Stock Analysis

- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Three Swedish Dividend Stocks Offering Yields From 3% To 4.7%

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating European markets, with political uncertainties and varying economic indicators influencing investor sentiment, Sweden's market presents an intriguing area for those interested in dividend stocks. In this context, selecting stocks that not only offer attractive yields but also demonstrate stability and strong fundamentals becomes particularly crucial.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.37% | ★★★★★★ |

| Betsson (OM:BETS B) | 6.16% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.42% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.31% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.11% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.80% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.40% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.15% | ★★★★★☆ |

| Husqvarna (OM:HUSQ B) | 3.40% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bilia (OM:BILI A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership with operations in Sweden, Norway, Luxembourg, and Belgium, boasting a market capitalization of SEK 12.82 billion.

Operations: Bilia AB generates revenue through various segments, including SEK 19.28 billion from car sales in Sweden, SEK 7.16 billion in Norway, and SEK 3.61 billion in Western Europe; additionally, service revenues contribute SEK 6.16 billion in Sweden, SEk 2.16 billion in Norway, and SEK 654 million in Western Europe.

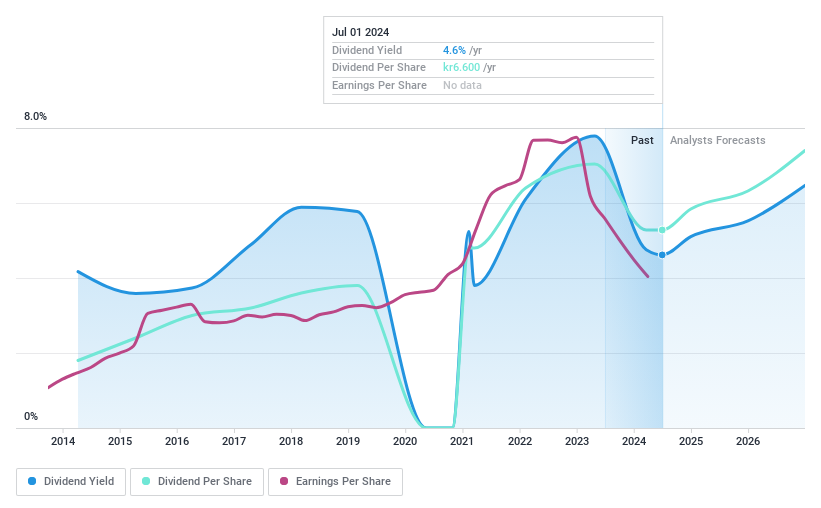

Dividend Yield: 4.7%

Bilia's dividend yield stands at 4.73%, ranking in the top 25% of Swedish dividend payers, despite a recent decrease to SEK 6.60 per share, payable in four installments through 2025. The company's financial position is challenged by high debt levels and a cash payout ratio of 518.9%, indicating that dividends are not well covered by cash flows. Additionally, Bilia has experienced volatility in its dividend payments over the past decade, with profit margins declining from last year to a current 2.2%. Recent strategic moves include a new partnership with Volvo Car Sweden and expansion into electric vehicle sales through XPENG brand facilities, aiming to enhance customer experience and market presence.

- Navigate through the intricacies of Bilia with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Bilia's current price could be quite moderate.

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB specializes in the distribution, handling, storage, recycling of cash and other valuables, with a market capitalization of approximately SEK 19.76 billion.

Operations: Loomis AB generates its revenue primarily from two segments: Europe and Latin America with SEK 13.86 billion, and the United States of America with SEK 15.17 billion.

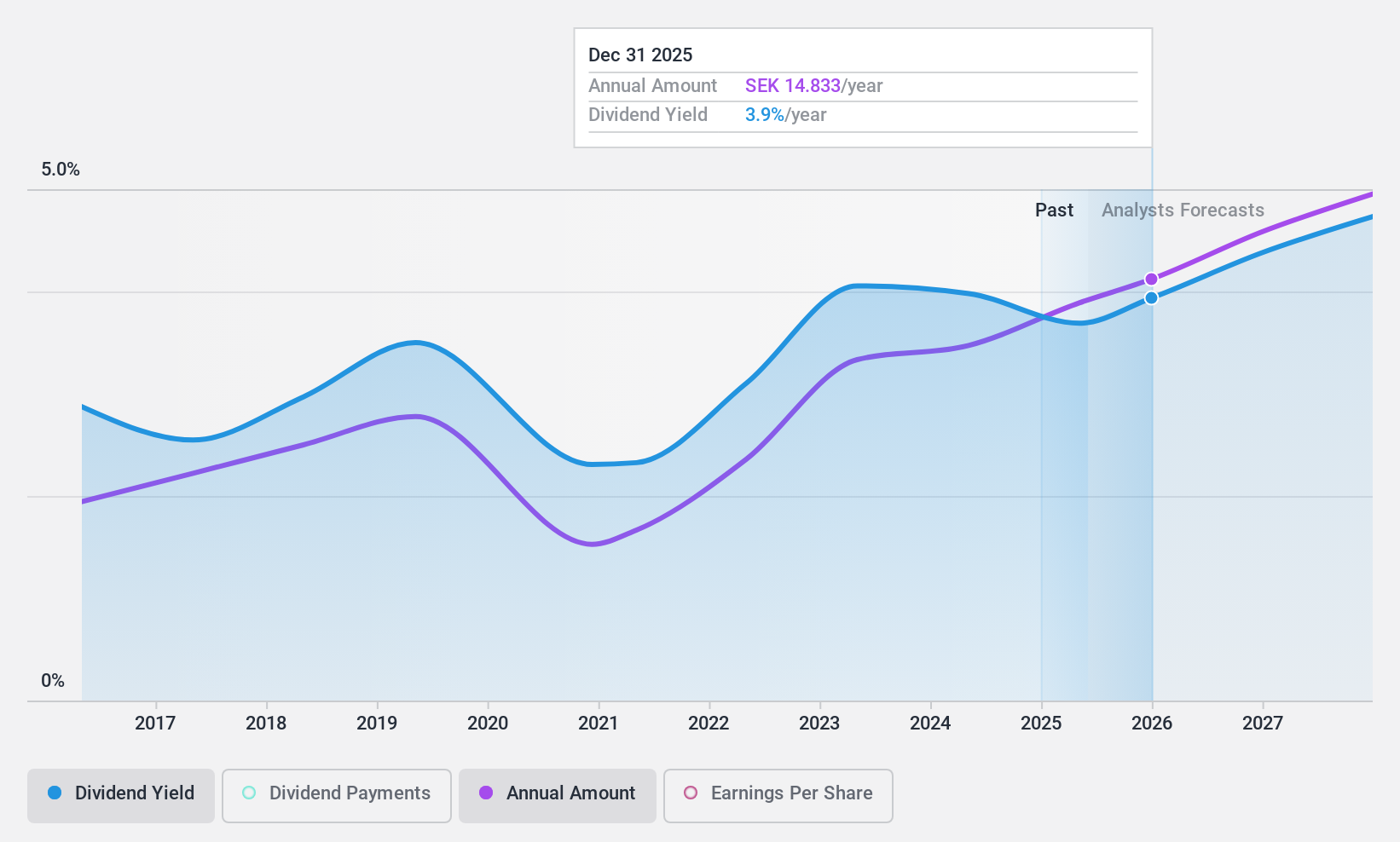

Dividend Yield: 4.4%

Loomis AB's recent dividend of SEK 12.50 per share aligns with its pattern of maintaining payouts, supported by a payout ratio of 61.2%. Despite a slight dip in Q1 2024 net income to SEK 359 million from SEK 403 million year-over-year, the company's dividends appear sustainable with earnings coverage and a cash payout ratio at 32.4%. Additionally, Loomis has initiated a share repurchase program valued at up to SEK 200 million, potentially bolstering shareholder value amidst stable capital restructuring efforts and ongoing legal challenges in Denmark.

- Dive into the specifics of Loomis here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Loomis shares in the market.

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) is a technical and engineering consultancy firm operating in Sweden, Finland, Norway, and the United Arab Emirates with a market capitalization of approximately SEK 3.28 billion.

Operations: Rejlers AB generates its revenue primarily from Sweden with SEK 2.58 billion, followed by Finland at SEK 1.34 billion, and Norway (including Embriq) contributing SEK 294.60 million.

Dividend Yield: 3%

Rejlers' dividend history reveals a pattern of fluctuations, with significant annual drops over the past decade, despite recent increases. The company's dividend yield stands at 3.04%, lower than the top quartile of Swedish dividend stocks at 4.25%. However, both earnings and cash flow adequately cover these dividends, with payout ratios of 49.5% and 34.9% respectively. Rejlers' collaboration with the Käppala Association could bolster future stability through enhanced operational capacities and environmental contributions.

- Get an in-depth perspective on Rejlers' performance by reading our dividend report here.

- According our valuation report, there's an indication that Rejlers' share price might be on the cheaper side.

Taking Advantage

- Reveal the 25 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Loomis is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOOMIS

Loomis

Provides solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables.

Very undervalued with flawless balance sheet and pays a dividend.