Jetty (NGM:JETTY) Share Prices Have Dropped 53% In The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Jetty AB (publ) (NGM:JETTY) share price is down 53% in the last year. That's well below the market return of 27%. We wouldn't rush to judgement on Jetty because we don't have a long term history to look at. The silver lining is that the stock is up 11% in about a week.

View our latest analysis for Jetty

We don't think Jetty's revenue of kr2,834,000 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Jetty can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Jetty investors have already had a taste of the bitterness stocks like this can leave in the mouth.

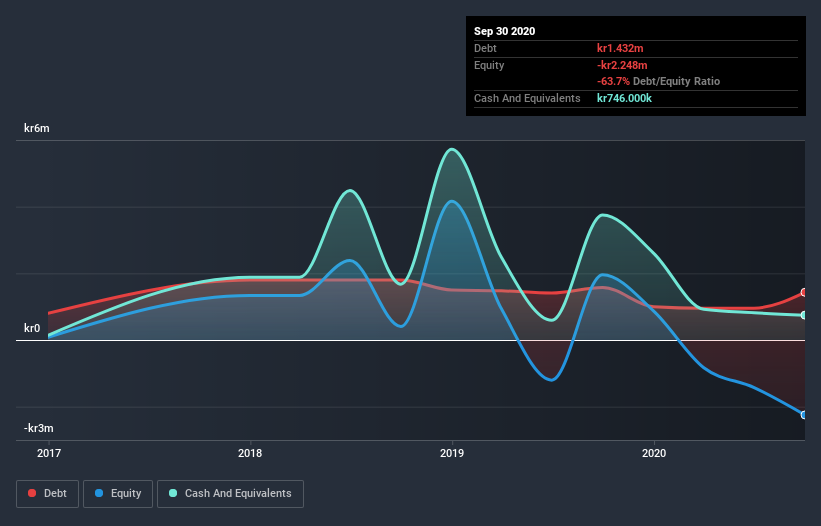

Our data indicates that Jetty had kr3.2m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. But since the share price has dived 53% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Jetty's cash levels have changed over time.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Jetty's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Jetty hasn't been paying dividends, but its TSR of -41% exceeds its share price return of -53%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While Jetty shareholders are down 41% for the year, the market itself is up 27%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline seems to have halted in the most recent three months, with the relatively flat share price suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Jetty better, we need to consider many other factors. Even so, be aware that Jetty is showing 7 warning signs in our investment analysis , and 6 of those make us uncomfortable...

But note: Jetty may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Jetty or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thinc Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:THINC

Thinc Collective

Offers systems, communication, and structure services in Sweden and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives