- Sweden

- /

- Construction

- /

- OM:NORB B

Investors Appear Satisfied With Nordisk Bergteknik AB (publ)'s (STO:NORB B) Prospects As Shares Rocket 28%

The Nordisk Bergteknik AB (publ) (STO:NORB B) share price has done very well over the last month, posting an excellent gain of 28%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

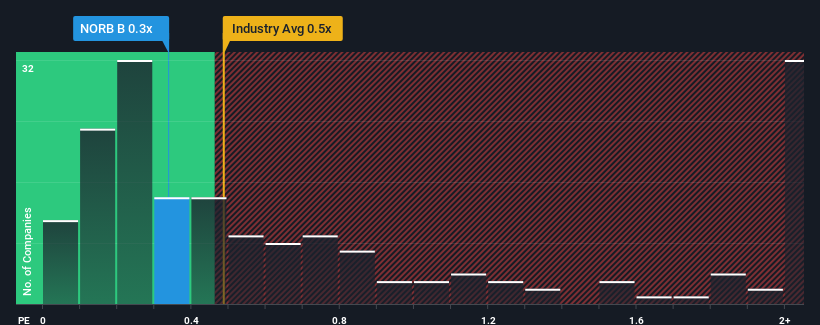

In spite of the firm bounce in price, it's still not a stretch to say that Nordisk Bergteknik's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Construction industry in Sweden, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nordisk Bergteknik

What Does Nordisk Bergteknik's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Nordisk Bergteknik's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Nordisk Bergteknik's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nordisk Bergteknik's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nordisk Bergteknik's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 196% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.9% as estimated by the two analysts watching the company. With the industry predicted to deliver 8.0% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Nordisk Bergteknik's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Nordisk Bergteknik's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Nordisk Bergteknik maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you settle on your opinion, we've discovered 3 warning signs for Nordisk Bergteknik (1 is a bit unpleasant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nordisk Bergteknik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NORB B

Nordisk Bergteknik

Provides rock handling and foundation solutions in Sweden, Norway, Finland, and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives