- Sweden

- /

- Construction

- /

- OM:PEAB B

One-Off Gain of SEK 431 Million Drives Peab (OM:PEAB B) Earnings, Raising Sustainability Questions

Reviewed by Simply Wall St

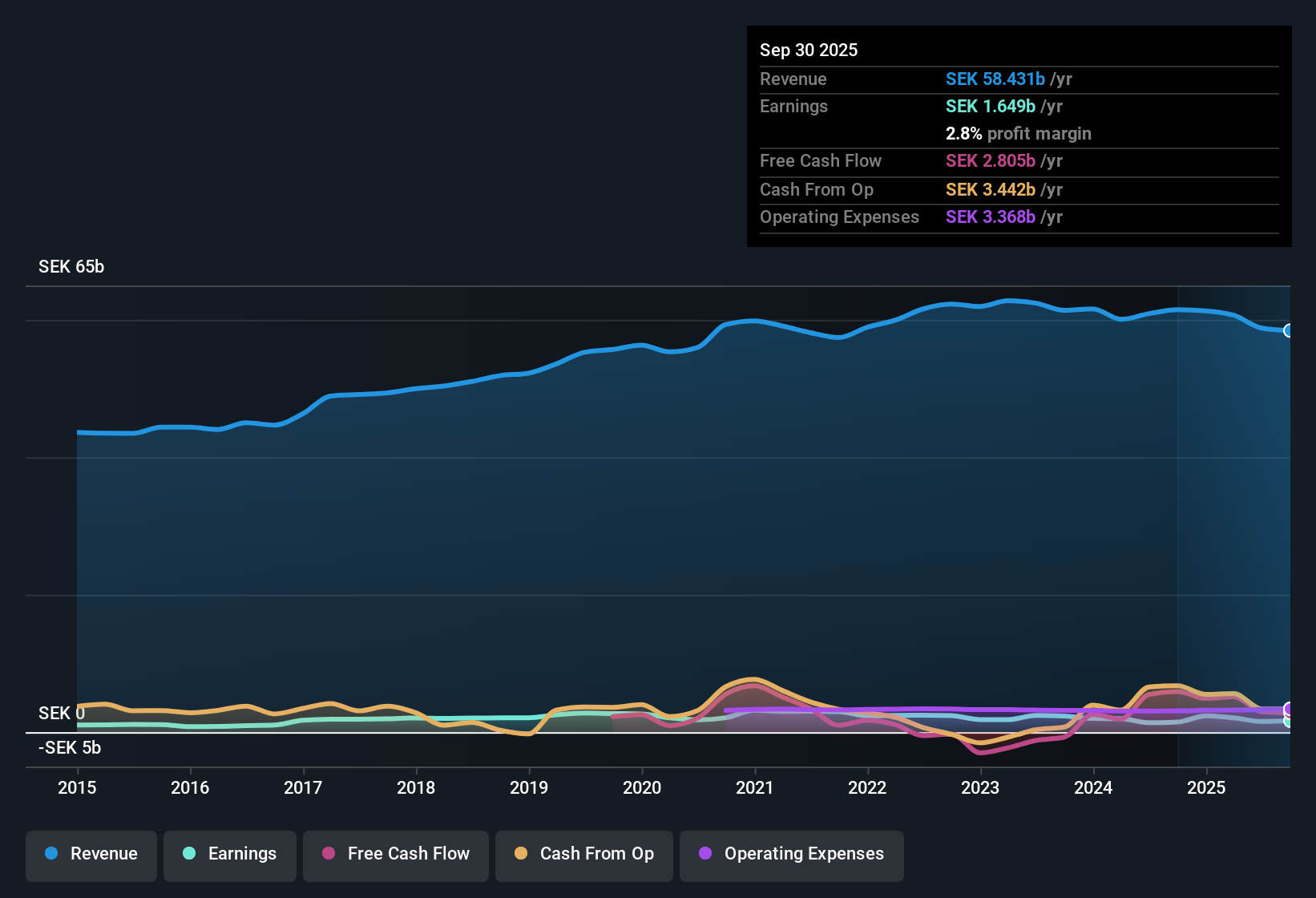

PEAB B (OM:PEAB B) is forecasting earnings growth of 22.78% per year and revenue growth of 4.9% per year, both ahead of the Swedish market averages of 12.6% and 3.9% respectively. Improved profit margins, up to 2.6% from 2.3% last year, accompany a positive shift in the company’s earnings trajectory, with annual growth of 13% replacing a prior five-year decline of 11.2% per year. The current share price of SEK 77.15 trades at a discount to the estimated fair value of SEK 144.71. However, the latest financials are impacted by a sizable one-off gain of SEK 431.0 million.

See our full analysis for Peab.Next, we will set PEAB B’s results against key community narratives from Simply Wall St to see where the story is confirmed, and where the earnings might raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain of SEK 431 Million Lifts Reported Profit

- The latest period includes a significant non-recurring gain of SEK 431.0 million, which has a clear impact on the reported profit and affects the assessment of underlying earnings quality.

- Recent profit improvement, while eye-catching, invites scrutiny:

- The large one-off makes it more difficult to evaluate how sustainable the new higher profit margins or growth rate actually are.

- It is notable that despite this boost, financial risk flags remain regarding the sustainability and quality of earnings in the core business.

Margins Expand to 2.6%, Reversing Multi-Year Downtrend

- Profit margins have climbed to 2.6%, up from 2.3% last year, ending a previous period of annual earnings decline that averaged 11.2% over five years.

- The shift in earnings trajectory points to renewed momentum:

- Forecasted annual earnings growth of 22.78% now significantly outpaces both the Swedish market average and Peab’s own past performance.

- This margin recovery supports a more optimistic view that Peab’s operational strengths are beginning to translate into real bottom-line improvement.

Trading at a Steep Discount to DCF Fair Value

- At a current share price of SEK 77.15, Peab B trades well below its DCF fair value of SEK 144.71, leaving a significant valuation gap relative to both peers and intrinsic worth.

- The prevailing analysis suggests:

- The Price-To-Earnings Ratio of 14.3x is below the European construction industry average of 14.5x and is considerably lower than the peer average of 20.7x.

- While investors may benefit from the discounted valuation and growth forecasts, risk flags around the sustainability of profit flows mean this discount could remain until earnings quality is demonstrated.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Peab's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite a rebound in margins, Peab B’s underlying earnings reliability remains questionable because of one-off gains and persistent concerns about sustainable profit quality.

If you want steadier performance with fewer earnings surprises, consider companies showing consistent revenue and profit growth by starting your search with stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PEAB B

Peab

Operates as a construction and civil engineering company in Sweden, Norway, Finland, Denmark, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives