- Sweden

- /

- Electrical

- /

- OM:SOLT

Investors Give SolTech Energy Sweden AB (publ) (STO:SOLT) Shares A 26% Hiding

Unfortunately for some shareholders, the SolTech Energy Sweden AB (publ) (STO:SOLT) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

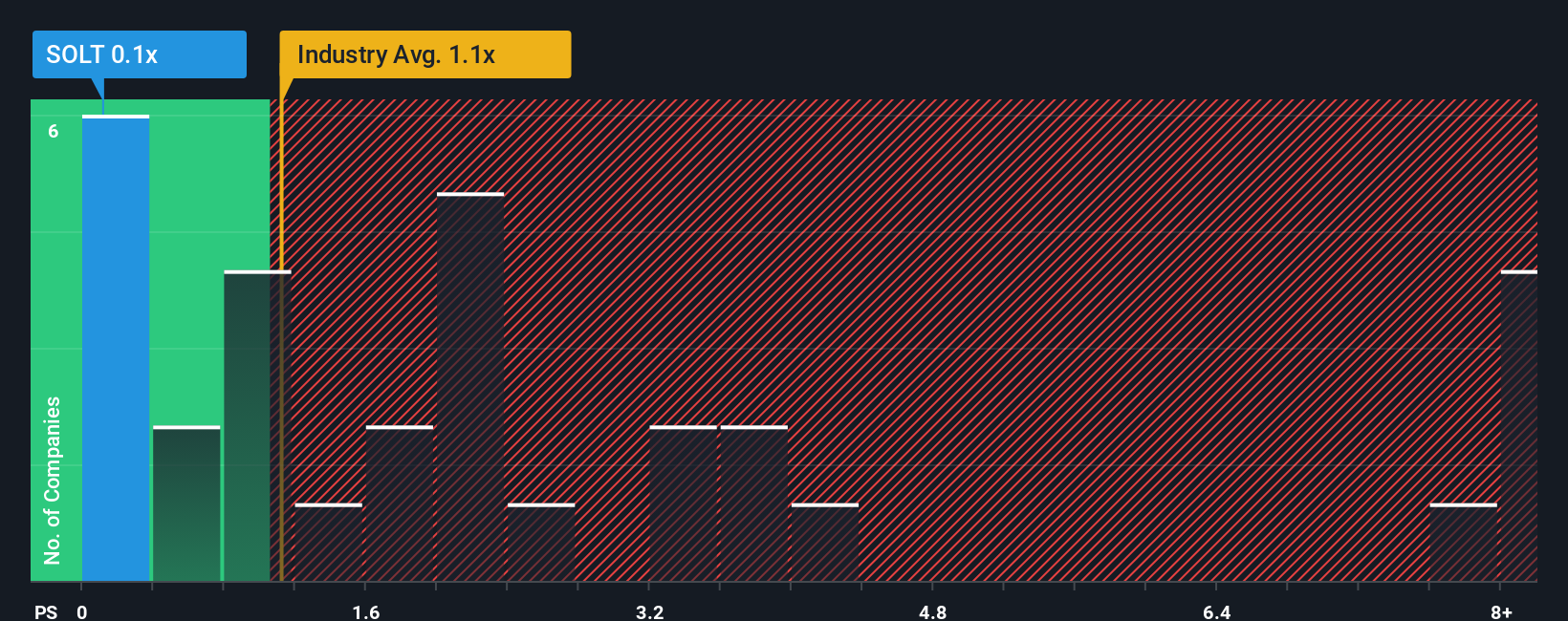

After such a large drop in price, SolTech Energy Sweden's price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Electrical industry in Sweden, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SolTech Energy Sweden

How Has SolTech Energy Sweden Performed Recently?

As an illustration, revenue has deteriorated at SolTech Energy Sweden over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on SolTech Energy Sweden will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SolTech Energy Sweden's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, SolTech Energy Sweden would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 118% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that SolTech Energy Sweden is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does SolTech Energy Sweden's P/S Mean For Investors?

Shares in SolTech Energy Sweden have plummeted and its P/S has followed suit. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of SolTech Energy Sweden revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for SolTech Energy Sweden you should be aware of, and 2 of them are concerning.

If these risks are making you reconsider your opinion on SolTech Energy Sweden, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SOLT

SolTech Energy Sweden

Develops, sells, and installs energy and solar cell solutions in Sweden and China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives