Stock Analysis

As global markets navigate through a landscape marked by fluctuating trade tensions and shifting economic indicators, Sweden's market remains a focal point for investors seeking stability through dividend stocks. In the context of current market dynamics, where value seems to be gaining an edge over growth, dividend-paying stocks could potentially offer both yield and a degree of safety in uncertain times.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.10% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.48% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.92% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.53% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.27% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.91% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.20% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.21% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.76% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.86% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top Swedish Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

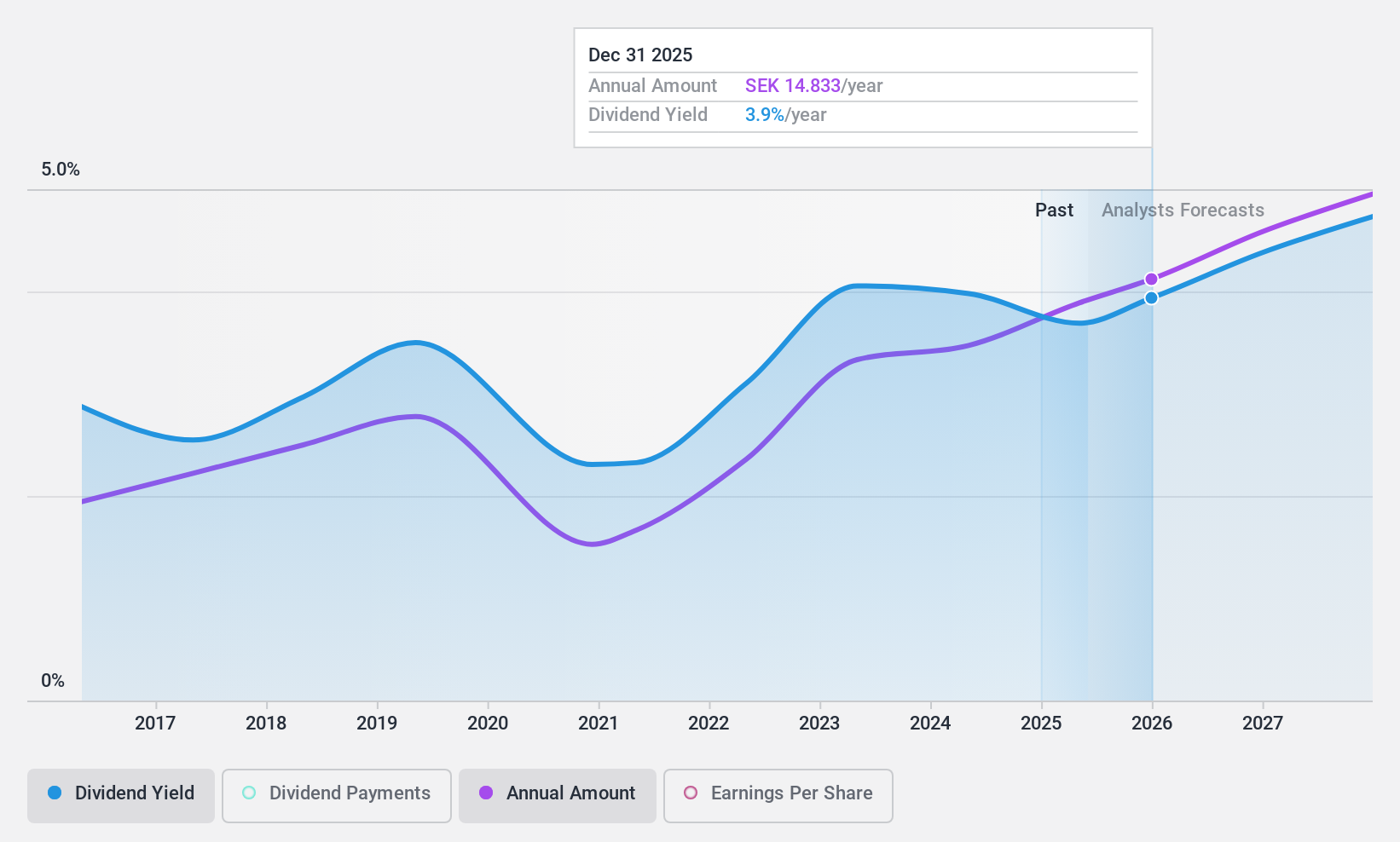

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB operates in providing comprehensive solutions for the handling, storage, distribution, payment processing, and recycling of cash and other valuables, with a market capitalization of approximately SEK 19.51 billion.

Operations: Loomis AB generates its revenue primarily through two segments: Europe and Latin America with SEK 13.86 billion, and the United States of America with SEK 15.17 billion, alongside a smaller contribution from Loomis Pay amounting to SEK 61 million.

Dividend Yield: 4.5%

Loomis AB, a Swedish firm, recently increased its dividend to SEK 12.50 per share, demonstrating a commitment to shareholder returns despite a dip in net income from SEK 403 million to SEK 359 million in Q1 2024. The company also initiated a share repurchase program, buying back shares worth SEK 200.13 million. While Loomis has a history of volatile dividends, current payouts are well-supported by earnings with a payout ratio of 61.2% and cash flows with a cash payout ratio of 32.4%.

- Navigate through the intricacies of Loomis with our comprehensive dividend report here.

- The analysis detailed in our Loomis valuation report hints at an deflated share price compared to its estimated value.

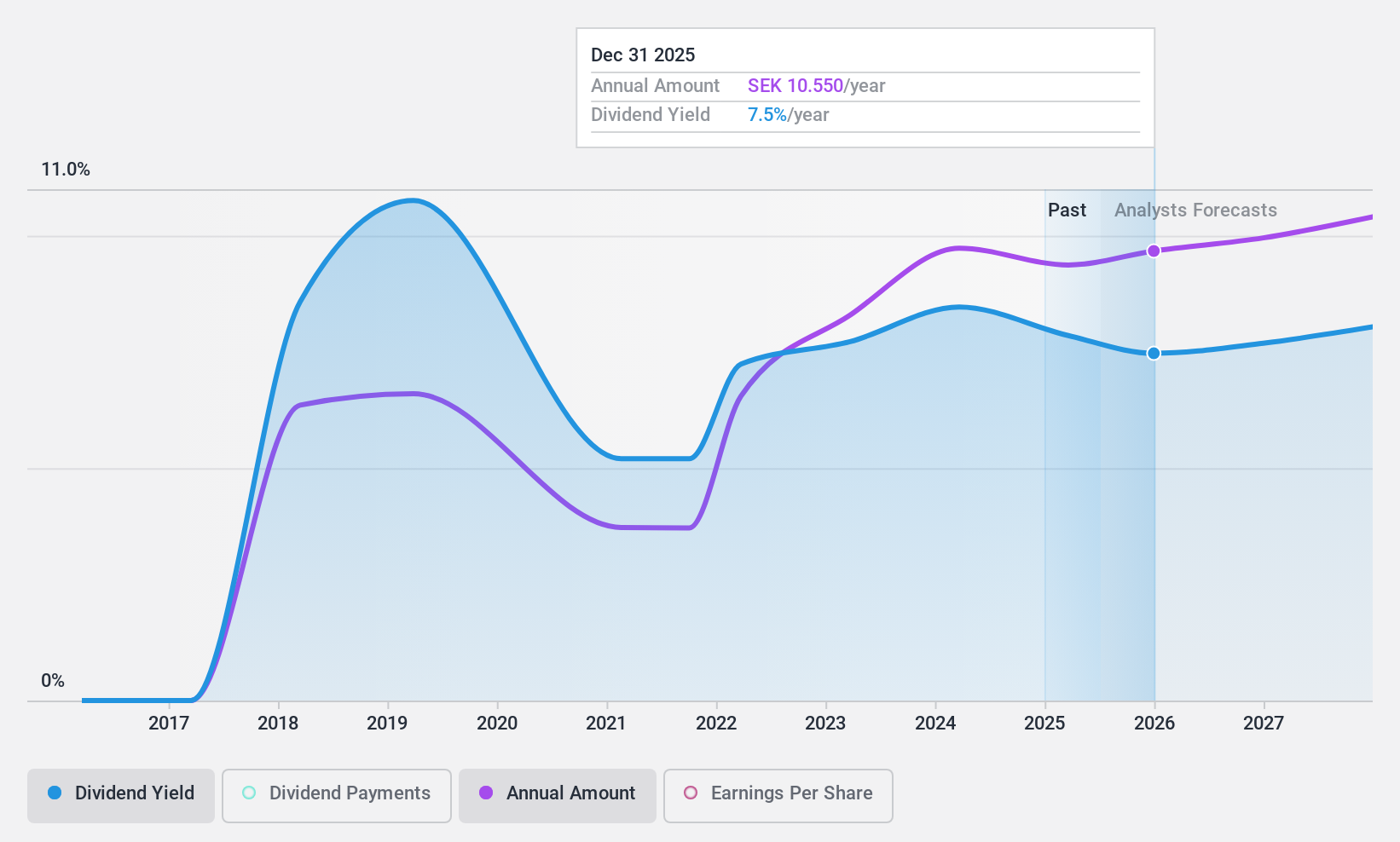

Nordea Bank Abp (OM:NDA SE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nordea Bank Abp is a financial services group providing banking products and services across Sweden, Finland, Norway, Denmark, and internationally, with a market capitalization of approximately SEK 440.70 billion.

Operations: Nordea Bank Abp generates revenue through various segments including Business Banking (€3.59 billion), Personal Banking (€4.78 billion), Asset and Wealth Management (€1.44 billion), and Large Corporates & Institutions (€2.48 billion).

Dividend Yield: 8.5%

Nordea Bank Abp's recent earnings show a slight decline in net income from EUR 1.335 billion to EUR 1.303 billion for Q2 2024, maintaining stable EPS at EUR 0.37. Over the past five years, earnings have grown by an average of 24.6% annually. Dividends are currently well-covered by earnings with a payout ratio of 63.8%, and this coverage is expected to remain adequate in three years at a forecasted payout ratio of 68.4%. However, the bank faces legal challenges with upcoming court proceedings in Denmark related to past anti-money laundering practices, although it has provisioned adequately for potential fines according to its assessments supported by external legal opinions.

- Unlock comprehensive insights into our analysis of Nordea Bank Abp stock in this dividend report.

- In light of our recent valuation report, it seems possible that Nordea Bank Abp is trading behind its estimated value.

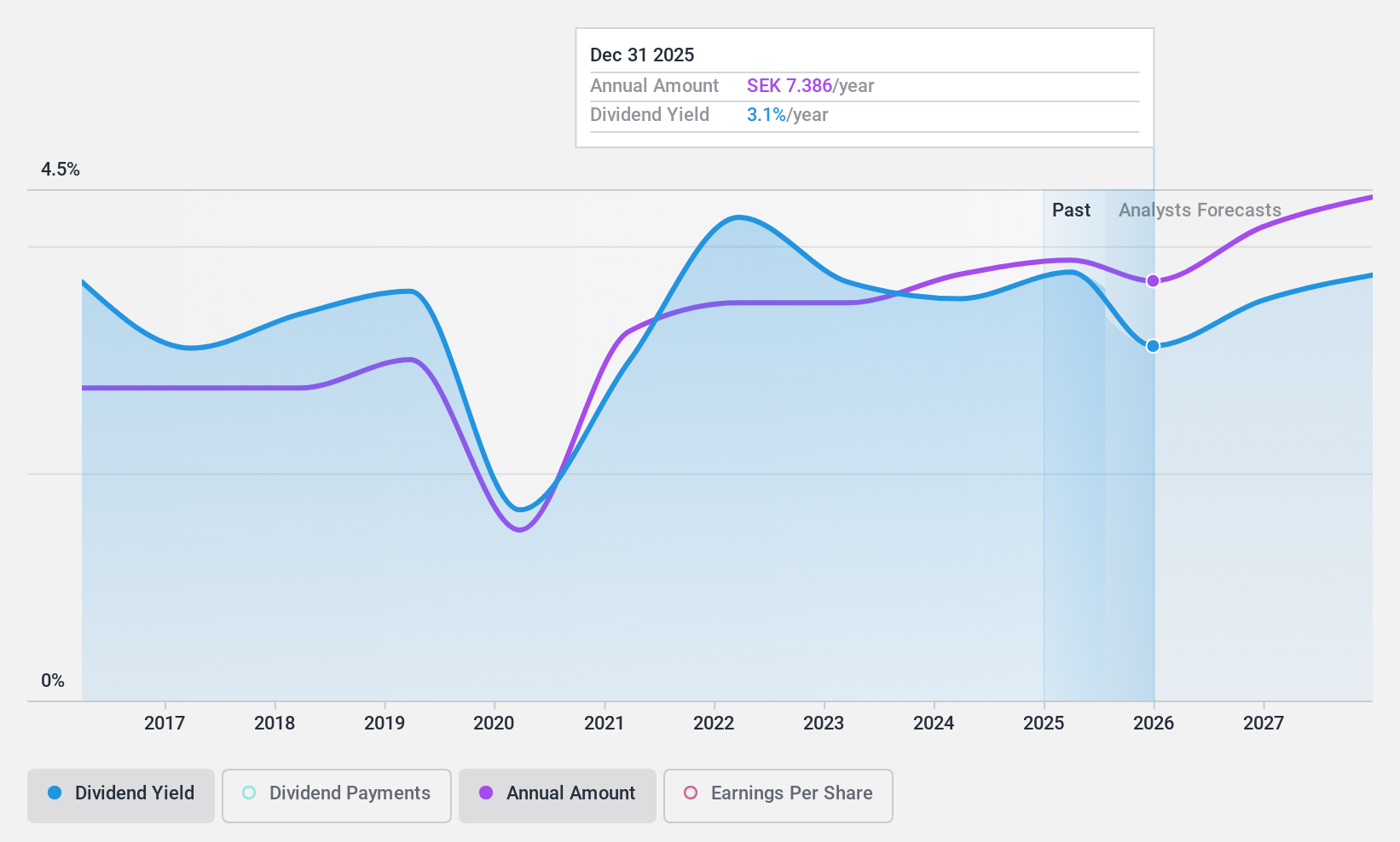

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global manufacturer and supplier of bearings, seals, lubrication systems, and related services with a market capitalization of approximately SEK 92.07 billion.

Operations: AB SKF generates SEK 29.44 billion from its Automotive segment and SEK 71.08 billion from its Industrial segment in revenue.

Dividend Yield: 3.7%

AB SKF's recent earnings reveal a decline in sales and net income in the first half of 2024, with expectations for continued low single-digit organic sales declines. Despite this, SKF maintains a cash payout ratio of 53.6%, suggesting dividends are covered by cash flows, though its dividend track record has been inconsistent over the past decade. Additionally, SKF is innovating with eco-friendly steel production in bearings, potentially enhancing its market reputation and long-term sustainability.

- Dive into the specifics of AB SKF here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that AB SKF is priced lower than what may be justified by its financials.

Make It Happen

- Delve into our full catalog of 19 Top Swedish Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Nordea Bank Abp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NDA SE

Nordea Bank Abp

Offers banking products and services in Sweden, Finland, Norway, Denmark, and internationally.

Flawless balance sheet, undervalued and pays a dividend.