As global markets navigate through varying economic signals, Sweden's market remains a focal point for investors seeking stability and potential growth through dividend stocks. Amidst this backdrop, understanding the characteristics that define a strong dividend stock is crucial, especially in a market environment marked by political shifts and economic adjustments across Europe.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.59% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.57% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.16% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.38% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.26% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.43% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.98% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.37% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.60% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

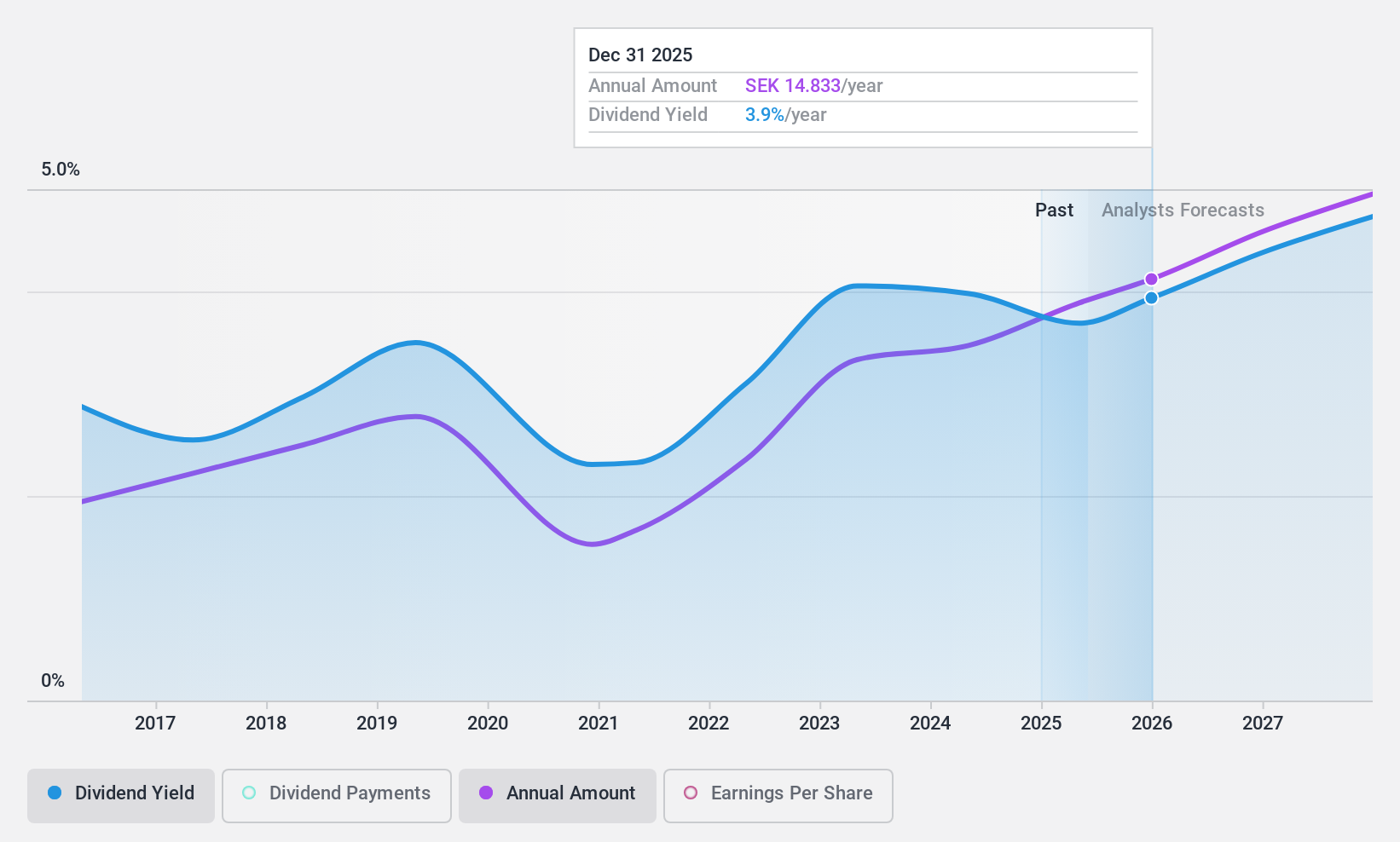

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB specializes in offering comprehensive services for the distribution, handling, storage, recycling of cash and other valuables, with a market capitalization of approximately SEK 19.11 billion.

Operations: Loomis AB generates its revenue primarily through services in Europe and Latin America, totaling SEK 13.86 billion, and in the United States of America, with revenues amounting to SEK 15.17 billion, alongside a smaller segment from Loomis Pay at SEK 61 million.

Dividend Yield: 4.6%

Loomis AB, a notable player in the Swedish market, recently increased its dividend to SEK 12.50 per share, reflecting a commitment to shareholder returns despite its earnings dip in Q1 2024 with net income falling to SEK 359 million from SEK 403 million year-over-year. The company also launched a share repurchase program, buying back shares worth SEK 200 million. While Loomis's dividend yield of 4.57% stands above the market average and dividends are well-covered by both earnings and cash flow (payout ratio: 61.2%, cash payout ratio: 32.4%), the dividend track record over the past decade has been unstable and unreliable, indicating potential risks for long-term dividend sustainability.

- Unlock comprehensive insights into our analysis of Loomis stock in this dividend report.

- Our expertly prepared valuation report Loomis implies its share price may be lower than expected.

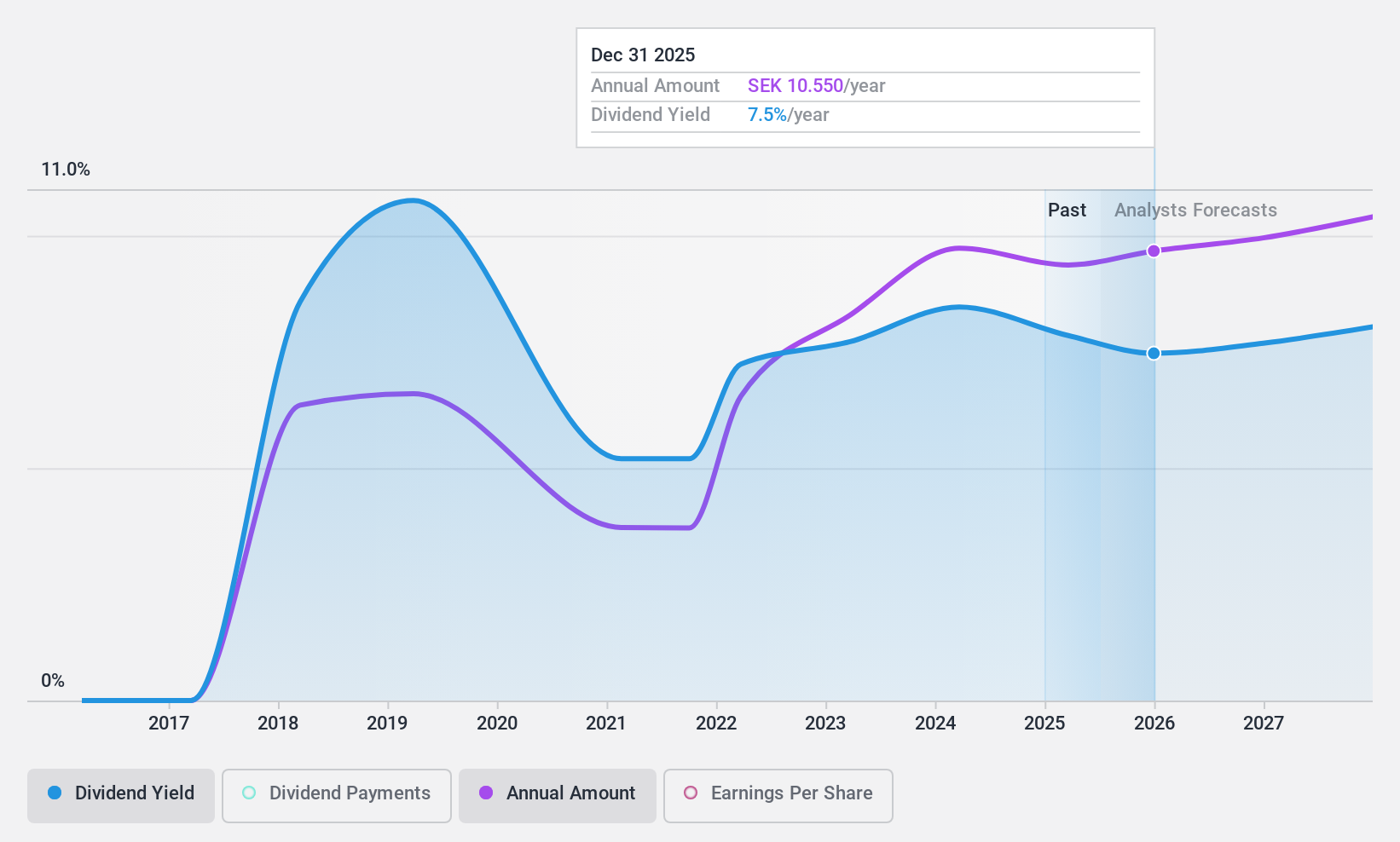

Nordea Bank Abp (OM:NDA SE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nordea Bank Abp is a financial services provider operating in Sweden, Finland, Norway, Denmark, and internationally, with a market capitalization of approximately SEK 443.01 billion.

Operations: Nordea Bank Abp generates revenue from various segments, including Business Banking (€3.55 billion), Personal Banking (€4.75 billion), Asset and Wealth Management (€1.44 billion), and Large Corporates & Institutions (€2.46 billion).

Dividend Yield: 8.3%

Nordea Bank Abp's dividend yield of 8.26% ranks in the top quartile within Sweden, supported by a payout ratio of 63.8%. Despite this attractive yield, the bank's dividends have shown volatility over the past decade, lacking consistency in growth and stability. Recent financials show a robust year-on-year increase in net income to €1.36 billion for Q1 2024 from €1.15 billion, underpinning current dividend payments. However, earnings are projected to decline annually by 2.5% over the next three years, raising concerns about future dividend sustainability amidst its recent fixed-income offerings totaling €747.81 million aimed at bolstering green initiatives.

- Delve into the full analysis dividend report here for a deeper understanding of Nordea Bank Abp.

- Our valuation report here indicates Nordea Bank Abp may be undervalued.

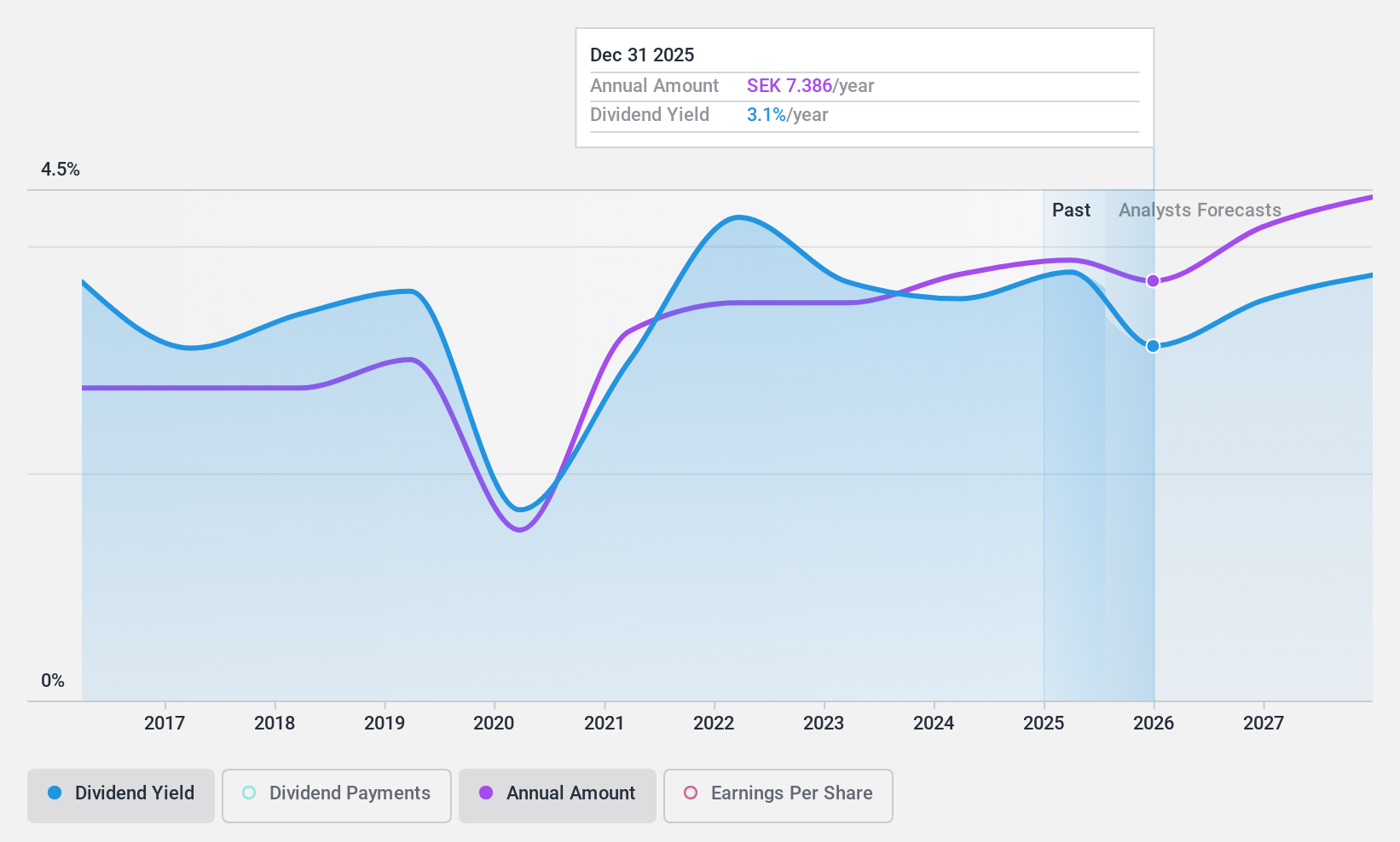

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global manufacturer and supplier of bearings, seals, lubrication systems, and related services with a market capitalization of approximately SEK 96.09 billion.

Operations: AB SKF generates revenue primarily through two segments: the Automotive segment, which brought in SEK 29.79 billion, and the Industrial segment, with revenues of SEK 72.25 billion.

Dividend Yield: 3.6%

AB SKF, recently added to the OMX Nordic 40 Index, offers a modest dividend yield of 3.55%, below the top quartile in Sweden. Despite a decade of increasing dividends, payments have been volatile and unreliable. The company's dividend sustainability is questionable with an unstable track record, although currently supported by a payout ratio of 55% and cash payout ratio of 45.2%. Recent innovations may boost performance but Q1 2024 saw earnings drop to SEK 1,888 million from SEK 2,073 million year-over-year amidst challenging currency impacts forecasted to negatively affect upcoming profits by approximately SEK 200 million.

- Dive into the specifics of AB SKF here with our thorough dividend report.

- Upon reviewing our latest valuation report, AB SKF's share price might be too pessimistic.

Turning Ideas Into Actions

- Delve into our full catalog of 23 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordea Bank Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NDA SE

Nordea Bank Abp

Offers banking products and services in Sweden, Finland, Norway, Denmark, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.