Troax Group (OM:TROAX): Margin Compression Tests Bullish Growth Narratives Despite Projected 34.8% Earnings Surge

Reviewed by Simply Wall St

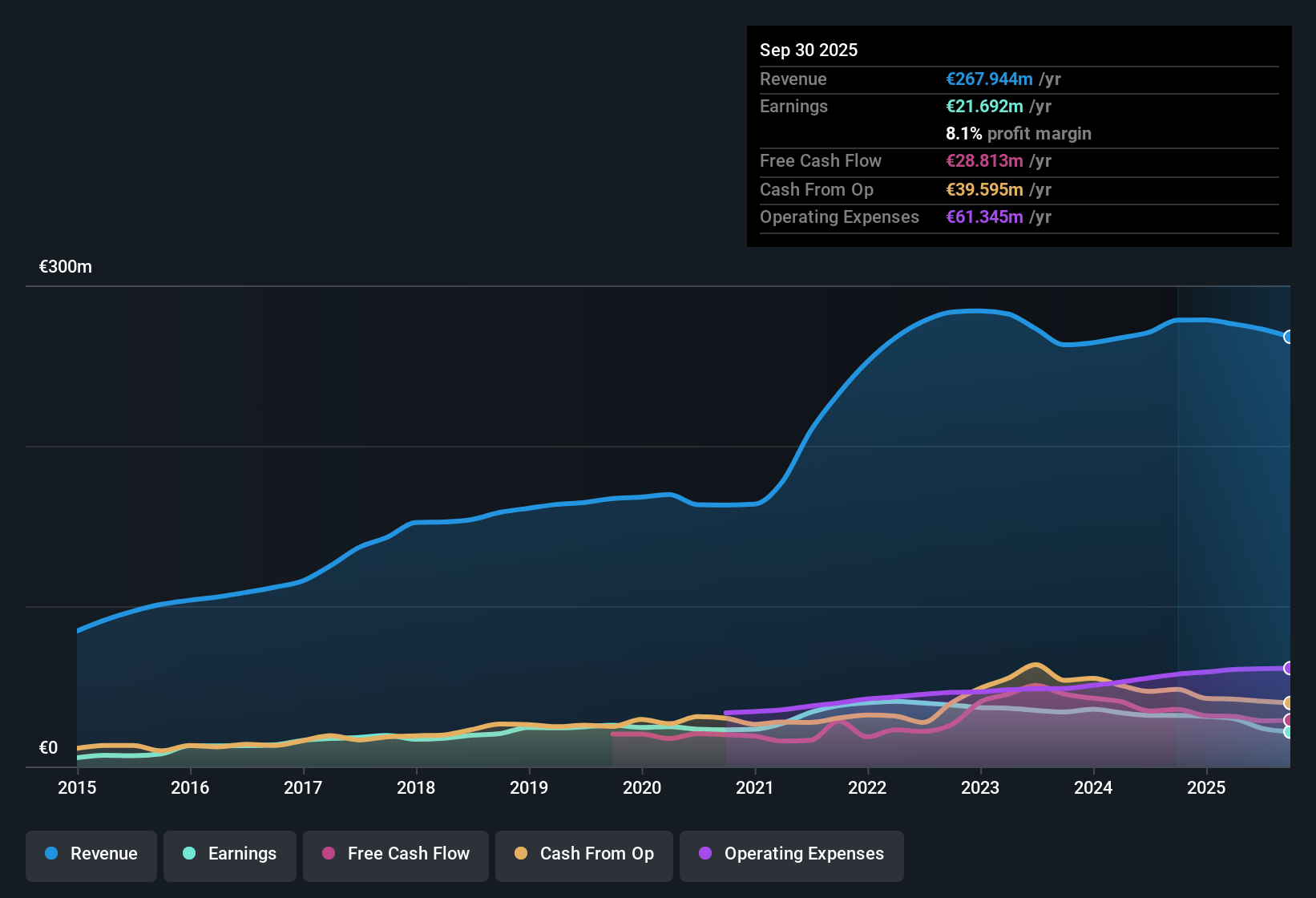

Troax Group (OM:TROAX) is poised for an impressive rebound, with earnings projected to jump 34.8% per year and revenue estimated to rise 5.3% annually, both handily outpacing the Swedish market. Despite a current net profit margin of 8.1%, down from last year’s 11.5%, and a five-year average earnings decline of 2% per year, shares continue to trade below analyst price targets at SEK141.2. With analysts expecting high quality earnings growth and highlighting only minor dividend sustainability risks, investors are balancing optimism on future gains with a watchful eye on the company’s profitability trends.

See our full analysis for Troax Group.Next, we’ll see how these headline figures compare to the narratives that shape market expectations, spotlighting where Troax Group’s story holds up and where it may get tested.

See what the community is saying about Troax Group

Margins Poised for a Turnaround

- Analysts project net profit margins will rebound from 8.7% today to 17.4% in three years, doubling profitability even as past five-year average earnings declined by 2% per year.

- The analysts' consensus view emphasizes how a combination of major cost-saving initiatives and facility consolidation, such as the €10 million annualized savings plan and closure of the Polish plant, are expected to structurally boost margins and operating leverage.

- Consensus points to ongoing production optimization enabling higher-margin, recurring revenue streams, even as current results reflect margin compression against last year’s figures.

- What’s surprising is the confidence in margin recovery, despite persistent weakness in key end-markets, based on the timing and size of cost cuts mapped to a late 2025 to 2026 revenue rebound.

Consensus narrative notes how cost discipline may set up a sharp recovery if warehousing demand bounces back as expected.

📊 Read the full Troax Group Consensus Narrative.

Premium Valuation Despite Industry Discount

- Troax trades at a 35.7x Price-To-Earnings Ratio, substantially above the Swedish Machinery industry average of 24.3x and its peer group average of 26.8x, yet remains 26% below its DCF fair value (SEK201.89) and 36% below the only permitted analyst price target (SEK191.72), given the current share price of SEK141.20.

- Consensus narrative flags an unusual valuation tension: while the market is pricing Troax at a significant premium to industry and peer earnings multiples, bulls argue that rapid forecasted earnings growth could justify the premium, especially if operating margins recover as projected.

- This creates a push-pull where the discounted price versus target and DCF value supports reward potential, but relative PE ratios raise doubts about current headroom for further re-rating.

- Consensus further notes that a key test will be whether Troax can sustain growth to bring its future PE down closer to the forecast 22.9x by 2028, aligning with sector averages as margin expansion materializes.

Warehousing and Safety Trends Shape Growth Outlook

- Expected annual revenue growth of 5.3%, outpacing Sweden’s machinery market at 3.7%, is pinned to the resurgence in warehousing demand and tighter safety regulations, with additional upside coming from North American expansion and M&A activity.

- According to the consensus narrative, Troax’s future growth is leveraged to industry recovery and automation trends, but faces meaningful challenges from falling orders (with Q2 order intake down 6%) and overreliance on legacy products.

- Bears argue that continued softness in automotive and warehousing segments, along with increased FX and material cost pressure, could threaten both topline momentum and profit margin ambitions.

- The balancing act for investors is betting on warehouse and safety automation trends outpacing structural risks associated with traditional mesh product commoditization and regional overexposure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Troax Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a new angle? Take a couple of minutes to build your own perspective and put your story into motion: Do it your way.

A great starting point for your Troax Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Troax’s promising revenue trajectory, its weakened profit margins and recent order declines suggest persistent volatility and uncertain fundamental momentum in the period ahead.

If you want companies with a steadier outlook, check out stable growth stocks screener (2119 results) to see which businesses continually post reliable earnings and sales even when the cycle turns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Troax Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TROAX

Troax Group

Through its subsidiaries, produces and sells mesh panels in the Nordic region, the United Kingdom, North America, Europe, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives