- Sweden

- /

- Construction

- /

- OM:PEAB B

Peab (OM:PEAB B): Assessing Valuation Following Major Contract Wins Across Education, Infrastructure, and Housing

Reviewed by Simply Wall St

Peab (OM:PEAB B) recently landed three major contracts spanning education, infrastructure, and residential development, earning new projects with a combined value of over SEK 850 million. These wins highlight solid demand for Peab’s construction expertise.

See our latest analysis for Peab.

Momentum has started to shift for Peab, with several large contract wins lining up alongside a modest 1.5% share price gain over the past 90 days. While the 1-year total shareholder return still sits at -5.3%, the long-term 3-year figure is an impressive 43%. This suggests considerable value has been created for patient investors despite recent ups and downs.

If these new deals have you curious about where else growth and insider confidence are combining, it might be time to explore fast growing stocks with high insider ownership

The latest contract wins and improving growth figures raise a pivotal question for investors: Is Peab's current share price overlooking its future potential, or has the market already priced in the company’s next phase of expansion?

Price-to-Earnings of 13.2x: Is it justified?

Peab's shares are currently trading at a price-to-earnings (P/E) ratio of 13.2x, which positions the stock at a discount compared to both its industry peers and the broader European Construction sector.

The price-to-earnings ratio evaluates how much investors are paying for each krona of earnings and is a widely used measure for valuing construction companies where profit stability and forecasts can vary with project pipelines. A lower P/E could suggest undervaluation or caution around growth prospects, while a higher figure signals investor optimism regarding future earnings growth.

At 13.2x, Peab's P/E is notably below the European Construction industry average of 14.2x and even further below the peer group average of 20.2x. The market may be underappreciating Peab's potential for earnings improvement, especially as its fair P/E, estimated through valuation models, stands significantly higher at 25.6x. The market could move toward this level if growth accelerates as projected.

Explore the SWS fair ratio for Peab

Result: Price-to-Earnings of 13.2x (UNDERVALUED)

However, sluggish year-to-date performance and ongoing sector volatility could quickly challenge Peab’s discounted valuation narrative if growth momentum stalls.

Find out about the key risks to this Peab narrative.

Another View: DCF Signals Deeper Discount

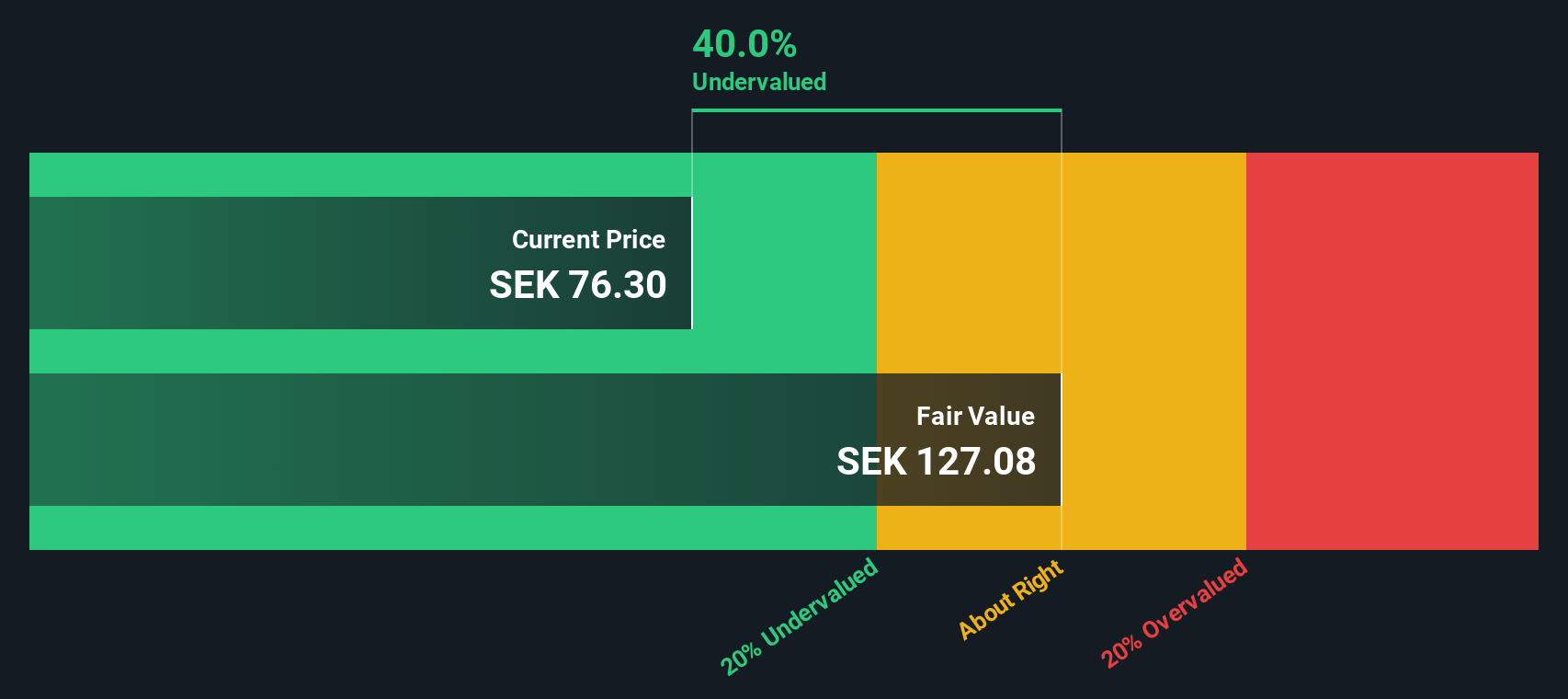

Taking a different approach, our DCF model places Peab's fair value at SEK126.42, which is well above today’s market price of SEK76.4. That represents a discount of nearly 40%, suggesting the shares could be meaningfully undervalued if the model’s assumptions play out. Will the market eventually close this gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Peab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Peab Narrative

If you see the story differently or want to test your own assumptions, our platform lets you build a personal take on Peab’s outlook in just a few minutes. Do it your way

A great starting point for your Peab research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Find Your Next Winning Stock?

Smart investors know that breaking out of the ordinary can uncover real opportunities. Don’t let the market’s best ideas pass you by. Step ahead with these expert-backed picks.

- Capture stable income streams by checking out these 15 dividend stocks with yields > 3% with consistently high yields to strengthen your portfolio’s cash flow.

- Tap into medical breakthroughs with these 31 healthcare AI stocks advancing diagnostics, personalized medicine, and healthcare innovation.

- Ride the momentum of digital transformation by targeting these 27 AI penny stocks fueling progress in automation and smart technology worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PEAB B

Peab

Operates as a construction and civil engineering company in Sweden, Norway, Finland, Denmark, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives