- Sweden

- /

- Industrials

- /

- OM:STOR B

Storskogen Group (OM:STOR B) Profitability Boosted by One-Off Gain, Raising Questions on Earnings Quality

Reviewed by Simply Wall St

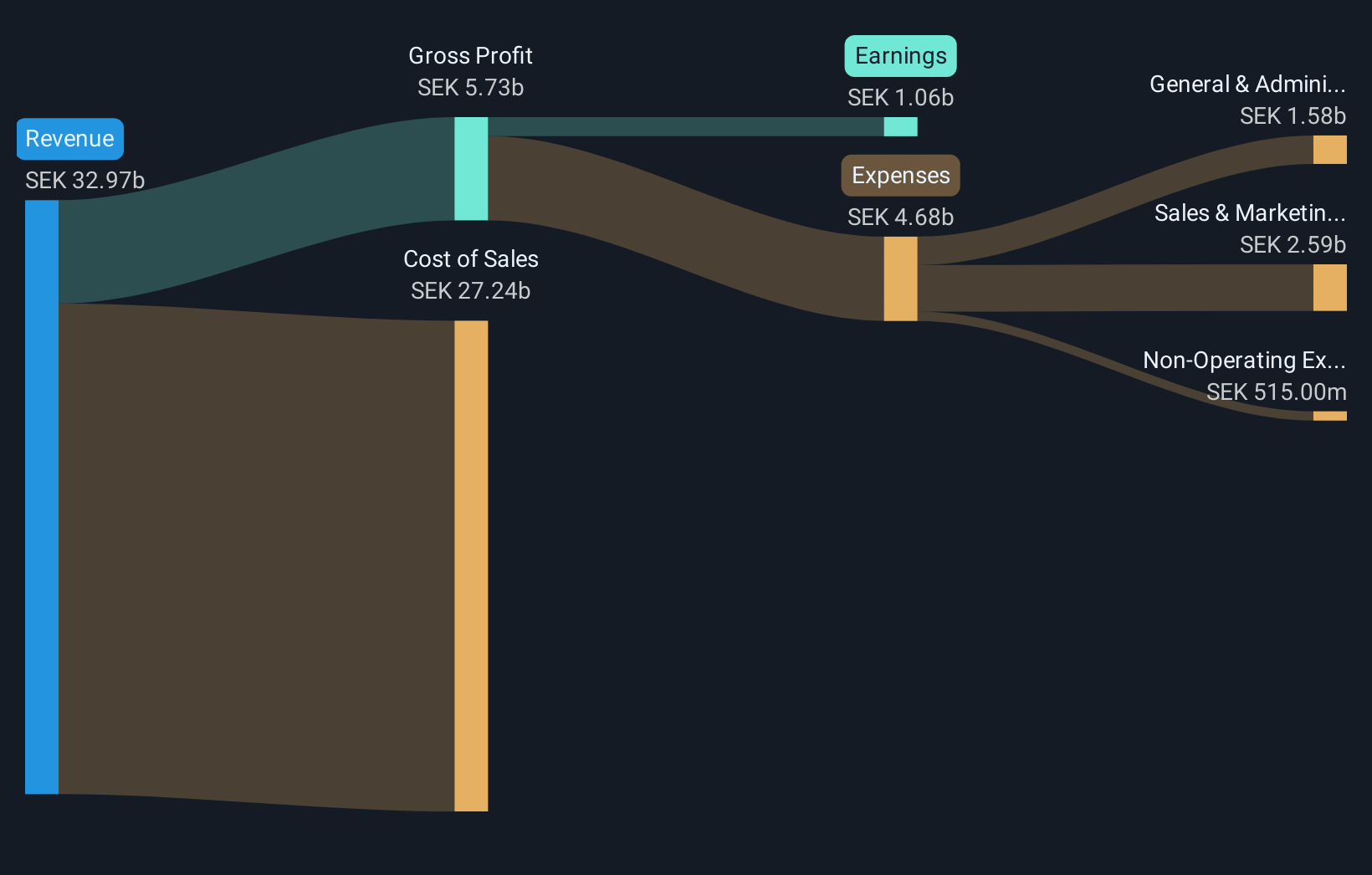

Storskogen Group (OM:STOR B) just turned profitable, with its net profit margin moving into positive territory for the past year. The company’s earnings include a one-off gain of SEK910.0 million in the latest 12 months ending September 30, 2025, which clouds the picture of underlying profit quality. Over the past five years, earnings have declined by 10.2% per year, and with revenue expected to grow at just 2.9% per year, which is slower than both the broader Swedish market and sector peers, investors are left to weigh low growth against the impact of those exceptional gains.

See our full analysis for Storskogen Group.The next section puts these headline numbers to the test by comparing them to the most widely followed narratives about Storskogen Group. See where the facts support conventional wisdom and where they push back.

See what the community is saying about Storskogen Group

Profit Margin Turns Positive on Non-Recurring Gains

- Storskogen Group’s net profit margin moved into positive territory this year, but this was boosted by a SEK910.0 million one-off gain that inflates profitability for the period.

- According to the analysts' consensus view, recent margin expansion is viewed as partly structural, with efficiency improvements and acquisitions in digital and healthcare segments supporting better group-level margins.

- Consensus narrative notes that ongoing integration of higher-margin businesses is expected to further diversify cash flows and reduce earnings cyclicality, providing more stability than in previous years.

- They also highlight that consistent cost discipline and margin-focused project selection could make future profit improvements more sustainable, even if headline growth remains muted.

Consensus: Bulls and bears alike are watching whether margin strength can persist without non-recurring boosts. Analysts outline how recurring business mix and acquisition strategy may hold the key. 📊 Read the full Storskogen Group Consensus Narrative.

Multi-Year Earnings Decline Continues at 10.2% Per Year

- Over the past five years, annual earnings declined by 10.2% per year, a trend that is not masked by the company’s recent transition to positive net profit margin.

- In the analysts' consensus narrative, they caution that while recent cost improvements are encouraging, weak organic sales growth, especially in Services and Trade segments, and price pressures in Professional and Consumer Products threaten to hold back any meaningful turnaround.

- Bears argue that ongoing revenue contraction, including a 9% year-on-year sales dip for Q2 due to divestments and operational headwinds, signals persistent operational pressures that could further challenge sustained margin development.

- Consensus view highlights that increased reliance on working capital for industrial orders and slower integration of acquisitions may limit the group’s ability to reverse long-term earnings declines.

Valuation Gap: Shares Trade at 18.3x PE, Well Below Peer Average

- Storskogen’s Price-to-Earnings ratio stands at 18.3x, below both the European industrials industry average of 21.4x and its direct peer group’s 41.3x, while the current share price (SEK11.5) is notably under both the analyst price target (SEK16.00) and DCF fair value (SEK36.20).

- The analysts' consensus view sees this discounted valuation as a key reward, noting that market skepticism around earnings quality and growth may be providing an entry point absent any further earnings shocks.

- Consensus notes that sector-wide momentum is moderate (Swedish market forecasted to grow 3.7% annually versus Storskogen’s 2.9%), but the magnitude of the valuation discount stands out among industry peers.

- With the number of shares expected to remain stable near-term, upside from multiple expansion and improved margins could be realized if structural improvements persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Storskogen Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results from another angle? Share your viewpoint by building a fresh, personal narrative in just a few minutes. Do it your way

A great starting point for your Storskogen Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Storskogen Group has struggled with multi-year earnings decline and muted growth, relying on non-recurring gains to temporarily lift profit margins.

If stable results matter more to you, use stable growth stocks screener (2082 results) to focus on companies consistently delivering steady growth and experiencing less earnings volatility through every cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in trade, industry, and services business areas.

Good value with adequate balance sheet.

Market Insights

Community Narratives