- Sweden

- /

- Construction

- /

- OM:SWEC B

Sweco (OM:SWEC B) Valuation: Examining Potential After Major Sida and Sporveien Contract Wins

Reviewed by Simply Wall St

Sweco (OM:SWEC B) has just landed a pair of major framework agreements in the Nordics: one with Sweden’s Sida agency for sustainable development consulting and another with Norway’s Sporveien for public transport infrastructure services. Together, these wins further establish Sweco as a go-to partner for high-impact regional projects.

See our latest analysis for Sweco.

Sweco’s two new agreements have come at a time when momentum in the shares has wavered, with a 1-day share price return of 1.2% trimming some of the recent declines. Over the past year, total shareholder return is essentially flat, but the company’s impressive 62% total return over three years serves as a reminder of its longer-term strength. Recent wins like these may spark renewed investor confidence as Sweco sharpens its focus on sustainable infrastructure and international growth.

If news of Sweco’s fresh contract wins has you curious, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With these contract wins in the spotlight and the stock still trading at a discount to analysts’ price targets, investors are left to ponder whether Sweco is undervalued based on its fundamentals or if the market has already taken future growth expectations into account.

Most Popular Narrative: 18.4% Undervalued

At SEK 160.8, Sweco’s share price sits well below the most widely followed narrative’s fair value estimate of SEK 197.00. This valuation reflects optimism about the company’s potential upside, fueled by stable expansion in key project segments.

Sweco's focus on operational efficiency, including higher pricing, improved billing ratios, and cost control measures, is expected to enhance margins and profitability, supporting higher future earnings.

Curious about what’s powering these bullish projections? The numbers beneath this headline involve more than typical growth. They hinge on shrewd strategies and bold financial bets that could rewrite Sweco’s future. Dive in for a look behind the curtain at the narrative’s most crucial assumptions and see how this ambitious valuation stacks up.

Result: Fair Value of $197 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow recovery in real estate demand and ongoing restructuring costs in Finland could quickly dampen Sweco’s near-term margin and growth outlook.

Find out about the key risks to this Sweco narrative.

Another View: What Do Earnings Multiples Reveal?

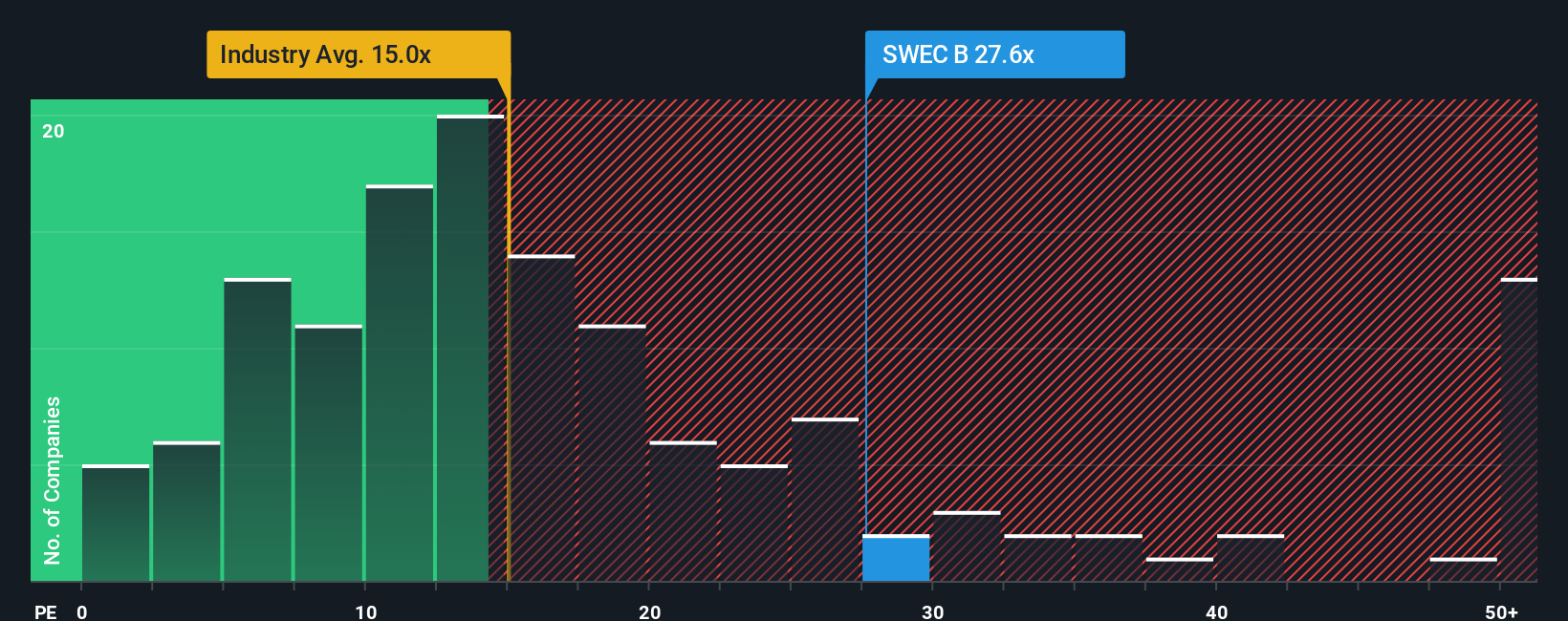

Shifting focus from the optimistic fair value estimate, Sweco's current price-to-earnings ratio of 26.8x stands out as significantly higher than the fair ratio of 24.7x and well above both peer and industry averages (16.9x and 14.5x, respectively). This gap suggests that the stock might be priced for strong growth, but it could also mean there is less margin for error if expectations fall short. Can this premium be justified, or does it signal valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sweco Narrative

If the story above does not align with your outlook, consider examining the figures and forming your own perspective in just a few minutes. Do it your way

A great starting point for your Sweco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move confidently and spot tomorrow’s winners. Take advantage of these hand-picked stock collections and gain an edge in your investing journey:

- Tap into future-shaping technologies by checking out these 28 quantum computing stocks as it pushes the boundaries of computing and innovation.

- Start building steady income streams by scanning for reliable yields with these 15 dividend stocks with yields > 3%, which offers attractive payouts above 3%.

- Ride the momentum of artificial intelligence with these 25 AI penny stocks as it remains at the forefront of transformative tech adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWEC B

Sweco

Provides architecture and engineering consultancy services worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026