- Sweden

- /

- Commercial Services

- /

- OM:SDIP B

Sdiptech (OM:SDIP B) Margin Decline Challenges Bullish Narratives Despite Strong Growth Forecasts

Reviewed by Simply Wall St

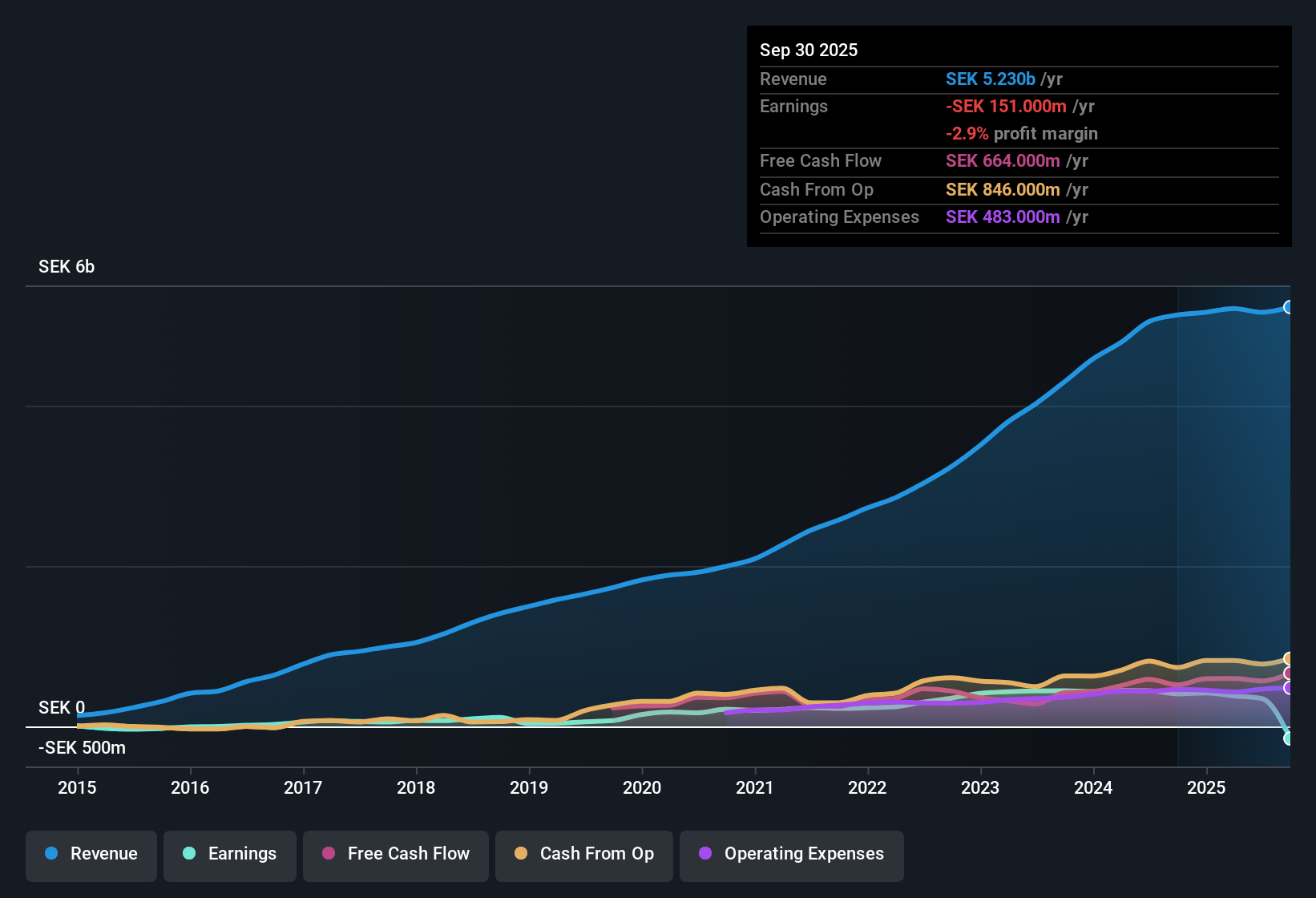

Sdiptech (OM:SDIP B) posted headline numbers that highlight its growth trajectory, with revenue forecast to rise 6.3% per year, outpacing the Swedish market’s 3.9% growth rate. The company’s EPS is projected to expand an impressive 43.3% annually, compared to the local industry’s 12.6%. For investors, this combination of rapid earnings forecasts and a share price currently trading at SEK 207, well below the fair value estimate of SEK 448.76, suggests potential opportunity despite some margin pressure and a less robust financial position.

See our full analysis for Sdiptech.Next, we'll see how these headline results measure up against the prevailing narratives that shape market expectations. Some may hold up, while others could be up for debate.

See what the community is saying about Sdiptech

Margin Expansion Hinges on Portfolio Shift

- Sdiptech's adjusted EBITDA margin decreased from 20.1% to 18.8% year-over-year, even as analysts forecast profit margins to rise from 6.7% today to 10.8% in three years. This underlines a gap between current trends and projected profitability.

- Analysts' consensus view emphasizes that management’s ongoing divestment of low-margin, non-core businesses and a pivot to product-based operations should boost net margins and return on capital from here.

- Consensus notes that operational efficiency via targeted acquisitions and a shift to higher-margin segments could gradually improve profitability. However, recent margin pressures highlight execution risks.

- Momentum in Sdiptech’s core segments such as Energy and Electrification supports this narrative. Persistent wage inflation and acquisition reliance could temper gains if not closely managed.

- Consensus narrative tie: These margin moves are key to whether Sdiptech can bridge current gaps and realize the profitability projected by analysts. 📊 Read the full Sdiptech Consensus Narrative.

Organic Sales Dip Contrasts With Acquisition Strategy

- Organic sales fell 4% for the quarter and 3% over the past year, in stark contrast to Sdiptech’s high reliance on acquisitions for growth and earnings stability.

- Consensus narrative draws attention to the tension between Sdiptech’s inorganic growth, which is expansion fueled by M&A, and the current weakness in organic performance.

- Acquisition-driven gains have built up earnings, but critics highlight that underlying performance has softened. This potentially masks structural issues that the next round of acquisitions may not fix alone.

- Consensus also points out the risk that persistent negative organic growth could weigh on future multiples, especially if margin expansion from acquisitions falls short.

Share Price Deep Discount to DCF Fair Value

- The current share price of SEK 207 trades at a substantial 53.9% discount to the DCF fair value estimate of SEK 448.76. This amplifies the focus on whether the company can deliver on its growth narrative.

- Consensus narrative cautions that while a discounted price signals opportunity, the path to closing this valuation gap depends on Sdiptech achieving projected SEK 6.1 billion in revenues and SEK 662.8 million in earnings by 2028.

- Consensus highlights that if Sdiptech’s profitability and organic growth fall short of targets, the discount may persist regardless of the fair value estimate.

- Steady execution on portfolio streamlining and cost control could help the market reassess and reward the stock’s upside potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sdiptech on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures suggest a different story to you? Take a few minutes to share your own perspective and shape the next narrative. Do it your way.

A great starting point for your Sdiptech research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sdiptech’s declining organic sales and recent margin pressures highlight vulnerabilities in sustaining growth when the company relies heavily on acquisitions.

If you’re seeking companies with more consistent performance, discover businesses showing reliable expansion year after year in our stable growth stocks screener (2099 results) collection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SDIP B

Sdiptech

Provides technical services for infrastructures in Sweden, the United Kingdom, Germany, Denmark, Italy, the Netherlands, Austria, Norway, Finland, the Unites States, and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives