- Sweden

- /

- Industrials

- /

- OM:NOLA B

How Stronger Earnings Amid Softer Sales at Nolato (OM:NOLA B) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

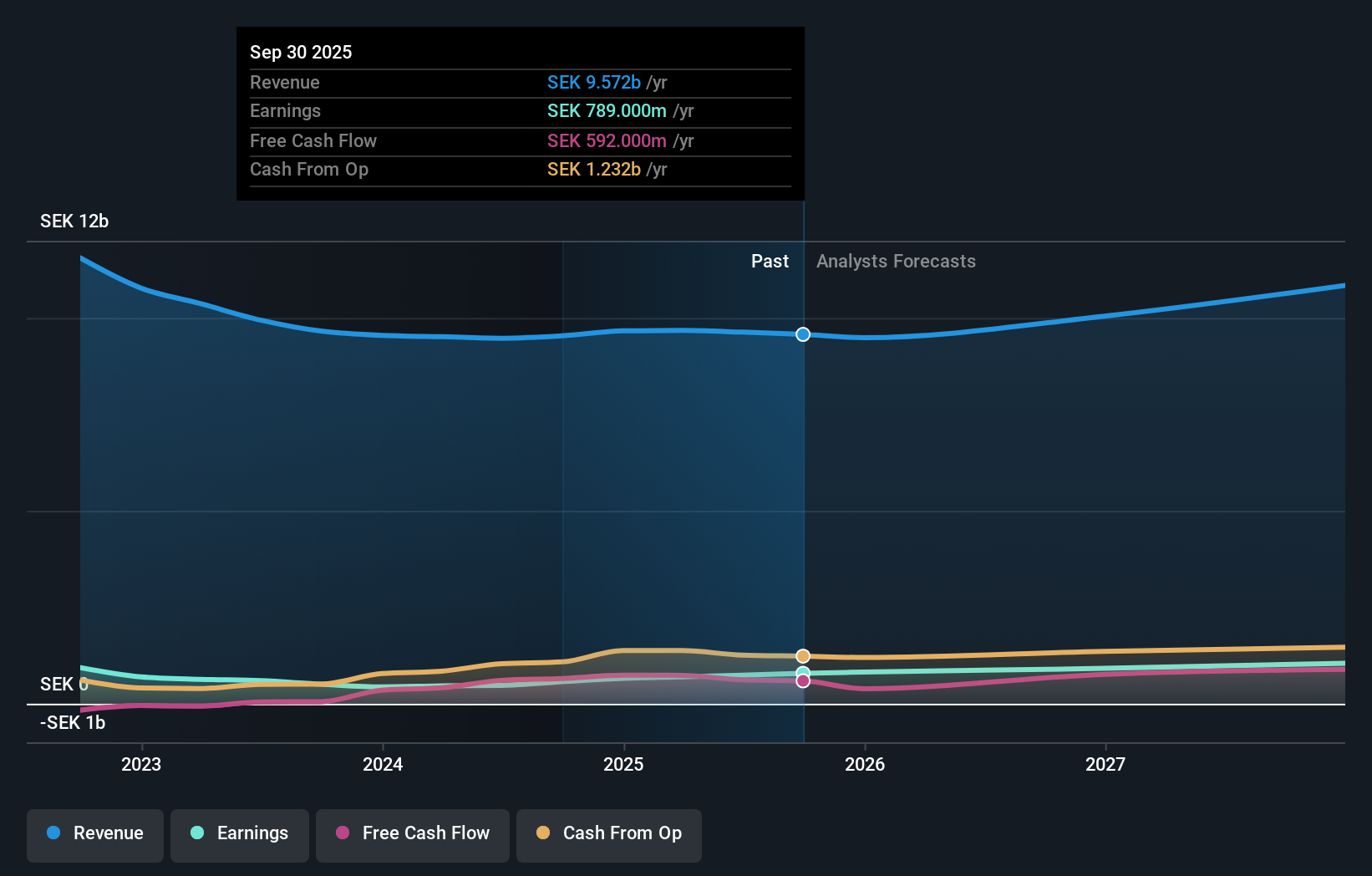

- Nolato AB recently reported its third quarter 2025 results, showing net income of SEK 215 million despite a slight dip in sales to SEK 2,342 million, and earnings per share from continuing operations increasing to SEK 0.8.

- This marks an increase in profitability compared to a year earlier, highlighting the company's ability to drive earnings growth even when revenue is marginally lower.

- We'll explore what stronger earnings on weaker sales could mean for Nolato's investment case and future expectations.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Nolato Investment Narrative Recap

Owning shares in Nolato means believing in the company’s ability to harness healthcare market growth, automation, and global manufacturing expansion for consistent margins and earnings, even when revenue fluctuates. The recent third-quarter earnings update reinforced short-term confidence, with profitability rising despite lower sales, but did not significantly shift the spotlight away from the ongoing risk of overcapacity in key regions like China and the U.S., nor the importance of driving organic sales growth to avoid stagnation.

The July earnings announcement, which showed similar trends, higher net income on lower sales, resonates with this quarter’s focus on margin improvement amidst flat top-line results. This consistency in margin gains underlines management’s operational effectiveness, but also brings into sharper relief the risk that further efficiency-driven improvement could be harder to achieve going forward.

By contrast, investors should be alert to risks that persist with underutilized capacity, as real earnings momentum may depend on ...

Read the full narrative on Nolato (it's free!)

Nolato's narrative projects SEK11.3 billion revenue and SEK1.1 billion earnings by 2028. This requires 5.5% yearly revenue growth and an earnings increase of SEK362 million from SEK738.0 million today.

Uncover how Nolato's forecasts yield a SEK67.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Community-based fair value estimates for Nolato span from SEK67 to SEK92, based on two user submissions from the Simply Wall St Community. As margin improvements meet slower sales growth, you can see how differently investors weigh the company’s future direction, consider a few alternative viewpoints when deciding what matters most for long-term performance.

Explore 2 other fair value estimates on Nolato - why the stock might be worth just SEK67.00!

Build Your Own Nolato Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nolato research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nolato research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nolato's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products in Europe, Asia, North America, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives