- Sweden

- /

- Commercial Services

- /

- OM:SES

Scandinavian Enviro Systems AB (publ)'s (STO:SES) 36% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, Scandinavian Enviro Systems AB (publ) (STO:SES) shares are down a considerable 36% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

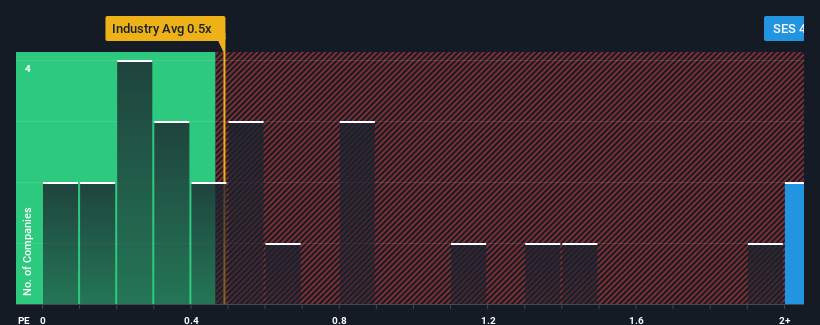

Although its price has dipped substantially, you could still be forgiven for thinking Scandinavian Enviro Systems is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.4x, considering almost half the companies in Sweden's Commercial Services industry have P/S ratios below 0.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

We've discovered 4 warning signs about Scandinavian Enviro Systems. View them for free.Check out our latest analysis for Scandinavian Enviro Systems

What Does Scandinavian Enviro Systems' P/S Mean For Shareholders?

Scandinavian Enviro Systems certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Scandinavian Enviro Systems.How Is Scandinavian Enviro Systems' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Scandinavian Enviro Systems' to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 11% per year during the coming three years according to the one analyst following the company. With the industry predicted to deliver 4.5% growth per year, that's a disappointing outcome.

In light of this, it's alarming that Scandinavian Enviro Systems' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Scandinavian Enviro Systems' P/S

Even after such a strong price drop, Scandinavian Enviro Systems' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Scandinavian Enviro Systems currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Scandinavian Enviro Systems (at least 2 which can't be ignored), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SES

Scandinavian Enviro Systems

Develops, builds, owns, and operates facilities for material recovery of resources from used tires in Sweden and internationally.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026