- Sweden

- /

- Professional Services

- /

- OM:AFRY

AFRY (OM:AFRY) Profit Margins Decline to 3.6%, Challenging Bullish Growth Narrative

Reviewed by Simply Wall St

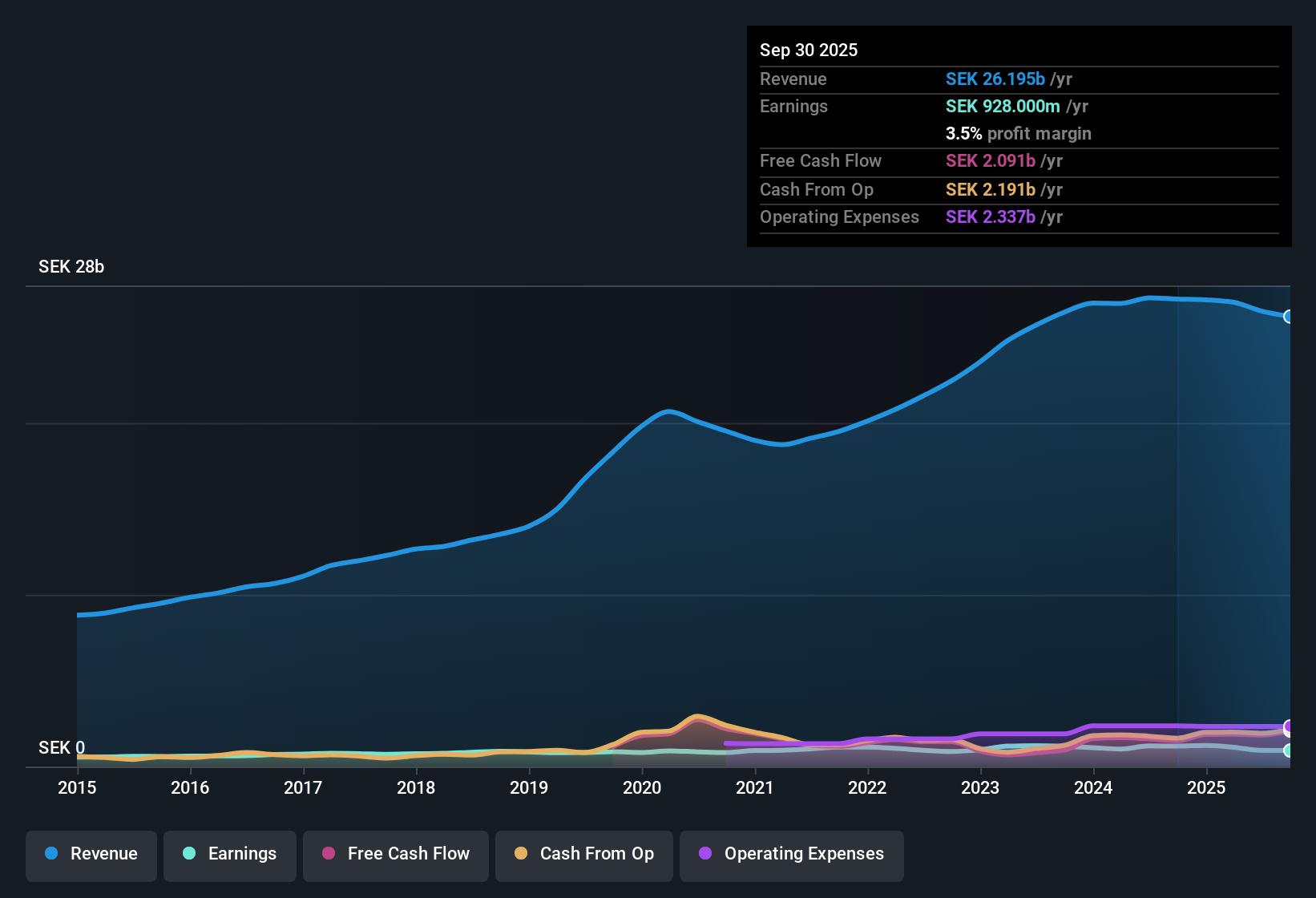

AFRY (OM:AFRY) is forecasting earnings growth of 30.3% per year, far outpacing the Swedish market’s average of 12.6% and the company's own projected revenue growth rate of 4.9%. Net profit margins currently sit at 3.6%, down from last year’s 4.4%, while earnings have averaged 4.1% growth per year over the last five years. With shares trading at a Price-to-Earnings ratio of 20.7x, which is above its peer average but in line with the broader industry, investors are weighing the company’s high growth outlook against its compressed margins and the premium on its stock.

See our full analysis for Afry.Now, let’s see how these headline results compare to the main narratives circulating in the market. Where do the numbers confirm investor sentiment, and where do they challenge the consensus?

See what the community is saying about Afry

Margin Recovery: Analysts See Jump to 6.8%

- Analysts expect profit margins to rise from 3.6% today to 6.8% over the next three years, a notable improvement compared to both last year’s margins and the more compressed present.

- According to the analysts' consensus view, this anticipated turnaround is driven by ongoing restructuring and a shift toward high-value consulting:

- Cost reduction programs and new group structures are designed to improve efficiency and utilization rates, directly addressing the challenge from underused capacity.

- Analysts highlight that recurring revenue from advisory and sustainability consulting is positioned to lift both margins and earnings quality, provided operational efficiency targets are met.

- Anticipated margin expansion is seen as a key lever for unlocking higher earnings growth, even as revenue projections remain moderate.

See how margin forecasts anchor analysts' balanced perspective in the full consensus narrative. 📊 Read the full Afry Consensus Narrative.

Restructuring Costs: SEK 200 to 300 Million Overhang

- Ongoing restructuring is expected to incur SEK 200 to 300 million in extra costs in the next 12 months, flagged mainly as personnel-related.

- Analysts' consensus view notes these restructuring expenses could weigh on short-term profitability, especially if utilization rates don’t recover quickly:

- Optimists point to portfolio optimization and greater efficiency over time, but skeptics warn these programs only pay off if market demand supports higher project volumes.

- The consensus also highlights that continued underutilization, if not reversed, may cap the upside from these strategic shifts and add operational complexity.

DCF Fair Value Gap: Shares Trade 58% Below Estimate

- AFRY trades at SEK 171.70 per share, which is 58% below its DCF fair value estimate of SEK 410.66, suggesting significant potential upside if intrinsic value is realized.

- In the analysts' consensus view, this apparent discount creates room for debate:

- On the one hand, the share price trades below both the DCF fair value and the analyst target of SEK 212.50, which supports the value case for patient investors.

- However, the stock’s premium PE ratio (20.7x versus peer average of 17x) and persistent margin pressure raise questions as to whether the market is properly discounting ongoing operational risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Afry on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your perspective and shape a unique narrative in just a few minutes: Do it your way

A great starting point for your Afry research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While AFRY offers strong earnings growth potential, concerns linger over its compressed profit margins, significant restructuring costs, and the possibility that ongoing operational challenges could weigh on future performance.

If you want steadier returns with less earnings uncertainty, check out stable growth stocks screener (2098 results) to find companies delivering consistent growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AFRY

Afry

Provides engineering, design, and advisory services for the infrastructure, industry, and energy sectors in the Nordics, North America, South America, Asia, rest of Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives