- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

Why Saab (OM:SAAB B) Is Up 13.1% After Raising 2025 Guidance and Securing Major Defense Deals

Reviewed by Sasha Jovanovic

- Earlier this month, Saab AB reported strong third quarter results, raised its 2025 full-year sales growth guidance to between 20% and 24%, and shared multiple new client orders, including a SEK9.6 billion submarine contract and a SEK2.6 billion fighter system study for Sweden.

- Additionally, Saab is positioning for future growth, noting a strong balance sheet with SEK12.2 billion in cash and liquid investments and the formation of a new Group Strategy and Technology division to focus on technology, acquisitions, and partnerships.

- We'll explore how Saab's upgraded earnings outlook and focus on acquisitions influence its investment narrative and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Saab Investment Narrative Recap

To be a shareholder in Saab today, you need to believe in enduring global demand for advanced defense technologies and the company’s ability to convert a robust order backlog into profitable growth. The latest news, upgraded sales guidance, new mega-contracts, and a focus on technology-driven expansion, strengthens the short-term outlook, supporting strong execution as the key catalyst while heightening attention to geopolitical and budget-driven revenue risks; these updates meaningfully reinforce, rather than change, the current narrative.

One recent announcement that stands out is Saab's SEK9.6 billion submarine production contract for the Swedish Navy. This major order not only boosts the already substantial backlog but closely aligns with increased European defense spending and technology priorities, directly supporting momentum in the company's growth catalysts.

Yet, while the sales pipeline looks healthier than ever, investors should also be mindful of how dependent Saab remains on political decisions in key markets if...

Read the full narrative on Saab (it's free!)

Saab's outlook anticipates SEK112.3 billion in revenue and SEK9.8 billion in earnings by 2028. This is based on annual revenue growth of 17.1% and reflects a SEK4.6 billion increase in earnings from SEK5.2 billion today.

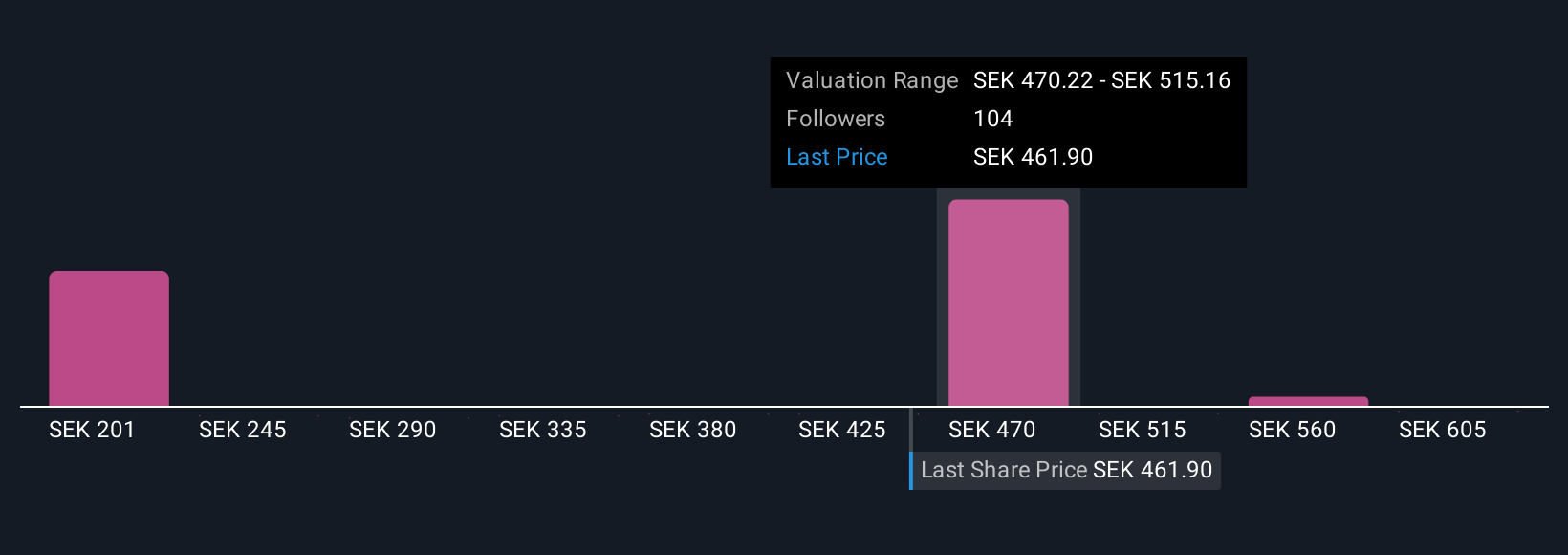

Uncover how Saab's forecasts yield a SEK473.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Twelve retail investors in the Simply Wall St Community estimated Saab’s fair value between SEK413 and SEK641, reflecting broad opinion on both potential upside and risk. Keep in mind, political and budget sensitivity remains crucial for the company’s outlook, review these diverging views to get the full picture.

Explore 12 other fair value estimates on Saab - why the stock might be worth 21% less than the current price!

Build Your Own Saab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saab research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Saab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saab's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives