- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

A Look at Saab (OM:SAAB B) Valuation Following Major Defense Contracts and Global Expansion

Reviewed by Simply Wall St

Saab (OM:SAAB B) has attracted attention with a string of significant wins recently, including a SEK 2.1 billion order for Swedish air defence systems and a EUR 3.1 billion fighter jet contract with Colombia. These developments highlight Saab’s growing footprint in global defense.

See our latest analysis for Saab.

Saab’s major contract wins, including a substantial air defence deal in Sweden and new partnerships in Colombia and Germany, have helped fuel strong momentum in its shares. The 2024 year-to-date share price return is up an impressive 102%, capping off a three-year total shareholder return of 394%. This reflects both the company’s growth pipeline and shifting sentiment toward defense stocks.

If global defense demand has you watching Saab, it’s a smart move to explore the broader sector. See all the aerospace and defense standouts in our curated selection: See the full list for free.

With so much positive news already reflected in a share price that has more than doubled this year, investors are left to wonder if there is still a buying opportunity here or if future growth is already priced in.

Most Popular Narrative: 2.2% Undervalued

Saab’s widely followed narrative suggests that its fair value estimate stands just above the latest closing price, reflecting strong optimism for continued growth. The market seems to recognize major contract wins and rising sector tailwinds. However, further upside might depend on surpassing ambitious forecasts.

The significant ramp-up in global defense spending, especially following the recent NATO commitment for member states to target 5% of GDP by 2030-2035, directly supports sustained demand for Saab's advanced defense solutions. Saab's strong backlog (~SEK 200 billion) and rising book-to-bill ratio position it to benefit from this long-duration trend, likely driving outsized topline growth over the next several years.

Want to uncover the assumptions propelling this ambitious fair value? The narrative mixes rising sector demand, hi-tech contract wins, and bold growth forecasts. Some aggressive margin and earnings bets are hiding in the math. Click in to see what quantifies these sky-high expectations.

Result: Fair Value of $481 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Saab’s reliance on government contracts and the risk of tightening export controls could quickly change the outlook if conditions shift.

Find out about the key risks to this Saab narrative.

Another View: What Do Multiples Say?

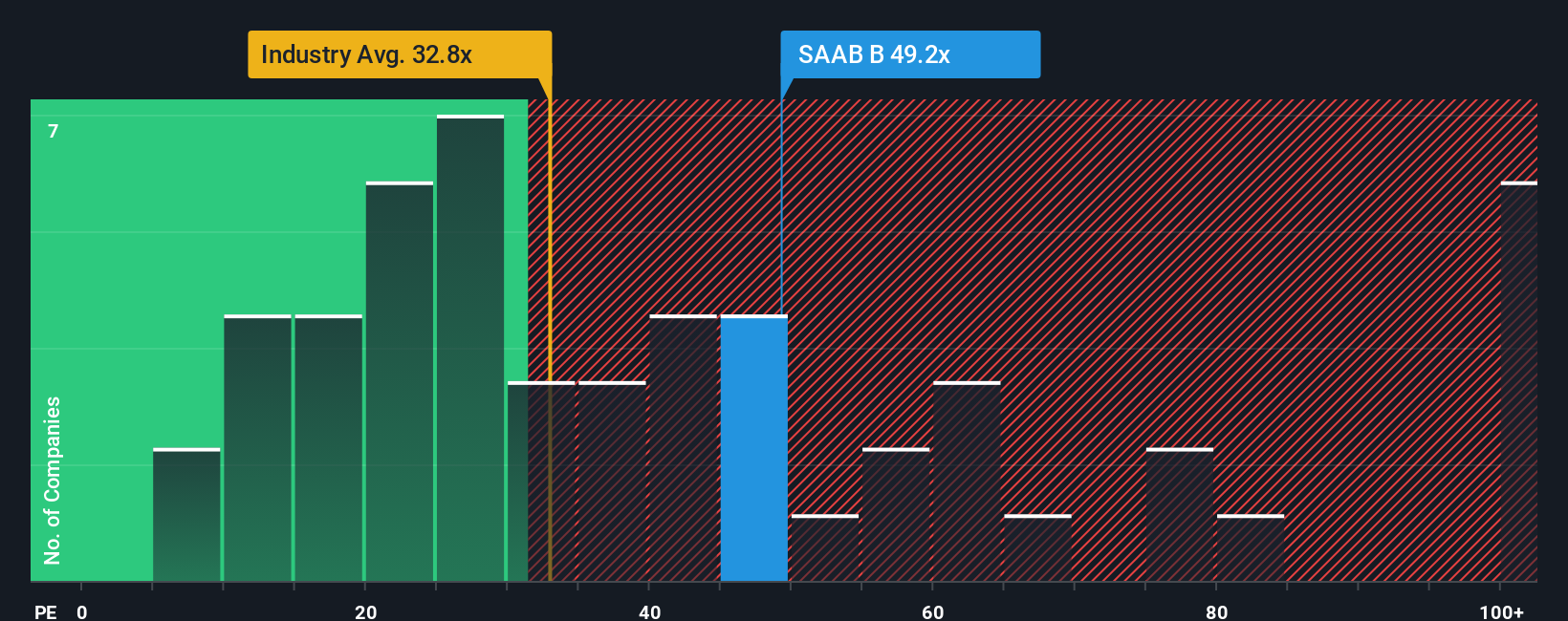

Looking through the lens of price-to-earnings, Saab trades at 48.7x earnings, above both its European industry peers (31.9x) and the fair ratio estimate of 44x. This notable gap suggests investors are paying a premium for growth, adding risk if expectations fall short. Does this multiple leave room for upside, or is it warning of limited potential ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saab Narrative

Prefer a hands-on approach? Dive into the numbers and build your own perspective on Saab. The process takes just minutes. Do it your way

A great starting point for your Saab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Uncover breakthrough stocks and unlock fresh potential in high-growth sectors before the crowd jumps in. Here are some handpicked ideas you won't want to miss:

- Tap into future-defining technology by checking out these 25 AI penny stocks with strong momentum in artificial intelligence and automation advancements.

- Kickstart your search for under-the-radar value by spotting overlooked gems through these 927 undervalued stocks based on cash flows that show powerful upside based on cash flows.

- Catch income opportunities early and see which businesses are rewarding shareholders via these 15 dividend stocks with yields > 3% with attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success