- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

Did Major European Defense Orders Just Shift Saab's (OM:SAAB B) Investment Narrative?

Reviewed by Sasha Jovanovic

- Saab recently announced two major defense contracts: a SEK 510 million deal with the Danish Ministry of Defence for the Carl-Gustaf M4 weapon system, and a nearly SEK 1 billion order from the Swedish Defence Materiel Agency for new Gripen aircraft launch systems, with deliveries scheduled between 2026 and 2028.

- These high-value orders highlight the continuing demand for Saab’s advanced weaponry and aerospace solutions as European nations prioritize defense modernization and self-reliance.

- We’ll examine how these sizeable contract wins reinforce Saab’s positioning as a preferred supplier amid Europe’s focus on next-generation military capabilities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Saab Investment Narrative Recap

For investors interested in Saab, the core thesis rests on the industry's strong defense spending trends, long-term order visibility, and Saab's role as a leading supplier for European modernization efforts. While the recent SEK 1.5 billion in new contracts further strengthens the company’s backlog, it does not materially shift the greatest short-term catalyst, the ongoing ramp-up in European and NATO-aligned defense budgets. However, the company’s continued reliance on a concentrated set of government buyers remains the largest risk, with contract wins vulnerable to changing political or budget priorities.

Among the recent company updates, Saab’s SEK 9.6 billion submarine order from the Swedish Defence Materiel Administration stands out as most relevant. This significant contract supports the ongoing catalyst of heightened demand for locally produced, next-generation defense solutions across Europe, positioning Saab to benefit from future defense budget allocations.

But even as incoming orders may support visibility, investors should also consider the risk if defense spending priorities suddenly shift or new export controls are imposed on...

Read the full narrative on Saab (it's free!)

Saab's narrative projects SEK112.3 billion in revenue and SEK9.8 billion in earnings by 2028. This requires 17.1% yearly revenue growth and an increase of SEK4.6 billion in earnings from the current SEK5.2 billion.

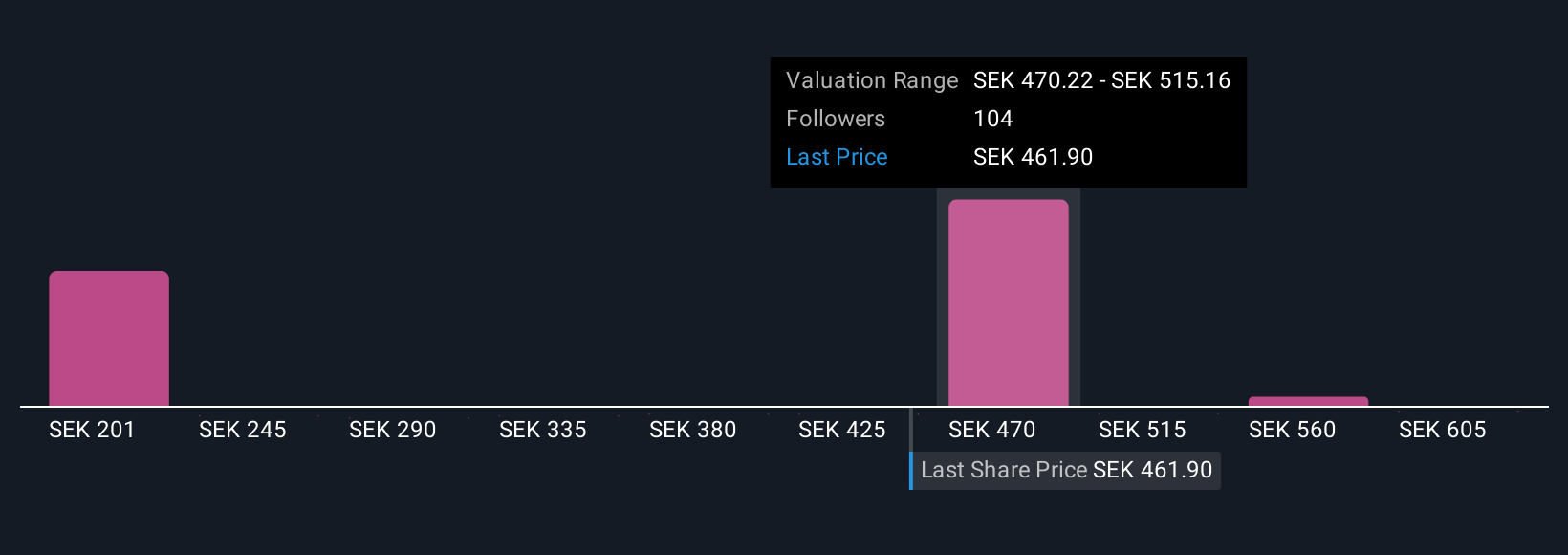

Uncover how Saab's forecasts yield a SEK481.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published 15 fair value estimates for Saab, ranging from SEK 259.14 to SEK 640.61 per share. Despite this wide spread, growing order intake from defense contracts remains central to the company’s outlook, and alternative community perspectives provide valuable food for thought.

Explore 15 other fair value estimates on Saab - why the stock might be worth less than half the current price!

Build Your Own Saab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saab research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Saab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saab's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives