- Sweden

- /

- Commercial Services

- /

- OM:IRIS

Market Cool On Irisity AB (publ)'s (STO:IRIS) Revenues Pushing Shares 49% Lower

To the annoyance of some shareholders, Irisity AB (publ) (STO:IRIS) shares are down a considerable 49% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

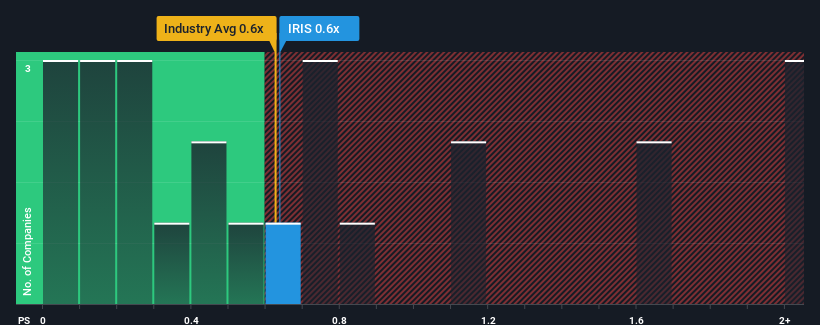

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Irisity's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Sweden is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Irisity

What Does Irisity's P/S Mean For Shareholders?

Recent times have been advantageous for Irisity as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Irisity will help you uncover what's on the horizon.How Is Irisity's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Irisity's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. Pleasingly, revenue has also lifted 166% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 18% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 4.6% growth forecast for the broader industry.

With this information, we find it interesting that Irisity is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Irisity's P/S?

With its share price dropping off a cliff, the P/S for Irisity looks to be in line with the rest of the Commercial Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, Irisity's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Irisity (4 make us uncomfortable!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IRIS

Irisity

Provides AI-powered video analytics solutions in Sweden and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives