NIBE Industrier (OM:NIBE B) Is Down 9.2% After Strong Q3 Profit Turnaround—Has Market Sentiment Shifted?

Reviewed by Sasha Jovanovic

- NIBE Industrier AB (publ) recently reported its third quarter and nine-month earnings for the period ended September 30, 2025, highlighting SEK 10.09 billion in sales and SEK 609 million in net income for the quarter, both higher than the prior year.

- The company also achieved a significant turnaround over nine months, moving from a SEK 204 million net loss last year to a SEK 1.49 billion net profit this year, signalling substantial improvement in profitability.

- We now examine how this improved profitability, demonstrated in the recent earnings, may shape the ongoing investment narrative for NIBE Industrier.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NIBE Industrier Investment Narrative Recap

To be a shareholder of NIBE Industrier, you need to believe in the sustained transition to electric heating and energy-efficient solutions in Europe and beyond, plus NIBE's ability to maintain or improve its profitability and margin profile despite sector headwinds. The recent rebound in earnings suggests some margin recovery, which offers support to the investment case, but does not fully resolve lingering concerns about the pace of recovery in weaker market segments, particularly in Stoves, nor the potential for ongoing trade-related pressure.

The company’s third-quarter earnings report, showing both sales and net income growth compared to last year, stands out as the most relevant recent announcement. This improved profitability comes after a period of integration cost concerns from prior acquisitions in the Stoves division, an area analysts cite as a key drag on group margins and a notable risk to more robust financial recovery. However, as NIBE posts positive results, it remains to be seen whether this momentum can be sustained over the coming quarters, especially amid...

Read the full narrative on NIBE Industrier (it's free!)

NIBE Industrier’s outlook anticipates SEK48.7 billion in revenue and SEK4.1 billion in earnings by 2028. This implies a 6.1% annual revenue growth rate and an increase in earnings of SEK1.4 billion from the current SEK2.7 billion.

Uncover how NIBE Industrier's forecasts yield a SEK45.19 fair value, a 37% upside to its current price.

Exploring Other Perspectives

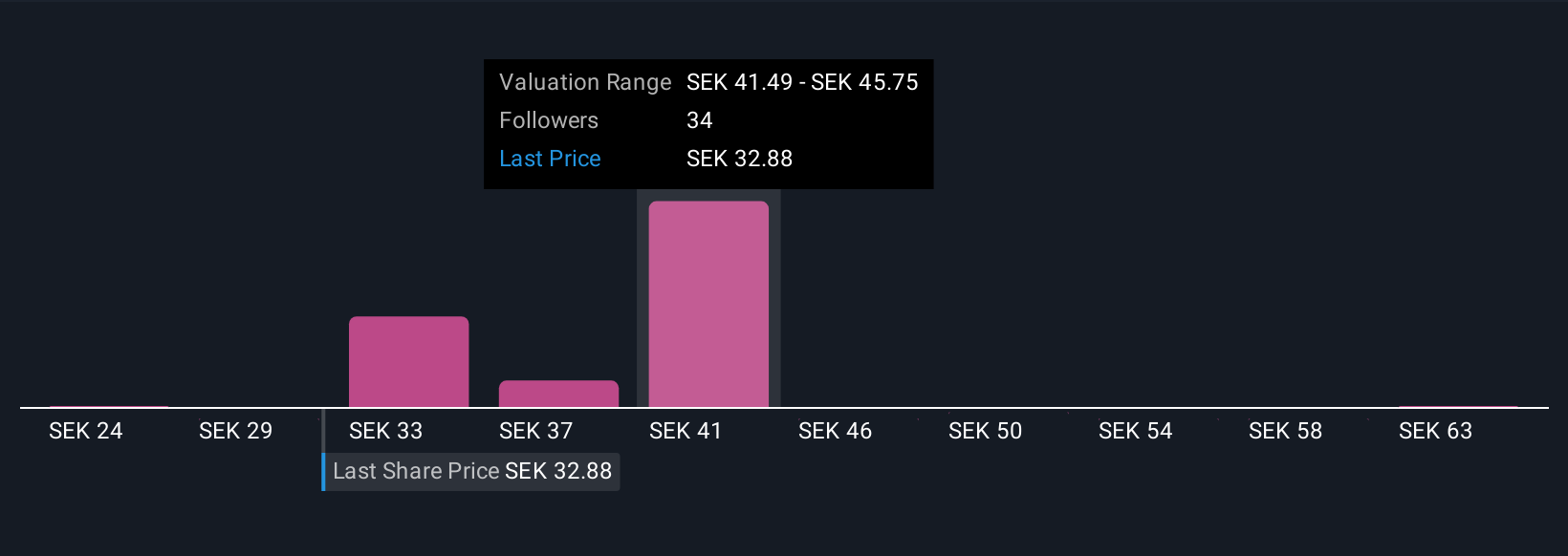

Seven members of the Simply Wall St Community gave fair value estimates for NIBE Industrier ranging from SEK24.49 to SEK67. With recent profit growth and ongoing uncertainty in core markets, you can see why investor opinions diverge so much.

Explore 7 other fair value estimates on NIBE Industrier - why the stock might be worth over 2x more than the current price!

Build Your Own NIBE Industrier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIBE Industrier research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NIBE Industrier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIBE Industrier's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives