Undiscovered Gems In Europe Highlight 3 Promising Small Caps

Reviewed by Simply Wall St

In the European market, the pan-European STOXX Europe 600 Index has recently shown positive momentum, rising 1.03% amid expectations of a potential interest rate cut by the U.S. Federal Reserve. As major indexes in Italy, France, Germany, and the UK all posted gains, investors are keeping an eye on small-cap stocks that could benefit from stable economic conditions and potential growth opportunities. A good stock in this environment is often characterized by strong fundamentals and resilience to macroeconomic fluctuations—traits that can be particularly appealing as investors seek to uncover promising small-cap companies with untapped potential in Europe.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Marie Brizard Wine & Spirits (ENXTPA:MBWS)

Simply Wall St Value Rating: ★★★★★★

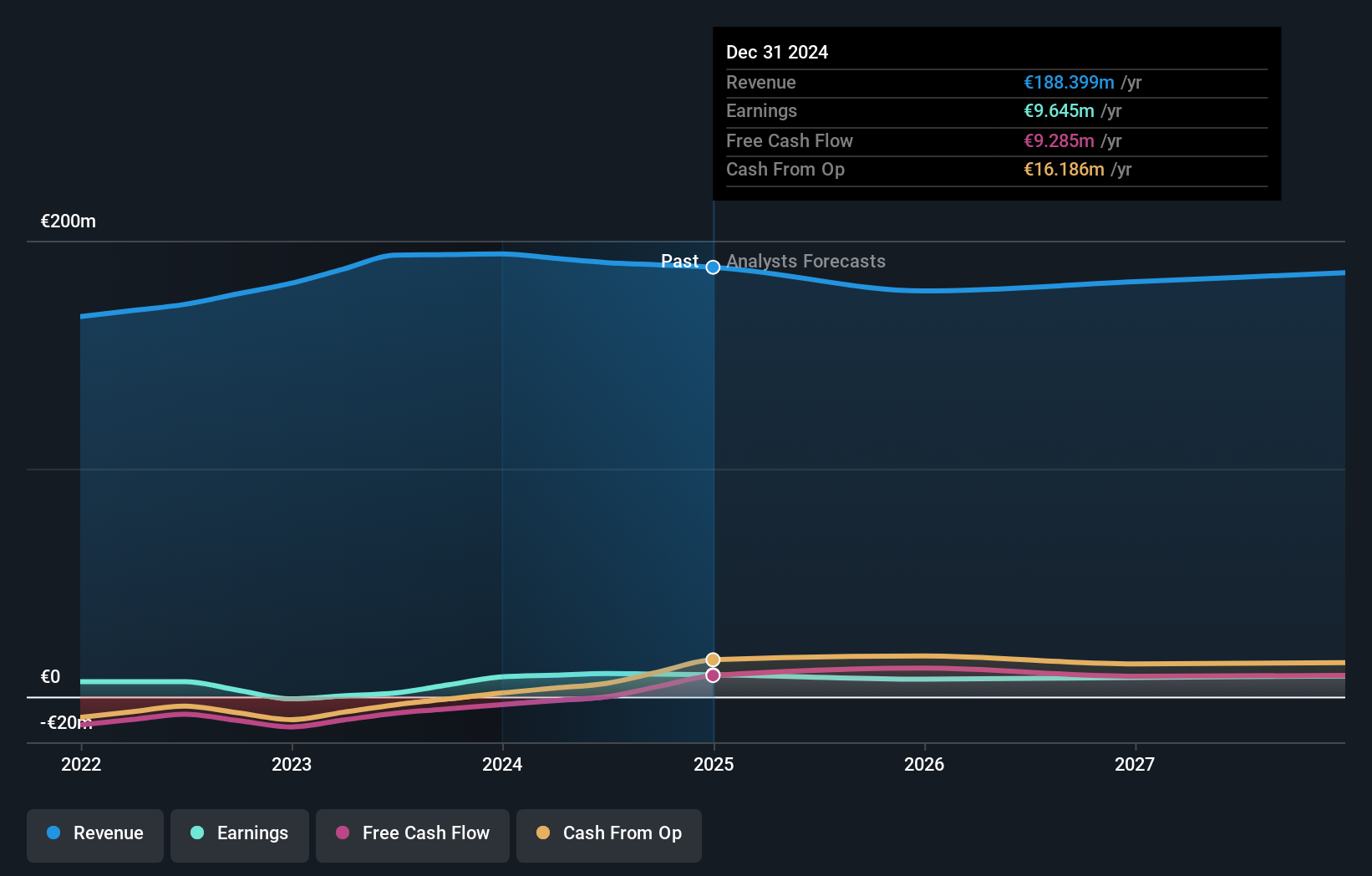

Overview: Marie Brizard Wine & Spirits SA is involved in the production, marketing, and sale of wines and spirits across various regions including France, Europe, Africa, the Americas, and the Asia Pacific with a market capitalization of €332.19 million.

Operations: MBWS generates revenue primarily from its operations in France (€83.92 million) and international markets (€104.48 million).

Marie Brizard Wine & Spirits, a small player in the beverage industry, has shown robust earnings growth of 10.5% over the past year, outpacing its industry peers who faced a -29.9% slump. The company has successfully reduced its debt to equity ratio from 61.5% to just 2% over five years and maintains more cash than total debt, indicating financial prudence. Despite this progress, recent sales figures reveal some challenges with second-quarter revenue at €44 million compared to €51 million last year and half-year revenue at €87 million versus €95 million previously, suggesting potential headwinds ahead.

Bonheur (OB:BONHR)

Simply Wall St Value Rating: ★★★★★★

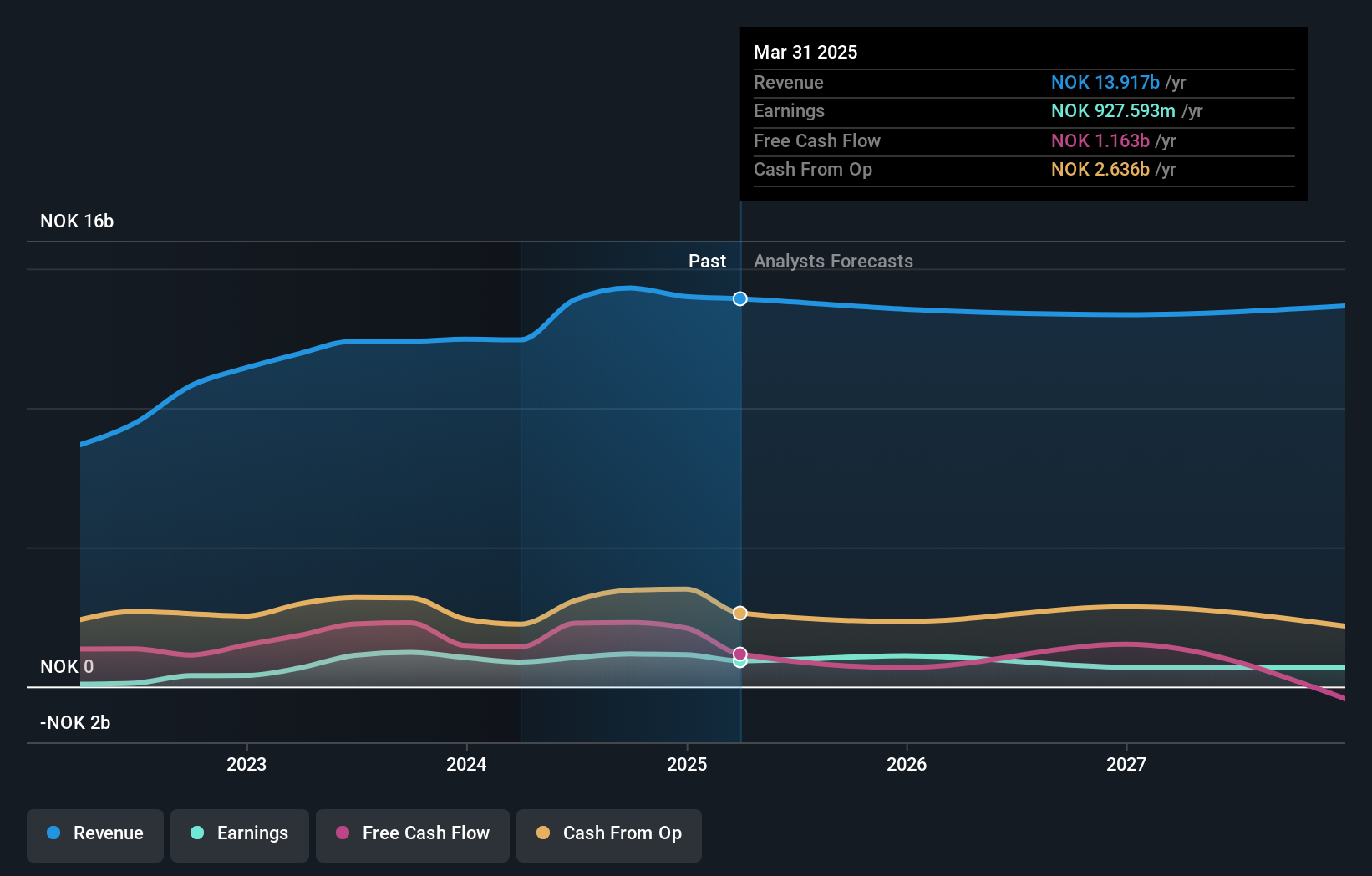

Overview: Bonheur ASA is a diversified company operating in renewable energy, wind services, and cruise sectors across various regions including the United Kingdom, Norway, and internationally, with a market cap of NOK9.65 billion.

Operations: Revenue streams for Bonheur ASA include Wind Service (NOK5.38 billion), Cruise (NOK3.65 billion), and Renewable Energy (NOK2.61 billion). The company experiences a segment adjustment of NOK-93.67 million in its financials.

Bonheur, a notable player in the energy sector, has shown robust earnings growth of 16% over the past year, outpacing the Industrials industry average. The company is trading at an attractive price-to-earnings ratio of 8x compared to Norway's market average of 12.5x. With a satisfactory net debt to equity ratio at 20.9%, Bonheur's financial health appears solid, further supported by well-covered interest payments with EBIT covering interest expenses by 3.8 times. Recently issuing NOK 700 million in green bonds for renewable projects underscores its commitment to sustainable growth despite potential challenges like declining energy prices and operational risks.

Rejlers (OM:REJL B)

Simply Wall St Value Rating: ★★★★★☆

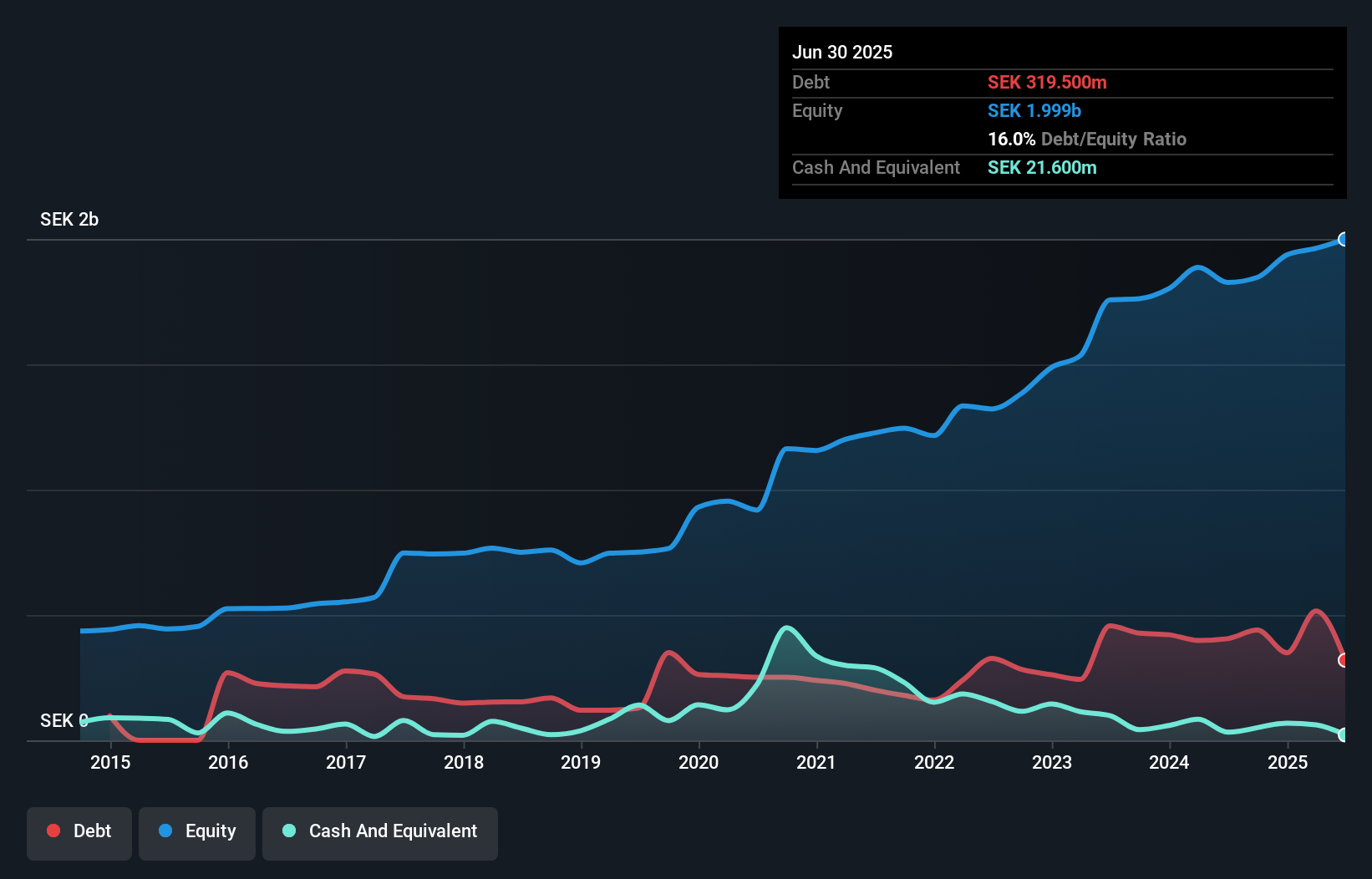

Overview: Rejlers AB (publ) is a company that provides engineering consultancy services across Sweden, Finland, Norway, and Abu Dhabi with a market capitalization of approximately SEK4.37 billion.

Operations: The company generates revenue primarily from its engineering consultancy services in Sweden (SEK 2.83 billion), Finland (SEK 1.48 billion), and Norway, including Embriq (SEK 346.10 million).

Rejlers is carving out a niche in Europe with its strategic focus on digitalisation and AI, highlighted by its collaboration with Endra to enhance building systems design. The company has shown resilience, with earnings growing 7.1% over the past year, surpassing industry growth of 6.4%. Its net debt to equity ratio stands at a satisfactory 14.9%, reflecting financial prudence as it reduced from 27.4% over five years. Despite a dip in recent net income compared to last year, Rejlers remains attractive, trading at 64% below estimated fair value while maintaining high-quality earnings and strong interest coverage of 11x EBIT.

- Unlock comprehensive insights into our analysis of Rejlers stock in this health report.

Examine Rejlers' past performance report to understand how it has performed in the past.

Taking Advantage

- Navigate through the entire inventory of 335 European Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MBWS

Marie Brizard Wine & Spirits

Engages in the producing, marketing, and selling wines and spirits in France, Europe, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives