stretched valuations and uncertain profitability make you uneasy, uncover better-priced opportunities with healthy fundamentals through these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Besqab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BESQAB

Besqab

AROS Bostadsutveckling AB engages in green field development of residential buildings and conversion of commercial real estate into residential premises.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives