- Sweden

- /

- Construction

- /

- OM:PEAB B

A Look at Peab (OM:PEAB B) Valuation Following Major New Project Wins in Sweden

Reviewed by Simply Wall St

Peab (OM:PEAB B) has just added several sizable contracts to its pipeline. These include a waterworks upgrade in Eskilstuna, a retirement home in Falun, and a sustainability-driven civil engineering project in Stockholm.

See our latest analysis for Peab.

It is no surprise that confidence is picking up around Peab, with several large contracts highlighting its robust outlook. The company’s recent news follows a steady share price climb, posting a 7.99% return over the last 90 days and contributing to a one-year total shareholder return of 3.01%. Momentum has been building gradually, indicating renewed growth expectations as Peab’s project wins bolster its reputation and resilience.

If these new contracts have you interested in what other companies are making moves, now’s a good time to discover fast growing stocks with high insider ownership

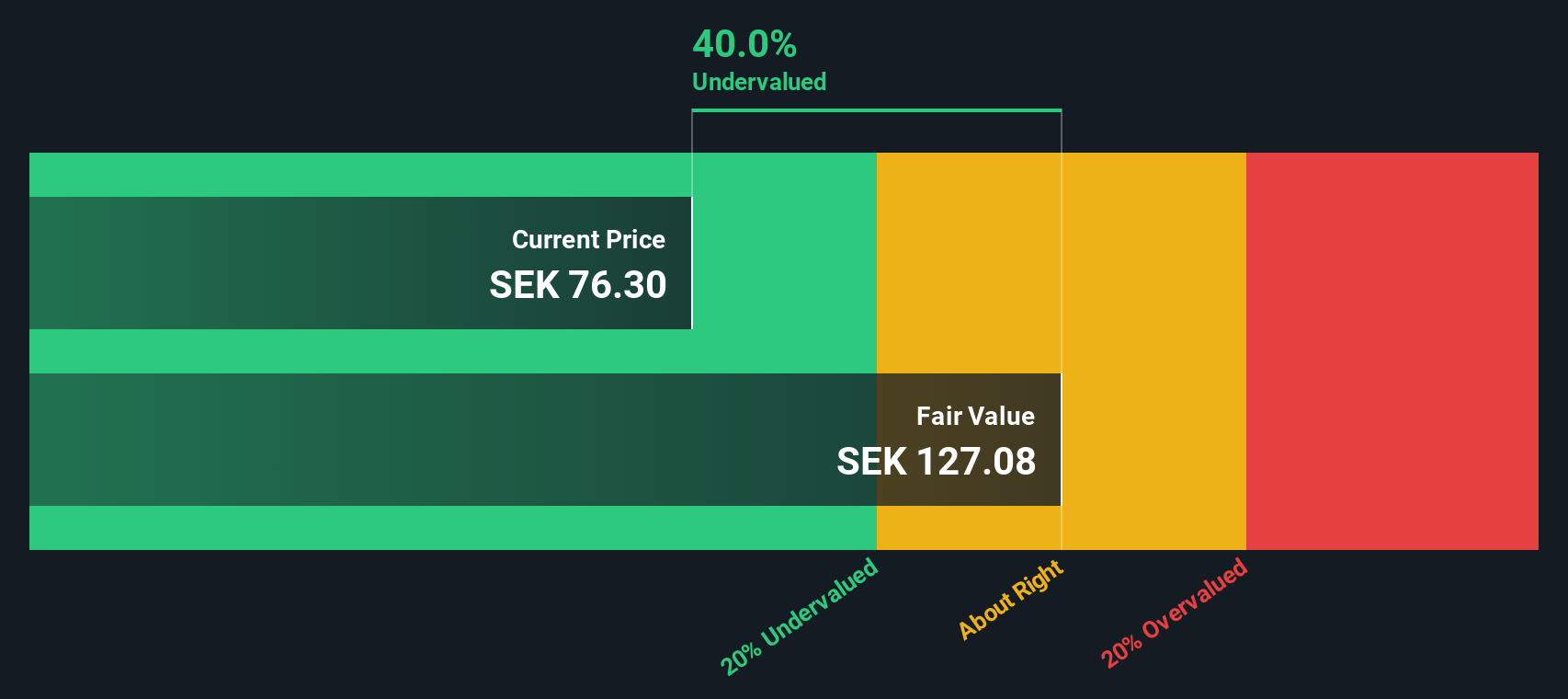

Yet with shares up nearly 8% in the past quarter and trading at a meaningful discount to analyst targets, investors may wonder if Peab’s stock is undervalued, or if the market has already priced in the company’s next growth phase.

Price-to-Earnings of 13.8x: Is it justified?

Peab’s shares recently closed at SEK79.7, placing its price-to-earnings (PE) ratio at 13.8x. This is below both the industry average and peer levels, suggesting that the market could be undervaluing the company’s potential earnings growth.

The price-to-earnings ratio measures how much investors are willing to pay today for each Swedish krona of Peab’s future earnings. It is a key indicator for comparing valuation across companies in the construction sector, where stable and predictable earnings are highly valued.

At 13.8x, Peab trades at a discount to the European Construction industry average of 14.5x and shows a notable gap from the peer average of 20.1x. Our analysis also suggests this discount becomes even more pronounced when compared to the fair price-to-earnings ratio of 25x. The market could move toward such a level if growth projections and profitability trends develop as forecast.

Explore the SWS fair ratio for Peab

Result: Price-to-Earnings of 13.8x (UNDERVALUED)

However, unexpected challenges in project execution or weaker profitability trends could quickly dampen investor optimism and stall Peab’s upward momentum.

Find out about the key risks to this Peab narrative.

Another Perspective: What Does Our DCF Model Suggest?

Our SWS DCF model offers a second angle. It estimates Peab’s fair value at SEK129.15 per share, which is far above its current price. By projecting future cash flows, this approach points to a company trading at a significant discount. However, is the market missing something, or are expectations too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Peab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Peab Narrative

If you have a different take or prefer to investigate on your own, you can shape your own perspective on Peab in just a few minutes with Do it your way.

A great starting point for your Peab research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your opportunity set. Let the Simply Wall Street Screener help you spot investments you might otherwise miss. Bold moves start with the right insights.

- Uncover high-yield potential by tapping into these 15 dividend stocks with yields > 3% which offers reliable returns with impressive dividend yields above 3%.

- Strengthen your watchlist with these 30 healthcare AI stocks, showcasing companies harnessing AI to revolutionize patient care and medical innovation.

- Seize value opportunities with these 914 undervalued stocks based on cash flows that are currently trading below their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PEAB B

Peab

Operates as a construction and civil engineering company in Sweden, Norway, Finland, Denmark, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026