- Sweden

- /

- Commercial Services

- /

- OM:GREEN

Green Landscaping Group (OM:GREEN) Margin Decline Tests Bullish Growth Narrative

Reviewed by Simply Wall St

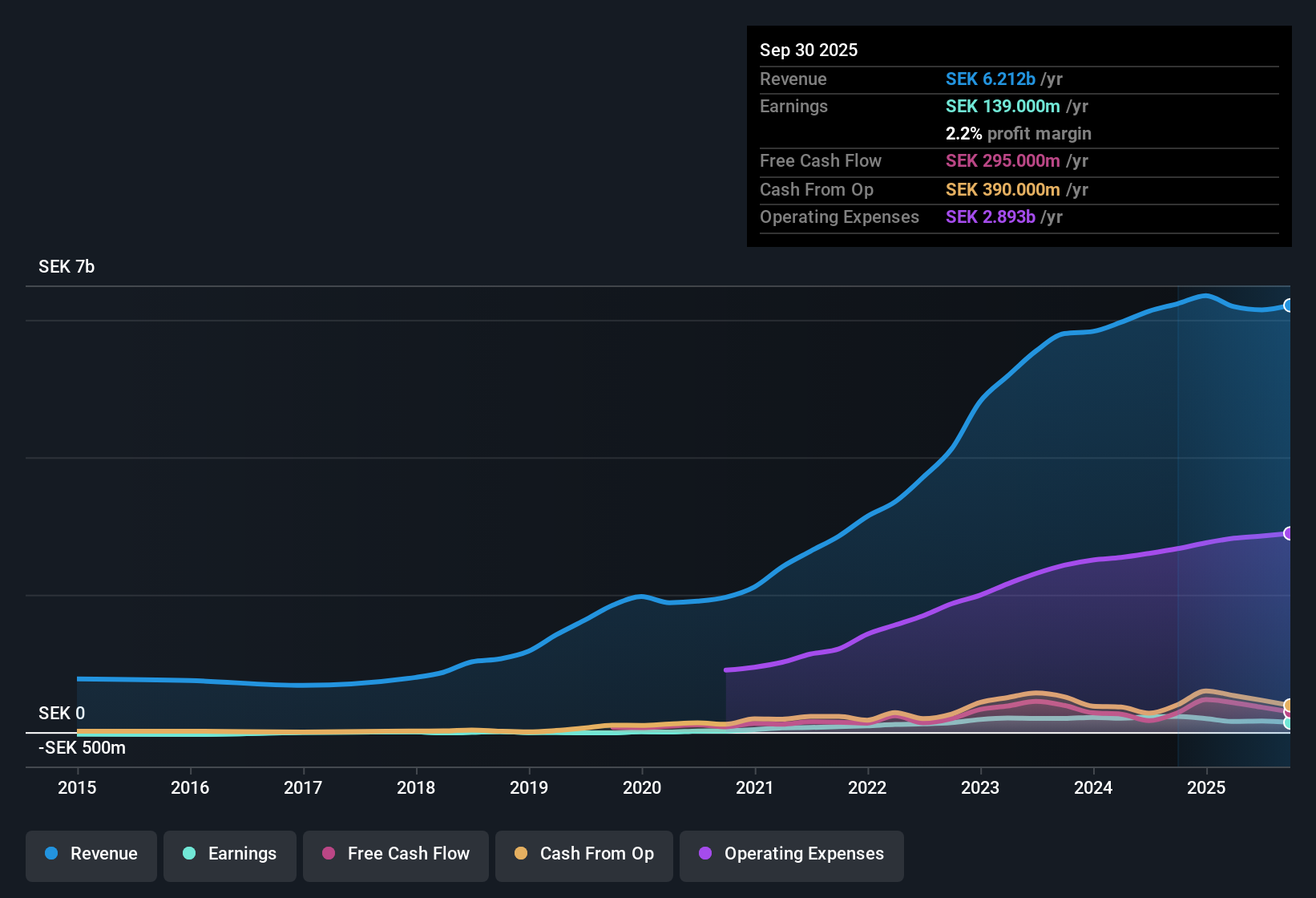

Green Landscaping Group (OM:GREEN) is forecasting annual earnings growth of 22.6%, sharply ahead of its 5% projected yearly revenue growth and Sweden's market earnings forecast of 12.3%. Despite net profit margins slipping from 3.6% last year to 2.6% currently, the company has delivered a strong 26.3% average earnings growth rate over the past five years and maintains a notable quality of earnings.

See our full analysis for Green Landscaping Group.Next, we will see how these headline numbers compare to the dominant narratives shaping investor sentiment. A few expectations will line up, while others may be tested.

See what the community is saying about Green Landscaping Group

Margin Expansion Hinges on Operational Streamlining

- Analysts project Green Landscaping Group’s net profit margin to rise from 2.6% today to 5.8% in three years, with margin expansion fueled by ongoing cost-cutting and targeting higher-value contracts.

- The analysts' consensus view connects this margin outlook to the strategy of discontinuing unprofitable contracts and leveraging technology investment for improved productivity.

- Consensus narrative notes that strategies such as operational streamlining, investing in digital platforms, and recurring revenue from sustainability trends are expected to gradually lift EBITDA and net profit margins. These effects are expected to compound by late 2025 through 2026.

- However, margin volatility in the near term is expected as the company works through weak organic demand and integration of new M&A targets.

- To see if these steady improvements are coming through at the group level or getting bogged down by other regions, check the full consensus narrative for the latest detailed breakdown. 📊 Read the full Green Landscaping Group Consensus Narrative.

Acquisition-Led Growth Brings Leverage Risks

- Financial leverage has reached 2.9x, now exceeding management’s target, while Q2 operating cash flow fell to negative SEK 78 million, down sharply from a prior SEK 11 million. This highlights increased pressure on liquidity and elevated balance sheet risk.

- According to the analysts' consensus view, the rapid pace of acquisitions is a double-edged sword.

- Bulls see the potential for faster geographic reach and higher-value contract wins, arguing that recent M&A is set to accelerate EBITA and group profit margins as larger, better-structured companies are absorbed.

- However, critics highlight that dependence on acquisitions, stretched leverage, and negative cash flow could threaten earnings predictability and force difficult trade-offs in investment versus financial prudence.

Trading Well Below Both Peer and DCF Valuations

- Shares currently trade at SEK 44.00, representing a substantial discount to the peer average price-to-earnings of 73.9x and also far below the DCF fair value of SEK 267.51.

- The analysts' consensus view argues that, despite a premium to the broader European commercial services sector (industry average PE of 14.5x), the stock’s deep discount to peer multiples and its lower-than-consensus share price (peer target of 79.83) weigh favorably for investors seeking perceived value.

- Consensus narrative underscores that for the market to close the gap toward the consensus analyst target of SEK 79.83, investors must believe that profit margins and revenue can sustainably lift, while the company successfully manages its higher debt load and drives margin improvement as projected.

- The disconnect between discounted share price and both peer and DCF fair value provides a potential opportunity, but also hinges on execution and macro resilience.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Green Landscaping Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have a unique take on these figures? Share your viewpoint by building your own narrative in just a few minutes. Do it your way.

A great starting point for your Green Landscaping Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Green Landscaping Group’s dependence on acquisition-led growth and rising leverage, together with negative cash flow, raises concerns about the company’s financial resilience.

If you’re seeking businesses with lower debt and more robust liquidity, use our solid balance sheet and fundamentals stocks screener (1984 results) to quickly identify companies built for financial strength and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GREEN

Green Landscaping Group

Engages in the green space management and landscaping business in Sweden, Norway, and rest of Europe.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives